Key Takeaways

- The SEC approved Grayscale’s conversion of its large-cap crypto fund into a spot ETF.

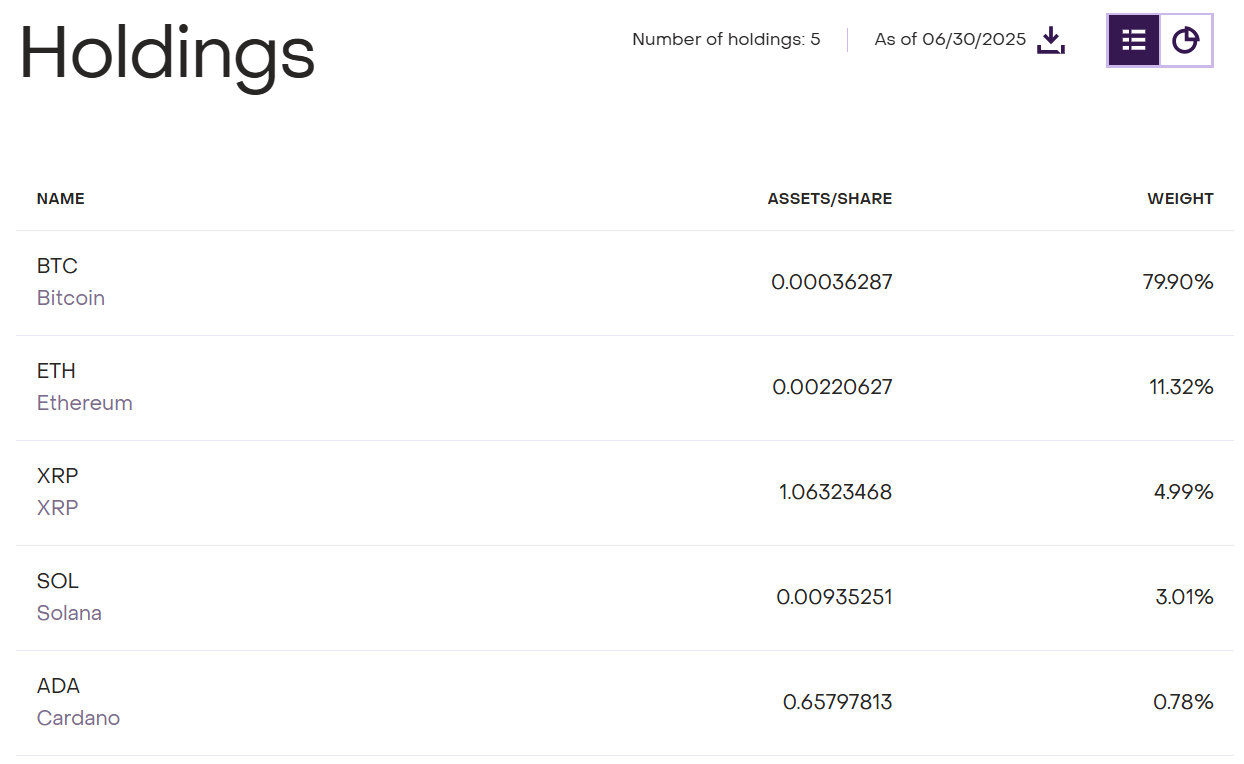

- The ETF will include Bitcoin, Ethereum, XRP, Solana, and Cardano, expanding regulated crypto products for US investors.

The US Securities and Exchange Commission has approved the listing and trading of Grayscale’s Digital Large Cap Fund (GDLC) as a spot exchange-traded fund (ETF) on NYSE Arca, according to a newly published order granting accelerated approval on July 1, first shared by Phoenix News.

The decision follows Grayscale’s submission of an amended S-3 filing to the SEC just yesterday, which was seen as evidence of active dialogue between the issuer and the regulator. ETF Store President Nate Geraci predicted Grayscale’s bid would be successful.

Introduced in 2018, Grayscale’s GDLC fund offers investors a single vehicle to gain exposure to five of the largest digital assets, including Bitcoin, Ethereum, XRP, Solana, and Cardano. The portfolio is heavily weighted toward Bitcoin at approximately 80% as of June 30.

The fund has grown to nearly $775 million in assets under management, according to Grayscale’s latest data.

Source: https://cryptobriefing.com/crypto-spot-etf-sec-approval/