- Yingxi Group signs a term sheet to acquire up to 12,000 Bitcoins.

- The move is part of a strategy to augment digital asset holdings.

- Potential effects could include shareholder dilution and industry shifts.

On July 2, 2025, Yingxi Group, a Chinese company listed on the U.S. stock market, revealed plans to acquire up to 12,000 Bitcoins in a deal potentially worth $1.3 billion. This strategy follows a preliminary agreement intending to bolster digital asset holdings.

The proposal signifies a scaling beyond the previously considered 8,000 Bitcoins. It also underscores Yingxi’s plans to pay through newly issued common stock, potentially influencing shareholder interests.

Yingxi Group’s $1.3 Billion Bitcoin Strategy Emerges

Yingxi Group’s engagement in acquiring up to 12,000 Bitcoins marks a shift in the scale of their intended digital asset holdings. Previously, they had talked about 8,000 Bitcoins. This involves issuing common stock to settle the purchase, indicating a move from cash transactions typical in large-scale asset acquisitions. The unnamed major Bitcoin holder agreed to the deal, although the final specifics, such as pricing and share issuance, are pending negotiations.

If successful, this acquisition will be one of the largest by a non-crypto-native public company. Share dilution could impact current stockholders unless managed carefully during negotiations. This transaction situates Yingxi alongside past large Bitcoin acquisitions by firms like MicroStrategy and Tesla, though differing in method by using shares instead of cash.

Reactions from industry leaders have yet to surface, though CEO Mr. Hong Zhida has stated this aligns with Yingxi’s objective to increase its digital asset repertoire. Absence of regulatory comment at this time indicates no immediate hurdles, but the transaction’s structure might later draw further attention from financial bodies upon completion.

Bitcoin Market Dynamics & Yingxi’s Future Implications

Did you know? In 2018, MicroStrategy initiated corporate interest in Bitcoin by purchasing 21,454 BTC using cash—a strategy still regarded as pivotal for institutional adoption.

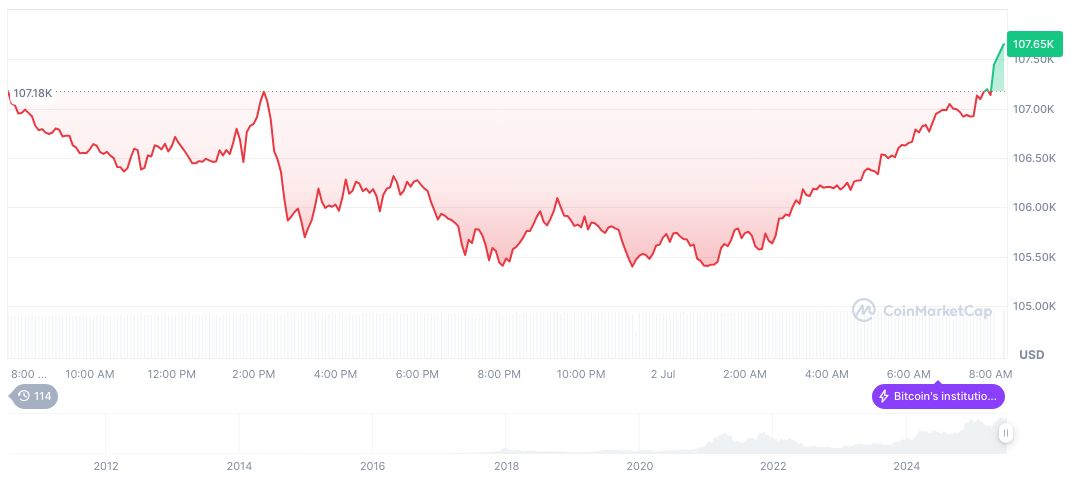

Bitcoin (BTC) currently trades at $109,513.77, with a market cap approximated at formatNumber(2177852772903.33, 2). Over the last 24 hours, trading volume reached $53.49 billion, experiencing a 3.67% price increase. Data from CoinMarketCap shows a 13.76% rise in the last 60 days, reflecting robust market dynamics.

Insights from the Coincu research team suggest that the deal’s completion could initiate financial leverage changes and invite more companies to explore equity-swapped crypto acquisitions. Regulatory bodies might later consider regulatory frameworks adjustments to handle such transactions, potentially impacting future corporate crypto engagement strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346495-yingxi-group-bitcoin-acquisition/