- The SEC reviews Grayscale’s ETF plan, affecting Bitcoin’s market.

- Grayscale’s ETF conversion is paused pending review.

- The decision may affect altcoin ETF sentiment.

Grayscale’s plan to convert its Digital Large Cap Fund into a multi-asset ETF, including Bitcoin and Ethereum, is under review following a decision by the SEC on July 1, 2025.

The awaited SEC review continues to hold the interest of industry players, with Grayscale yet to release a formal statement.

Grayscale’s ETF Conversion Plan

The SEC’s decision temporarily affects potential market expansion and altcoin ETF sentiment, reflecting cautious regulatory oversight.

Grayscale Investments, led by CEO Michael Sonnenshein, is seeking conversion of its Digital Large Cap Fund to a spot ETF. The SEC’s recent notice, as described under Rule 431, places the proposal under review, pausing any immediate actions on this conversion. The fund was set to be listed on NYSE Arca and would cover Bitcoin, Ethereum, Solana, XRP, and Cardano as underlying assets. Currently, the fund holds assets worth approximately $755,000,000, with Bitcoin comprising 80% of this amount.

Nate Geraci mentioned via X (Twitter) the conversion could have provided a “test run” for additional crypto assets, considering the significant share of Bitcoin and Ethereum in GDLC’s holdings.

“Side benefit for SEC in approving GDLC is that it would provide nice ‘test run’ for additional crypto assets in ETF wrapper…xrp, sol, & ada represent < 10% combined of GDLC’s holdings. Easy way to slowly step into other assets.”

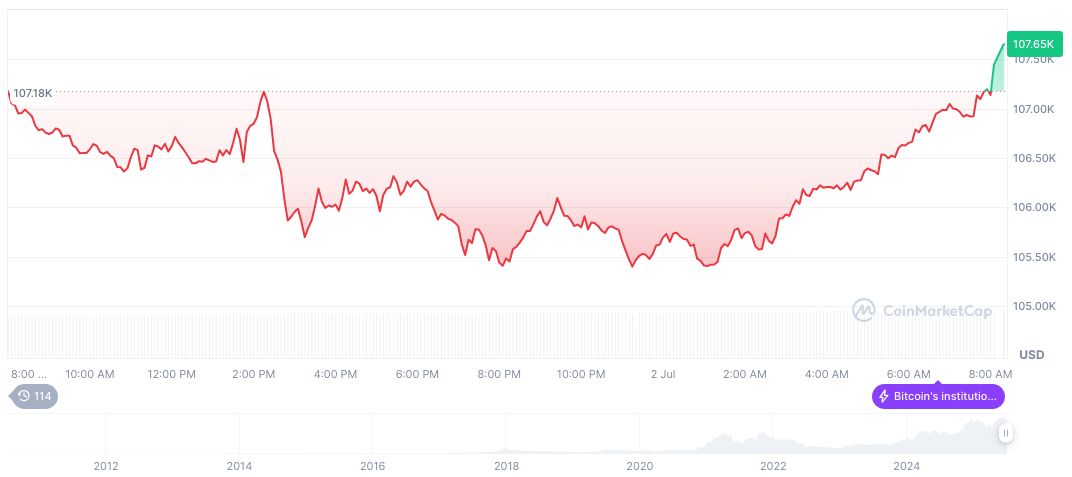

Market Implications as Bitcoin Price Rises

Did you know? The SEC has historically been cautious in approving ETF applications, often leading to delays in altcoin market access.

According to CoinMarketCap, Bitcoin (BTC) currently trades at 109,471.74 USD, with a market cap of $2,177,016,900,113, marking a 3.69% rise over the past 24 hours. The asset’s notable growth includes a 33.62% spike over 90 days, amid ongoing regulatory scrutiny. Circulating supply stands at 19,886,565 BTC out of a total 21 million BTC cap, highlighting sustained investor interest despite regulatory hurdles.

The Coincu research team suggests that while the SEC’s hesitance reflects ongoing caution in fully embracing altcoin ETF offerings, existing approvals for Bitcoin and Ethereum ETFs signal bullish regulatory trends. However, stakeholders may observe increased transparency requirements and keen monitoring of liquidity adjustments within new crypto asset classes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346501-sec-reviews-grayscale-etf-proposal/