- U.S. May core PCE index exceeds forecasts, influencing risk appetite.

- Inflation data suggests possible future market volatility.

- Lack of direct crypto market response observed so far.

The U.S. May core PCE price index increased by 0.2% month-on-month and 2.7% year-on-year, surpassing expectations of 0.1% and 2.6% respectively.

This unexpected rise in the core PCE index could influence U.S. Federal Reserve policies, potentially affecting risk assets including cryptocurrencies.

U.S. Core PCE Index Rises to 2.7% Year-on-Year

The U.S. May core PCE price index recorded a month-on-month increase to 0.2%, exceeding expectations of 0.1%. Year-on-year, the index also rose to 2.7%, surpassing the predicted 2.6%. Market participants are monitoring the potential influence on monetary policy and digital assets.

The higher-than-expected core PCE inflates prospects of stricter monetary policy, which could dampen risk appetite in markets including cryptocurrencies. “Historically, high inflation results in increased volatility and sell-offs in cryptocurrency markets,” as noted by industry analysts.

Current market reactions indicate no direct correlation between the PCE data and immediate crypto price adjustments. Industry insiders remain watchful of policy shifts and their broader market effects, focusing on Bitcoin and Ethereum’s behavior amidst changing economic conditions.

Bitcoin and Ethereum Stability Amid Inflation Fears

Did you know? The core PCE index is a key indicator of inflation. Economic shocks such as this often precede significant market changes, impacting major cryptocurrencies like Bitcoin.

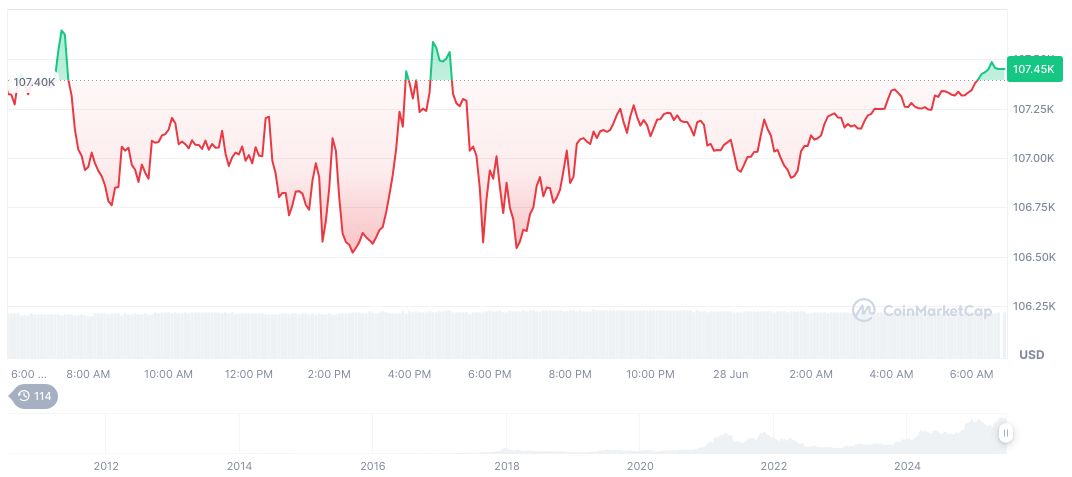

Bitcoin, with a price of $107,412.17, holds a market cap of $2.14 trillion and dominates 64.90% of the market. With minor fluctuations, it reflects a 3.64% growth over the past week. The trading volume decreased by 2.42% over 24 hours, as noted by CoinMarketCap.

The Coincu research team highlights potential ripple effects of higher inflation on digital currencies, emphasizing past trends where elevated inflation and tightening policies triggered volatility. They suggest monitoring structural economic adjustments and regulatory updates for anticipating asset behavior.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345675-us-may-pce-index-market-impact/