- Trump’s Fed interest rate criticism evaluated by BIS without major concerns.

- BIS sees no autonomy threats; emphasizes trade fragmentation risks.

- Financial markets show steady response despite political commentary.

Donald Trump’s critique of the Federal Reserve’s interest rate policy sparked discourse, with the Bank for International Settlements (BIS) clarifying that such commentary poses no threat to the Fed’s independence.

The BIS highlighted that society’s support for central bank stability upholds its autonomy, mitigating concerns over political influence. Attention was also drawn to economic growth suppression due to policy uncertainty and rising protectionism.

Trump’s Criticism and BIS’s Reassurance

Donald Trump, former U.S. President, critiqued the Federal Reserve’s interest rates, advocating for a cut from 4.3% to between 1% and 2%. The Bank for International Settlements assessed these remarks but assured that they do not compromise the Fed’s independence. Agustin Carstens confirmed that society’s support for stability-oriented institutions remains steadfast, safeguarding their autonomy.

Protectionist policies and advancing trade fragmentation present risks, as per the BIS evaluation. Nevertheless, Trump’s comments appear not to have immediately altered U.S. monetary policy. The U.S. dollar’s exchange rate and the economy have shown no significant adverse shifts.

“As long as society supports an institution with a mandate to preserve stability, it should not be a threat.” — Agustin Carstens, General Manager, Bank for International Settlements

The market has maintained stability amid Trump’s comments, with the BIS reiterating no concerns over the Federal Reserve’s independence. Agustin Carstens pointed out the public nature of such remarks doesn’t threaten central bank autonomy. The report further noted no immediate changes in policy frameworks or financial markets.

Monetary Stability Amid Political Pressure

Did you know? In earlier cases of presidential pressure, market sentiment showed temporary fluctuations, but core financial systems remained largely unaffected.

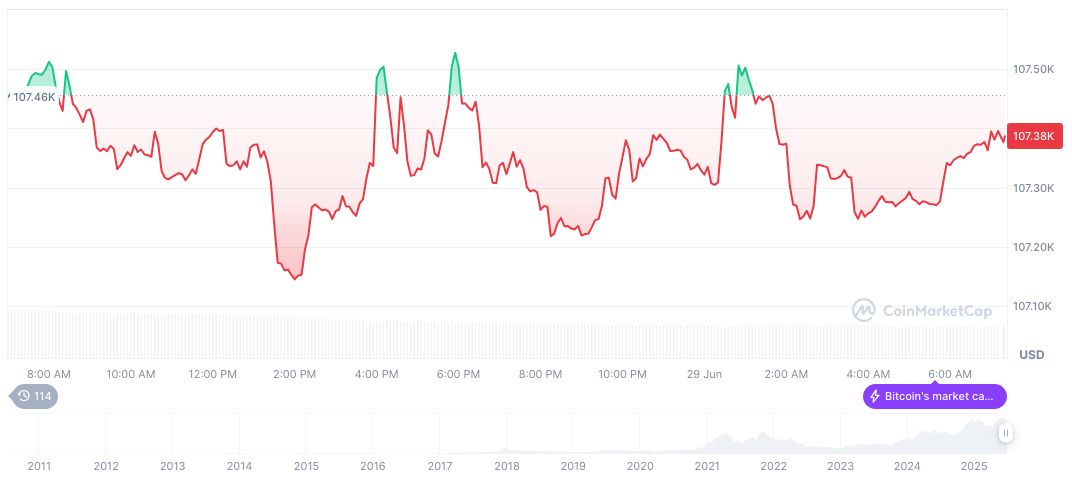

As of June 30, 2025, Bitcoin (BTC) is priced at $108,490.54, with a market cap of $2.16 trillion, according to CoinMarketCap. BTC maintains a 64.63% dominance, with notable price changes seen over the past three months, marked by a 30.40% increase.

The Coincu research team suggests watching for potential impacts on trade policies. Despite political interventions, the Fed’s foundational stability appears unaffected, with broad regulatory adherence maintaining market equilibrium. Historical resilience stands as a testament to ongoing economic vitality.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345947-bis-trump-fed-independence-concerns/