Key Points:

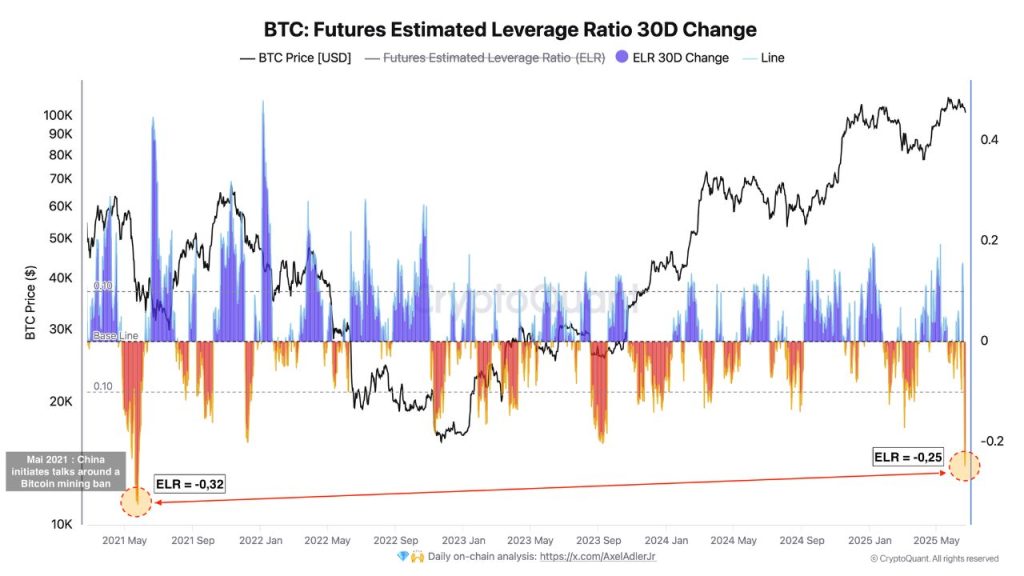

- Bitcoin’s ELR falls to -0.25, lowest since 2021, as traders unwind leveraged positions.

- 14.7K BTC sold at loss in 24 hours, while long-term holders continue holding positions.

- Market sentiment dips but shows signs of recovery as some traders cautiously buy the pullback.

Bitcoin’s Estimated Leverage Ratio (ELR) has dropped to -0.25, the lowest level since the 2021 China mining ban, according to CryptoQuant analyst Darkfost. This sharp three-day drop signals a major decline in leveraged positions and open interest. Analysts believe many traders are reducing exposure amid rising global uncertainty.

The steep fall in ELR suggests traders may be proactively closing positions to avoid forced liquidations. This action often occurs when volatility rises, and market participants seek to manage risk during uncertain price movements.

Bitcoin Price Falls Amid Geopolitical Tensions

Bitcoin price traded at $101,396 at press time, showing a 1.34% drop in the past 24 hours and 5.14% over the past week. Trading volume over the past day reached $49.71 billion. Over the weekend, Bitcoin briefly dropped to $98,000 before recovering above $100,000.

The decline occurred during increased tensions in the Middle East. As CoinCu reported, the US struck three Iranian nuclear sites, joining Israel’s ongoing conflict with Iran. Concerns remain around possible retaliation, including potential threats to US interests or a disruption in oil flow through the Strait of Hormuz.

Short-Term Selling Increases While Long-Term Holders Stay Quiet

On-chain data shows that in the last 24 hours, 14,700 BTC were sold at a loss and 3,100 BTC at a profit, mostly by short-term holders. This results in a net capitulation of 11,600 BTC across centralized exchanges.

Despite the volatility, long-term holders continue to hold. Data from the Binary Coin Days Destroyed (CDD) 30-day average shows a moderate reading of around 0.6, below the cautionary level of 0.8 that often precedes broader market corrections.

Market Sentiment Weak but Shows Signs of Stabilization

Sentiment indicators show continued caution. The Advanced Sentiment Index fell to a local minimum of -20% before recovering to 37%. This shift, along with easing taker volume imbalance, suggests some participants may be buying the dip. Still, general sentiment remains within bearish territory.

Overall, Bitcoin appears to be in a consolidation phase. While short-term volatility has increased, there are no strong signals that long-term trends have shifted.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344731-bitcoin-leverage-hits-3-year-low/