- Willy Woo highlights Bitcoin’s sensitivity to global liquidity changes.

- Central banks’ money printing boosts Bitcoin’s value.

- Potential market shifts highlight Bitcoin’s role as a macro-sensitive asset.

With central banks’ continued money printing, Bitcoin’s valuation is expected to rise, attracting attention from investors. Woo’s observations highlight a potential rise in asset value linked to macroeconomic shifts.

Willy Woo’s tweet has garnered significant attention across the crypto community. His mention of fiat currencies becoming less valuable amid central bank policies reflects broader market sentiment, noting a strong investor reaction and discourse.

Bitcoin’s Sensitivity to Global Monetary Policies

Willy Woo, a noted crypto analyst, tweeted about Bitcoin’s unique sensitivity to global liquidity. His comments noted the correlation between money printing and Bitcoin’s value, positioning Bitcoin as a significant macroeconomic asset.

Among all macro assets, BTC is the most sensitive to global liquidity. Global liquidity equals money printing. This is a wonderful thing. As central banks print money, BTC becomes more substantial, and fiat currency becomes colder. — Willy Woo, Crypto Analyst, ChainCatcher

Among all macro assets, BTC is the most sensitive to global liquidity. Global liquidity equals money printing. This is a wonderful thing. As central banks print money, BTC becomes more substantial, and fiat currency becomes colder. — Willy Woo, Crypto Analyst, ChainCatcher

Bitcoin Price Trends and Analyst Perspectives

Did you know? Bitcoin has historically shown a strong correlation with global liquidity cycles. During periods of quantitative easing, Bitcoin’s value generally experiences significant upward trends, reinforcing its sensitivity to economic policies.

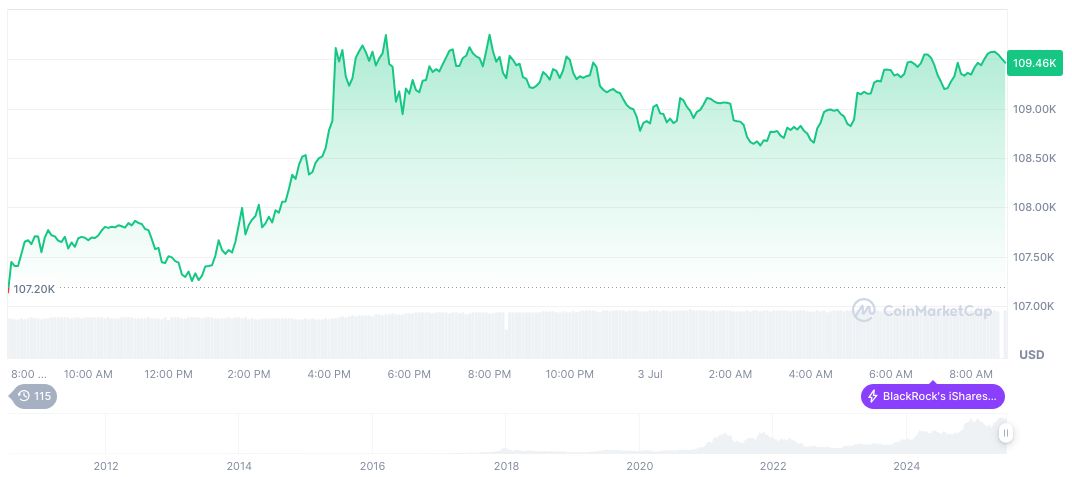

As of the latest data from CoinMarketCap, Bitcoin’s value is $109,807.64, with a current market cap of $2.18 trillion. Over 24-hours, it observed a 1.90% increase, continuing a 31.60% rise over 90 days, pointing to significant market activity.

Analysts from the Coincu research team speculate that Bitcoin’s sensitivity to liquidity suggests it might benefit from ongoing monetary policies. Historical analysis shows Bitcoin substantially appreciates during such fiscal expansions, highlighting its role as a macroeconomic asset.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346604-bitcoin-sensitivity-global-liquidity-woo/