- Banca Sella’s pilot of cryptocurrency custody service with Fireblocks technology.

- Potential extension to 1.4 million custody clients.

- Test targets digital asset education and regulatory readiness.

Banca Sella tests cryptocurrency custody with Fireblocks tech, aiming for potential service launch.

Banca Sella is conducting an internal test of a cryptocurrency custody service for selected employees, utilizing Fireblocks’ technology, expected to run through summer 2025.

Banca Sella’s Crypto Custody Pilot: Aiming for 1.4M Clients

Banca Sella, known for its tech innovation, has launched a pilot project to test cryptocurrency custody services internally. This initiative involves using Fireblocks’ technology to ensure the secure storage of digital assets like stablecoins. The project will continue until the end of the summer, when the feedback will help determine its potential customer rollout.

The bank is already exploring employee education and building digital capabilities, aiming to position itself in digital asset management. If successful, the services could extend to its 1.4 million clients, elevating its competitive stance in modern financial offerings.

“Banca Sella’s proactive approach to digital asset custody is seen as a significant step towards the mainstream adoption of digital assets in the traditional banking sector. The pilot project is expected to provide valuable insights into the operational and regulatory challenges associated with digital asset management. By conducting thorough testing and analysis, Banca Sella aims to develop a robust framework for managing digital assets, enhancing its service offerings and positioning itself as a leader in the digital finance space.” Source

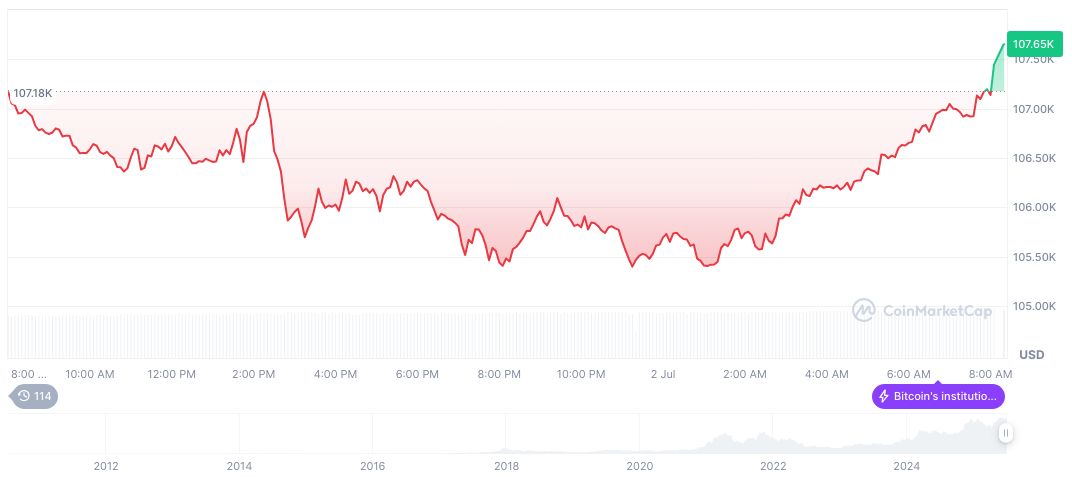

Bitcoin Market Dynamics Amid Growing Institutional Interest

Did you know? Banca Sella previously enabled Bitcoin trading through its Hype platform, marking a significant step in integrating cryptocurrencies into retail banking services across Europe.

Bitcoin’s current price is $10,452.83, with a market cap of $2.18 trillion, and holds a 64.53% dominance, as per CoinMarketCap. Recent activities show a 3.39% increase in the last 24 hours, highlighting its ongoing appeal and market resiliency. The asset’s max supply stands at 21 million, with 19,886,565 circulating.

Insights from the Coincu research team suggest such pilots underscore growing institutional interest in cryptocurrencies like BTC. Regulatory alignment remains crucial, echoing the EU MiCA framework, which can potentially stabilize crypto market engagements by formal financial institutions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346492-banca-sella-cryptocurrency-custody-test/