- SEC extends Rule 15c3-3 compliance deadline; brokers given more time.

- New deadline set for June 30, 2026.

- Brokers to adjust reserve filings frequency impacting securities services.

The U.S. Securities and Exchange Commission (SEC) announced an extension to the compliance deadline for Rule 15c3-3, now set for June 30, 2026.

This extension aims to avoid operational challenges for brokers, especially concerning the adjustment of customer reserve calculations from weekly to daily.

SEC Grants Brokers Additional Three Years for Compliance

SEC Chairman Paul S. Atkins emphasized that the extension is necessary, granting broker-dealers additional time to implement daily calculations under the Customer Protection Rule. This decision comes as a measure to mitigate potential strains on operational frameworks. Brokers dealing with securities-type digital assets will need to adjust reserve filings with increased frequency from weekly to daily. This rule targets U.S.-registered broker-dealers, impacting their custodial services for certain digital assets classified as securities.

So far, there has been a limited public response from crypto influencers or project teams, indicating that the impact is largely administrative and does not directly affect the broader decentralized digital asset market. SEC Chairman Paul S. Atkins stated,

“By extending this compliance date, we are giving broker-dealers additional time to implement daily computation under Rule 15c3-3. I am pleased the Commission agrees that additional time is necessary to allow broker-dealers to avoid operational challenges with meeting the initial compliance date.” – SEC Press Release, June 25, 2025

Historical Precedents and Market Stability Amid Rule Delays

Did you know? Rule extensions like these are not uncommon in the financial sector. When the SEC previously extended Regulation SCI deadlines, it allowed for technology upgrades without major market upheaval, showcasing the regulatory body’s cautious approach.

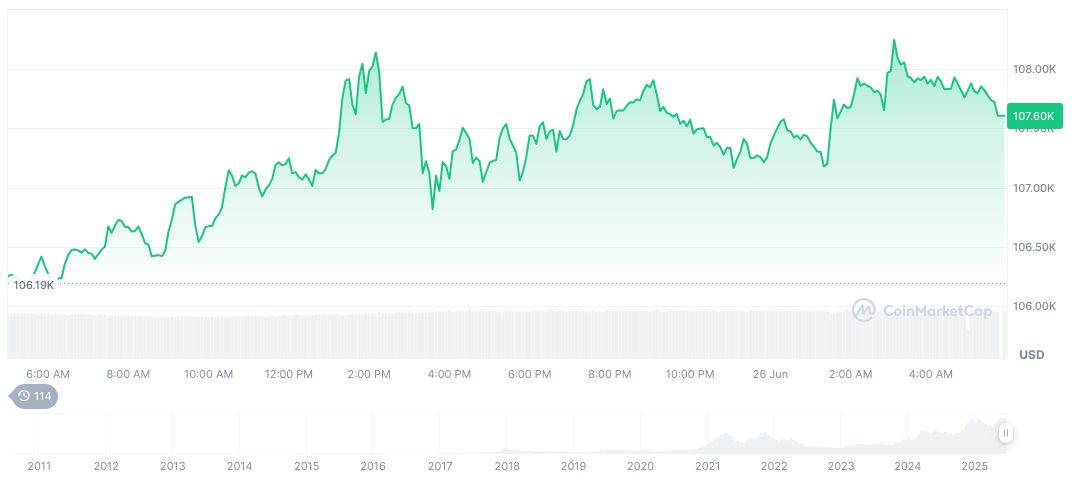

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $107,842.37 with a market cap of 2,144,303,304,271.00 and dominates 64.77% of the market. Within the past 90 days, BTC’s price increased by 26.35%. Today’s trading volume is $51,391,494,179.62, reflecting a 14.23% change. This data was last updated at 08:50 UTC on June 26, 2025.

Coincu research highlights that extended deadlines improve regulatory readiness, reducing the risk of compliance failures. Currently, no direct effect is observed on Bitcoin and most altcoins. However, security tokens remain under enhanced scrutiny with daily reserve mandates, suggesting the impact is more significant for assets requiring regular audits such as those involved in GC pooling services.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/345251-sec-extends-rule-15c3-3-deadline/