- Fed Governor Waller suggests rate cuts, affecting market sentiment.

- His stance diverges from FOMC, hinting at potential dissent.

- Bitcoin and Ethereum may benefit from dovish monetary signals.

Fed Governor Christopher Waller expressed a dovish view on rate cuts at the Federal Open Market Committee (FOMC) on June 20, hinting at policy changes.

Waller’s advocate for preemptive rate cuts might influence cryptocurrency markets as they seek signals of economic adjustments.

Waller’s Dovish Rate Cut Proposal and FOMC Dynamics

Christopher Waller, known for his dovish stance, reiterated his support for potential rate cuts in subsequent meetings. Despite internal FOMC consensus leaning against a cut, Waller emphasized considering early action to manage inflation and labor concerns. “I think we’ve got room to bring it down, and then we can kind of see what happens with inflation… The right call would be to ‘move now, don’t wait,’” said Waller, source. Should Waller dissent in July, it would mark a significant tonal shift within the Fed.

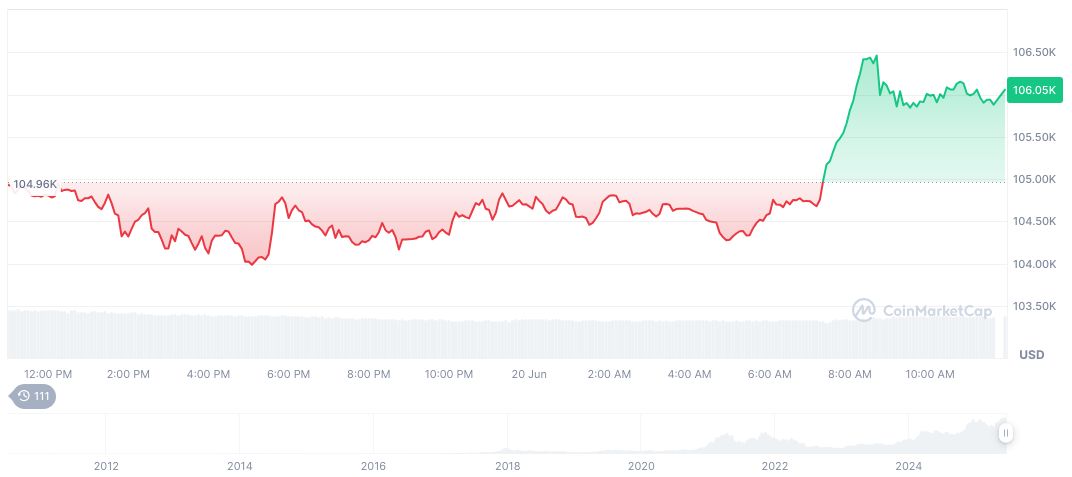

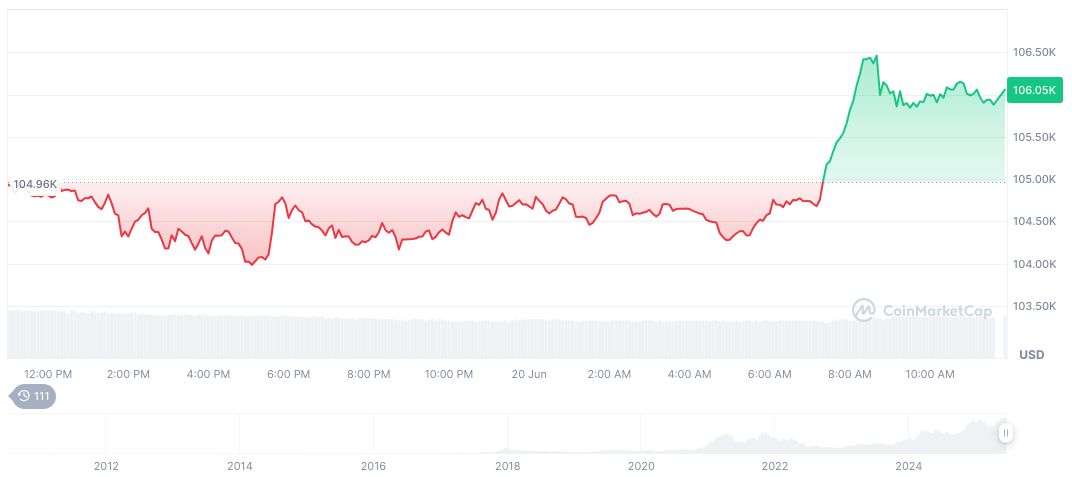

Signals of dovish monetary policy can lead to increased interest in risk assets. Cryptocurrency markets, particularly Bitcoin and Ethereum, reacted positively to Waller’s potential pivot, though the reaction was brief due to prevailing expectations of no immediate rate change. A temporary boost in sentiment was seen, highlighting market sensitivity to Fed commentary.

Waller’s comments echo the past influence of dovish approaches on digital assets, demonstrating a correlation between monetary policy signals and increased optimism within the crypto space. Despite no immediate consensus, markets remained attentive to ongoing policy debates. Importantly, Fed fund futures indicated a high likelihood of no cut in July, with remaining uncertainty about future rate policies.

Historical Context, Price Data, and Expert Insights

Did you know? In 2019, dovish Fed signals sparked significant rallies in crypto markets, showcasing a historical pattern where softened monetary approaches often lift digital assets like Bitcoin and Ethereum.

Bitcoin’s recent market data from CoinMarketCap reveals a value of $102,896.96, a market cap of $2.05 trillion, and a trading volume of $46.02 billion, up 13.35% over 24 hours. Despite slight short-term setbacks, with a 1.75% decline in a day and a 2.10% drop over a week, Bitcoin’s 90-day performance records a notable 22.21% gain.

According to Coincu research, Federal Reserve shifts, primarily through signals of potential rate easing, have historically created favorable conditions for cryptocurrency growth. Monitoring macroeconomic cues alongside regulatory developments, the industry’s path forward hinges on anticipated policy evolutions, balancing current fiscal pressures against digital asset opportunities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344551-fed-waller-advocates-rate-cuts/