- Trump and EU leaders debate over tariffs, taxes, and lawsuits.

- Expect trade tensions to impact $20 billion in goods.

- EU retaliatory tariffs could rise to 50% on select exports.

President Trump stated June 28, 2025, that while U.S.-Europe relations are sound, trade issues remain challenging, citing tariffs and lawsuits.

The emphasis on harsh trade measures highlights ongoing economic tensions between the regions, potentially affecting global markets and investor sentiment.

$20 Billion in Trade at Risk from Tariff Disputes

President Donald Trump announced concerns about severe trade relations with Europe, emphasizing heavy European taxes and legal challenges against U.S. businesses. “Good relations with Europe, but very tough on trade issues,” Trump asserted. European Commission President Ursula von der Leyen signaled a strategic shift by confronting U.S. trade threats amid ongoing negotiations.

Ongoing trade negotiations indicate an escalating tension due to proposed U.S. tariffs ranging from 20% to 25% on specific European imports, potentially impacting up to $20 billion in trade sectors like autos and tech.

Market participants report concern over potential escalation, as highlighted by von der Leyen’s quote that “conventional negotiating tactics are over.” Investors remain cautious about potential future tariff increases and the broader geopolitical implications.

Crypto as a Safe Haven Amid Geopolitical Strain

Did you know? Trade disputes under Trump’s prior tenure led to increased global market volatility and investor interest in digital assets for safety and diversification.

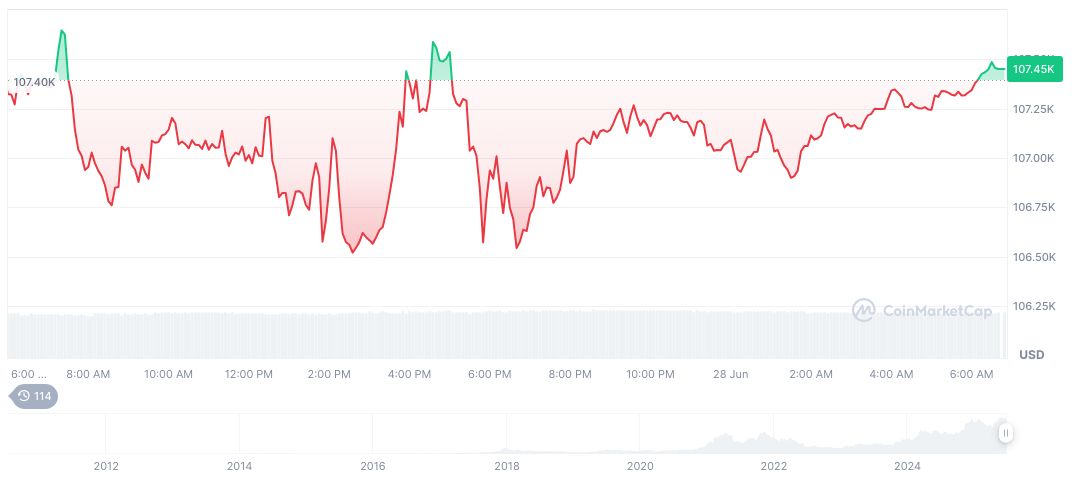

Bitcoin (BTC) is trading at $107,281.36 with a market cap of $2.13 trillion, reflecting a 24-hour price rise of 8.35% according to CoinMarketCap. The largest cryptocurrency by market dominance shows resilience amid broader geopolitical tensions.

Research insights highlight the potential for digital assets as safe havens in times of geopolitical turmoil, driven by increased market volatility and uncertain traditional asset performance. This context may reinforce Bitcoin’s role as a hedge against macroeconomic instability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345761-us-europe-trade-tensions-tariff-disputes/