BTC price is showing major strength, gaining 2.43% to $109,500 levels as veteran trader Peter Brandt highlights a strong breakout moment on charts, with a potential rally to $140K. However, Arthur Hayes undertakes a bearish outlook ahead of the Jackson Hole event in August, predicting a potential BTC crash to $90K. The upcoming key CPI data and july FOMC meeting will also add to volatility.

Peter Brandt Predicts Bitcoin Price Breakout to $140K

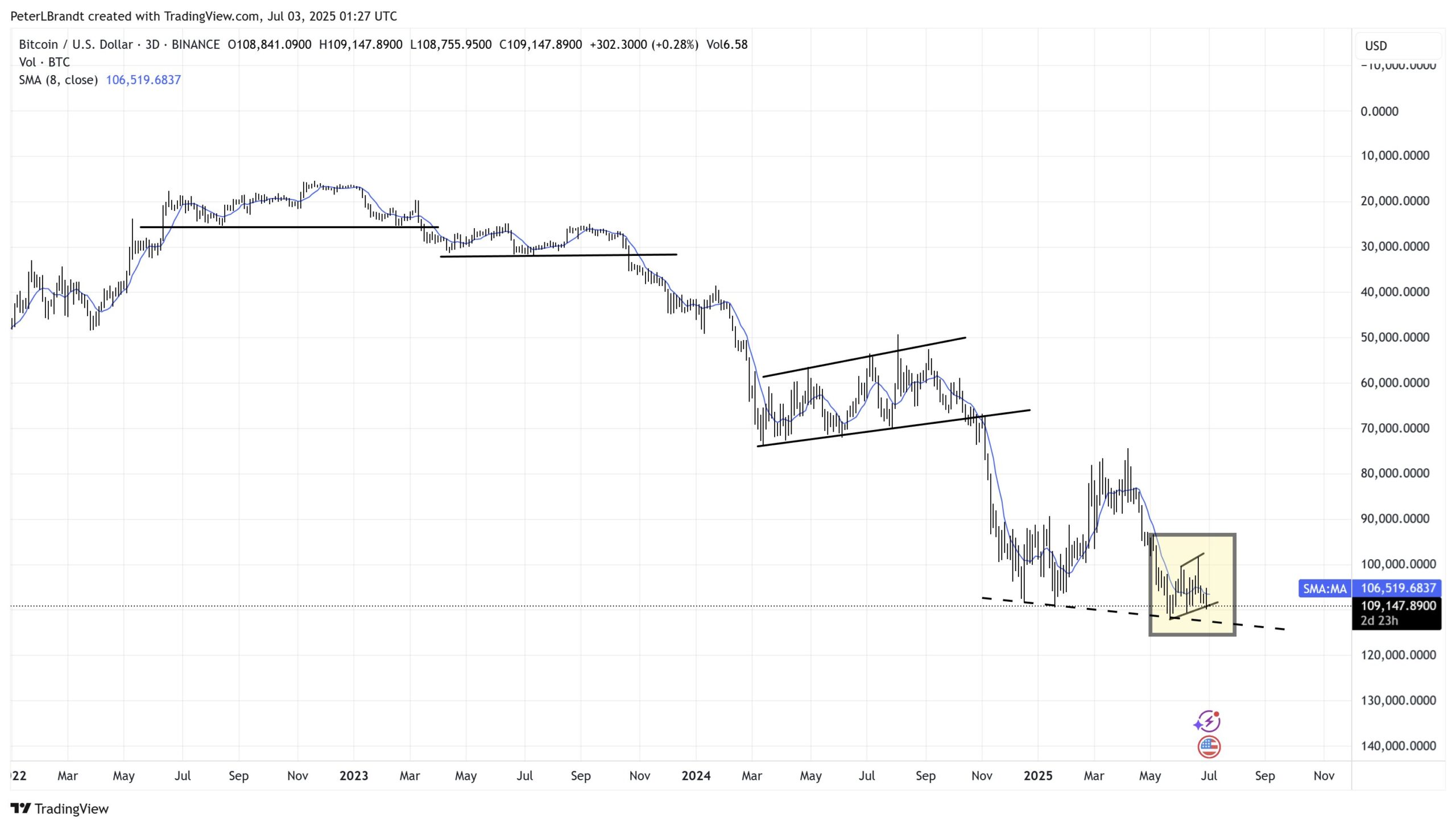

In a cryptic message on the X platform, veteran trader Peter Brandt shared the current chart setup for BTC/USD. While sharing an inverted chart, Brandt sarcastically mentioned: “Is this bear flag (yellow box) so obvious to everyone so as to not work? Or is this chart about to drop off a cliff? Just asking.” The chart below from Peter Brandt shows the next Bitcoin price stop at $104, after the breakout, which is in tune with the current predictions by Standard Chartered.

Brandt’s prediction aligns with Bitcoin following the trajectory of the Global M2 money supply, which has recently touched an all-time high of $55.48 trillion. Since 2024, Bitcoin has been closely following the M2 trajectory, and the current breakout could be a defining moment for BTC.

As of press time, Bitcoin price is trading at $109,500 levels with its daily trading volume surging by 20% to $56 billion. On the other hand, the Coinglass data shows a 7.28% upside in the BTC futures interest, showing bullish sentiment among traders. Furthermore, the US CPI data for June could play a crucial role in deciding the next market trajectory. The market is also predicting a Fed rate cut this month in July.

Arthur Hayes Takes Contra Bet With BTC Crash to $90K

Arthur Hayes, CIO of crypto investment fund Maelstrom, has warned that the crypto market may trend sideways or slightly lower heading into the Jackson Hole symposium in August. In his latest market outlook, Hayes pointed to potential USD liquidity pressures from Treasury General Account (TGA) replenishment, which he says could drag Bitcoin down to the $90,000–$95,000 range.

“I believe that between now and the August Jackson Hole Fed speech to be given by beta cuck towel bitch boy Jerome Powell, the market will trade sideways to slightly lower,” wrote Hayes.

As a precautionary move, Maelstrom has liquidated all of its illiquid altcoin holdings. The fund also signaled it may trim its Bitcoin exposure further if market conditions deteriorate in the coming weeks.

Major US Events That May Impact Bitcoin Price

As CPI data and Fed decisions loom, investors face a pivotal moment as liquidity dynamics and sentiment will shape Bitcoin’s next major move. With the Consumer Price Index later today and the Fed set to deliver its rate cut decision, Bitcoin is in store for a big move—upward in all probability.

If inflation is to take a satisfactory upside shock then real yields will stay low and liquidity will flow into non-yielding assets like BTC and catalyze a rally above major areas of resistance. Even a mildly hawkish rate call from the Fed can garner a short-term decline as short positions are liquidated but that shall prove shallow if the central bank signals future reduction or a reprieve in its balance-sheet runoff.

Moderation in quantitative tightening in that case will release copious amounts of cash sidelined that will be set to drive Bitcoin through its recent peaks. Overall the direction of least resistance is bullish with a higher CPI report or dovish Fed talk swinging the pendulum toward an upside break out.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/90k-or-140k-crypto-pundits-divided-ahead-of-fomc-meeting-and-cpi-data/