- Publicly listed companies’ Bitcoin acquisitions doubled ETF purchases in 2025.

- Bitcoin is increasingly viewed as a corporate financial asset.

- Michael Saylor and other companies lead the trend in Bitcoin treasury management.

Publicly listed companies acquired 245,510 BTC in the first half of 2025, doubling the volume bought by ETFs during the same period, according to Cryptoslate. The marked shift signifies Bitcoin’s new role as a corporate financial asset rather than a speculative tool.

Michael Saylor’s strategy leads a wave of Bitcoin treasury acquisitions, amassing over 553,000 BTC. Companies across sectors are integrating Bitcoin as a key financial asset. The trend is reflected in strategy shifts by other listed companies.

Bitcoin’s Role in Financial Stability Strengthens

The increased Bitcoin acquisition reflects companies prioritizing inflation hedging, brand alignment, and cross-border liquidity. ETFs, once prominent players, now trail as corporate buying surges.

Michael Saylor highlights Bitcoin’s strategic value, stating, “Bitcoin is hope.” Dylan LeClair describes the corporate embrace as “a one-way train.” These sentiments suggest growing institutional confidence in Bitcoin.

The corporate race for BTC is heating up faster than many expected. – Andre Dragosch, Head of Research, Bitwise Europe

Market Data and Insights

Did you know? Bitcoin’s current market shift is reminiscent of MicroStrategy’s pivotal role in 2020, which significantly molded the corporate Bitcoin narrative. This year, widespread corporate adoption doubles previous ETF demand.

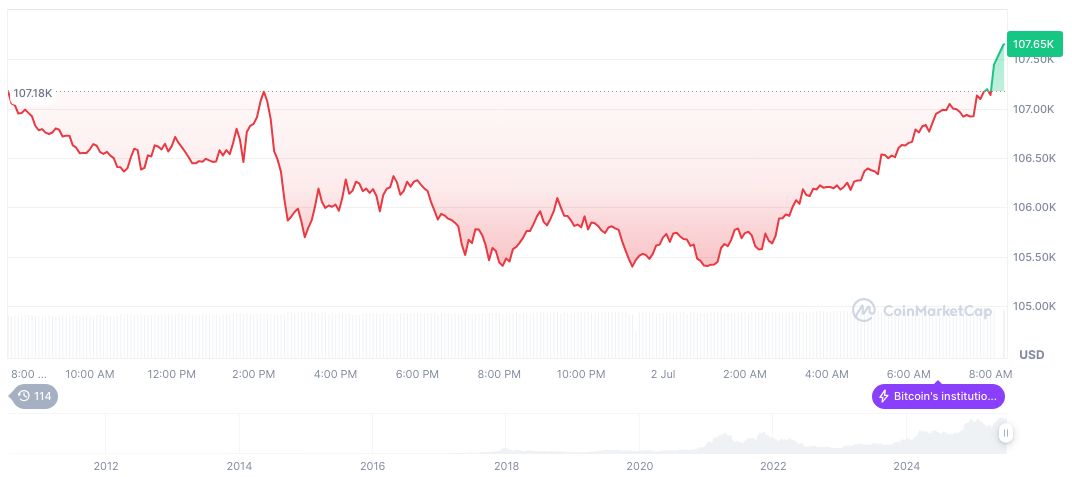

Bitcoin (BTC) is currently priced at $107,563.50, with a market cap of 2139044409267.56. Dominating 64.68% of the market, it showcases stability, as reported by CoinMarketCap. Recent trends reflect a 28.64% rise over 90 days.

According to Coincu’s research team, a stronger corporate focus on Bitcoin signals evolutionary financial practices. Corporate treasuries globally recognize Bitcoin’s role in financial stability. This marks a shift from speculative interest, aligning with evolving digital finance paradigms.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346398-corporate-bitcoin-holdings-outpace-etfs/