- Approval of QCDT Fund by Dubai’s DFSA boosts regional institutional finance.

- Fund supports bank collateral, stablecoins, and Web3 payments.

- Regional tokenization leadership strengthens with Gulf markets leading RWA space.

Qatar National Bank and DMZ Finance’s joint project—the QCD Money Market Fund—was approved by the Dubai Financial Services Authority within the Dubai International Financial Centre as of July 8, 2025.

The approval marks a notable step for institutional finance, as QCDT offers crucial applications like bank collateral, centralized trading asset collateral, and more.

Dubai’s DFSA Approves Highly Anticipated QCDT Fund

The Dubai Financial Services Authority’s approval of the QCD Money Market Fund (QCDT) represents a pivotal event in digital finance. Spearheaded by Qatar National Bank and DMZ Finance, the fund is expected to provide a robust tokenization infrastructure. QNB oversees investment, while DMZ Finance implements technical infrastructure, facilitating institutional financial operations.

The immediate implications are clear: QCDT’s innovative structure allows banks and platforms to utilize it as collateral. The fund’s regulatory endorsement by DFSA emphasizes Dubai’s standing in the tokenized asset domain, promoting broader institutional and stablecoin use.

Public statements from stakeholders emphasize regulatory clarity and technical alignment with QNB shaping investment strategy and DMZ Finance managing technical implementation, although no direct quote has been provided.

QCDT Fund Strengthens Tokenization and Institutional Finance

Did you know? Dubai’s financial frameworks position it among the early leaders in the tokenization sector, mirroring Franklin Templeton’s early forays into digital finance in other regions.

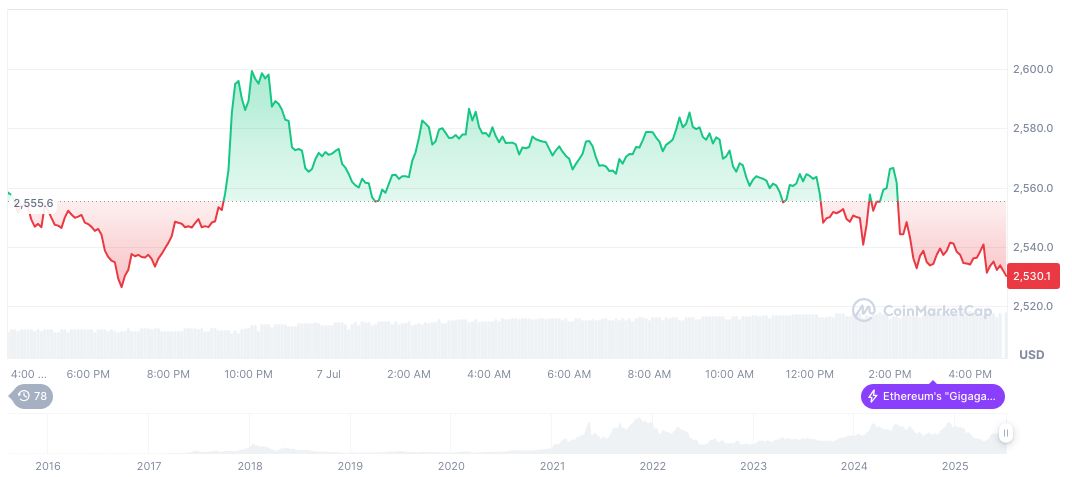

Ethereum (ETH) currently holds a price of $2,544.55 with a market cap of $307.17 billion, according to CoinMarketCap. Its 24-hour trading volume has reached $18.48 billion, witnessing a trading change of 25.50%. ETH shows a 1.13% decline over 24 hours but records gains of 3.57% over seven days and 74.99% over 90 days.

The Coincu research team highlights that the QCDT fund approval may further legitimize tokenized assets, drawing significant institutional interest. This aligns with previous similar initiatives, contributing to increased DeFi stability and liquidity, potentially paving the way for broader regulatory engagement in the Gulf markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347412-dubai-approves-qcd-money-market-fund/