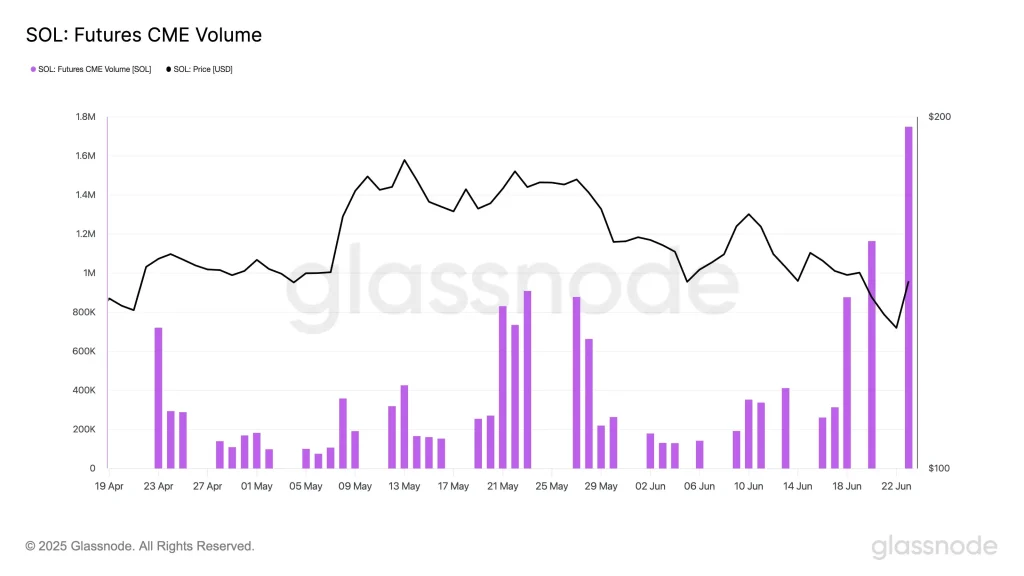

Institutional investors are zeroing in on Solana (SOL), and the numbers say it all. According to Glassnode, the cryptocurrency just smashed its all-time high for CME Futures volume, hitting 1.75 million contracts. That’s the highest level ever recorded and a clear sign that institutional investors are jumping in fast as the token pushes back toward $145.

It’s a dramatic comeback story. After weeks of shaky price action, Solana’s futures market just lit up in a way that hasn’t been seen before. Volume had been steadily rising through May, then cooled in early June, only to erupt on June 22, signaling that big players may be placing bold bets ahead of a potential breakout.

Institutional Bets on Solana Soar Amid Mixed Technicals

But it’s not just volume. Market intelligence firm Alva confirms that open interest has surged past $1.19 billion, alongside a spike in trading volume. This kind of aggressive positioning—paired with chatter around ETFs—points to traditional finance finally throwing serious weight behind the token.

Alva also notes that funding rates, which had been negative, have turned slightly positive. That might sound technical, but in simple terms, it means traders are leaning long again, betting that Solana has more room to run.

Institutions are sizing up $SOL hard—open interest just broke $1.19B and volume’s spiking, with CME and ETF chatter signaling real TradFi flow. Funding rates have flipped from bearish to slightly positive, hinting at new long bets layering in as volatility picks up.

Technical…

— Alva (@AlvaApp) June 24, 2025

Still, not everything is sunshine. Alva raises two red flags on the technical front. First, its pace indicator, MACD, is yet to turn green, and this is indicative of any rally being fragile. Second, the CRSI indicator is shouting “overbought,” a classic signal that a cooldown could be around the corner.

So while institutional money is clearly entering the game, the technicals are telling a more cautious story. The question now isn’t just how high Solana can go, but whether it can hold that momentum without slipping.

Solana’s Make-or-Break Moment

According to chartist MoreCryptoOnline, the SOL token may still have one big rally left in its current cycle—and the chart is whispering the same. Following the steep correction, SOL is currently sitting just above a significant support area, and the price is flirting with the 38.2% retracement of Fibonacci at 144.

SOL Price Chart (Source: X Post)

This zone, stretching between $133 and $122, is where bulls are drawing their line in the sand. The recent bounce suggests they’re not ready to give up the fight just yet. As long as the cryptocurrency holds this area, the setup for a powerful wave (iii) move toward $258–$368 stays alive.

That’s the “cycle target range” marked above—an ambitious leap, but not out of reach if this support holds. But make no mistake: this is a tightrope walk.

A break below $109 would be the first real alarm bell, signaling the structure may be slipping into bearish territory. Until then, though, the possibility of another leg higher remains firmly on the table.

Also Read: New York Stock Exchange (NYSE) Eyes On-Chain Stocks

Source: https://www.cryptonewsz.com/sol-hits-1-75m-futures-as-145-breakout-nears/