- Iran’s coordinated missile strike on U.S. base relieved market concerns.

- Oil prices fell 4%, calming over immediate supply disruptions.

- Cryptocurrency markets rebounded as fears subsided.

Iran launched a missile strike on the U.S. base in Qatar on June 24, 2025.

This symbolic act calmed investor fears, easing oil and cryptocurrency market volatility.

Iran Strike Leads to 4% Oil Price Drop

Iran launched missiles at the Al Udeid Air Base in Qatar, aiming to retaliate against previous U.S. actions. Qatari authorities and Iranian forces coordinated efforts, resulting in empty facilities being targeted to avoid casualties.

The strike prompted a 4% drop in oil prices, despite initial fears of regional escalation. Market participants were relieved as the attack did not affect crucial passageways like the Strait of Hormuz.

The Jerusalem Post reported, ‘Iran coordinated its strikes on US bases in Qatar with Qatari officials in advance in a bid to minimize casualties.’

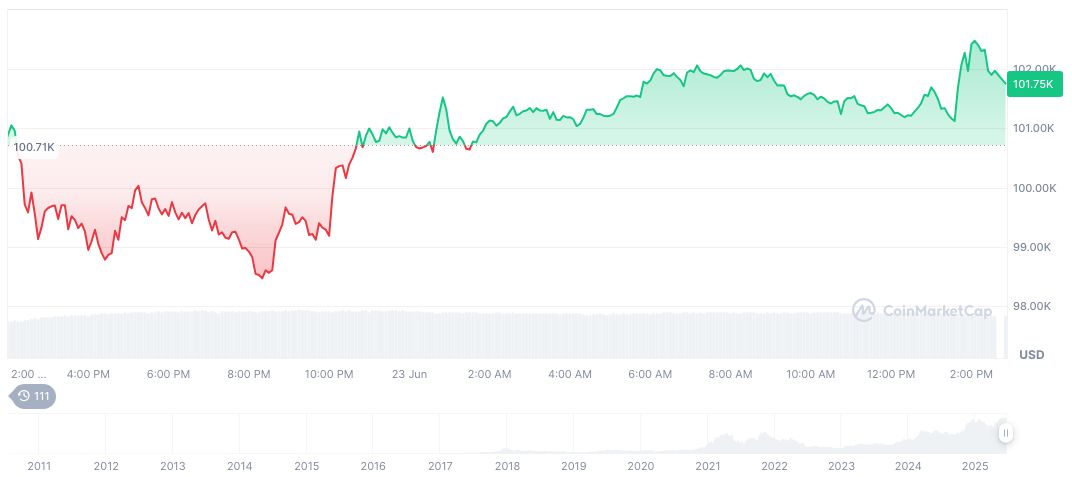

Bitcoin Surges 3.59% Amid Eased Geopolitical Tensions

Did you know? Iran’s coordination prior to the missile strike strategically minimized repercussions, avoiding escalation similar to previous strained encounters in the region.

Bitcoin’s current value stands at $103,052.73 with a market cap of $2.05 trillion and a trading volume drop of 8.97%. Within the last day, BTC saw a price increase of 3.59% but decreased over the past week by 4.54%, according to CoinMarketCap.

Coincu predicts that while geopolitical incidents temporarily sway markets, long-term impacts may shift regulatory focus. This might further stabilize cryptocurrencies post-crisis, as historical data suggests markets can adapt if major disputes are averted.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344818-iran-strike-eases-market-fears/