- The Trump administration’s digital asset group is set to release a comprehensive cryptocurrency policy report.

- Includes strategic digital asset recommendations.

- Potential major shift in U.S. cryptocurrency regulations.

The Trump administration’s digital asset group is set to release a comprehensive cryptocurrency policy report. It includes strategic digital asset recommendations and highlights a potential major shift in U.S. cryptocurrency regulations.

The Trump administration’s digital assets working group, co-chaired by David Sacks and Bo Hines, is preparing to submit a major cryptocurrency policy report by July 22. The report, aligned with a January executive order, outlines measures to bolster U.S. leadership in the crypto sector.

Trump’s Crypto Report: Strategic Plans and Regulatory Shift

The digital assets working group, led by David Sacks and Congressman Bo Hines, is preparing its first cryptocurrency policy report, due by July 22. This report results from coordinated efforts between top government officials, directed towards realizing President Trump’s January executive order on digital assets.

In terms of strategic reserve, the task force targets establishing a national digital asset reserve under budget-neutral strategies, potentially influencing Bitcoin’s demand. This action aims to enhance competitiveness without creating additional taxpayer costs.

“The work has been ‘productive and fruitful,’ and the upcoming report serves as the government’s ‘cryptocurrency roadmap.’” — Caroline Pham, Acting Chair, CFTC

Anticipated Impact on Bitcoin and U.S. Compliance Landscape

Did you know? Anticipated regulatory changes could significantly impact the demand for Bitcoin, echoing similar patterns seen with major policy announcements in crypto history.

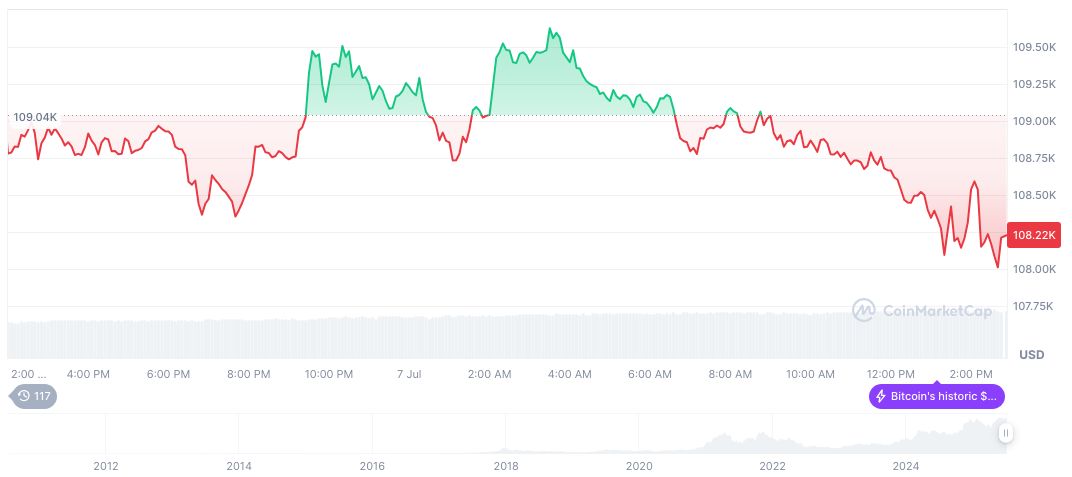

Bitcoin (BTC) stands at $107,908.35, backed by a market cap of $2.15 trillion and a 64.48% market share. Despite a 1.02% dip over 24 hours, BTC demonstrates resilience with 41.97% growth in the last 90 days, as reported by CoinMarketCap.

Insights by Coincu suggest the report could have a lasting regulatory and technological impact on the cryptocurrency environment. Increased focus on compliance may boost institutional involvement and stablecoin stability in the U.S. market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347389-trump-administration-crypto-policy-report-2/