- ETH capital flowed into Avalanche, with $6.5M in Bridged Netflow, hinting at quiet accumulation by bigger players.

- AVAX may be gaining quiet support, but whether it leads to recovery or stalls out remains an open question.

In the past 24 hours, Avalanche [AVAX] fell by 2.6% to $18, extending its weekly and monthly losses to 13% and 19%, respectively.

However, market analysis indicates that ongoing buying activity from Ethereum [ETH] investors could spark a broader rally—though key on-chain metrics still need to align.

Ethereum capital is creeping in—here’s what that could mean

Investor sentiment in the market is gradually shifting, as liquidity continues to move across various assets.

According to AMBCrypto’s analysis, $7 million in Bridged Netflow entered the AVAX ecosystem in the past 24 hours—$6.5 million of it came from ETH.

Source: Artemis

This significant capital flow from an asset like ETH into AVAX is noteworthy, as it suggests strong market participants are beginning to eye AVAX.

AMBCrypto examined this rising interest and traced it to AVAX setting new highs in on-chain activity.

On-chain activity surges for AVAX

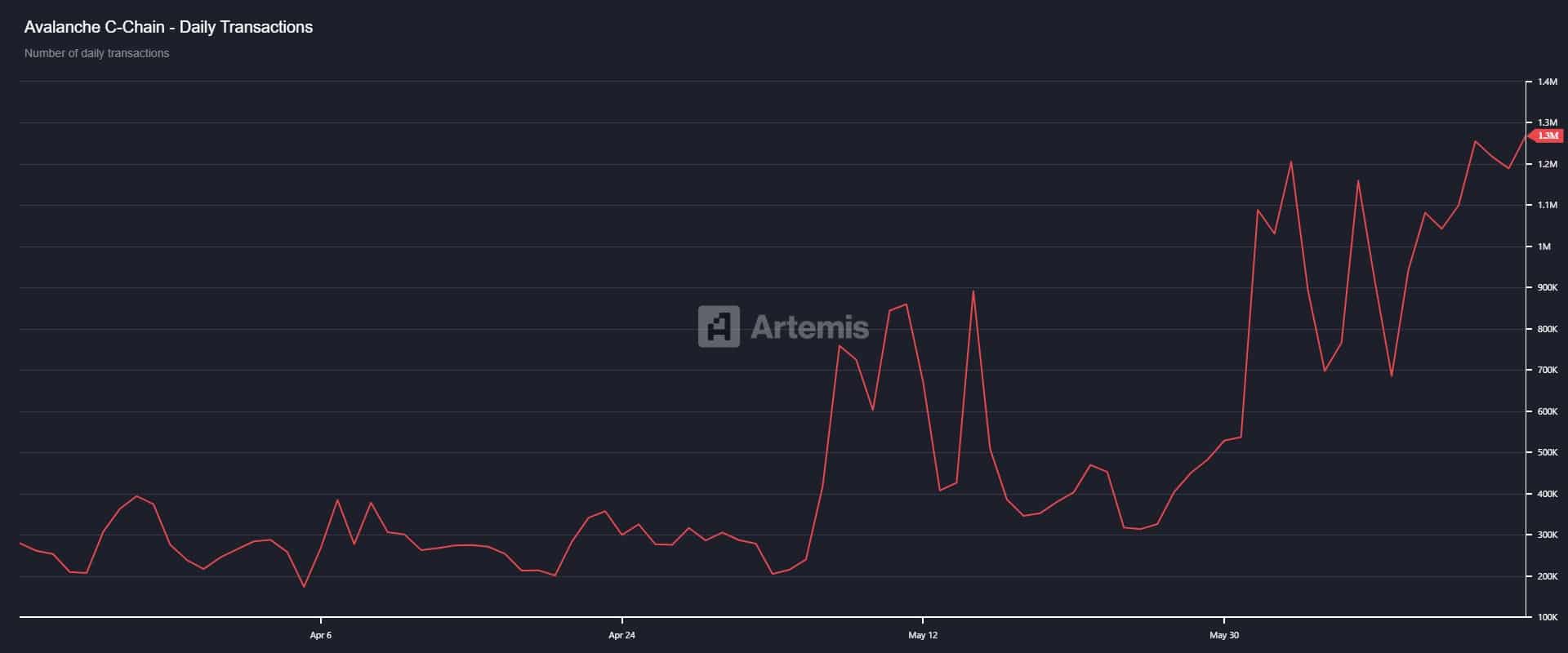

AVAX Daily Transactions hit a three-month high of 1.3 million, marking a surge in network usage.

At the same time, Daily Active Addresses also climbed to their highest point in June, validating that these aren’t just bot-driven spikes.

The combination points to rising user interaction, not just token speculation.

Source: Artemis

If this upward trend continues—with more on-chain activity and active users—it could lead to sustained accumulation of the asset over time. However, not all signals are aligned just yet.

Low DeFi activity raises questions about growth

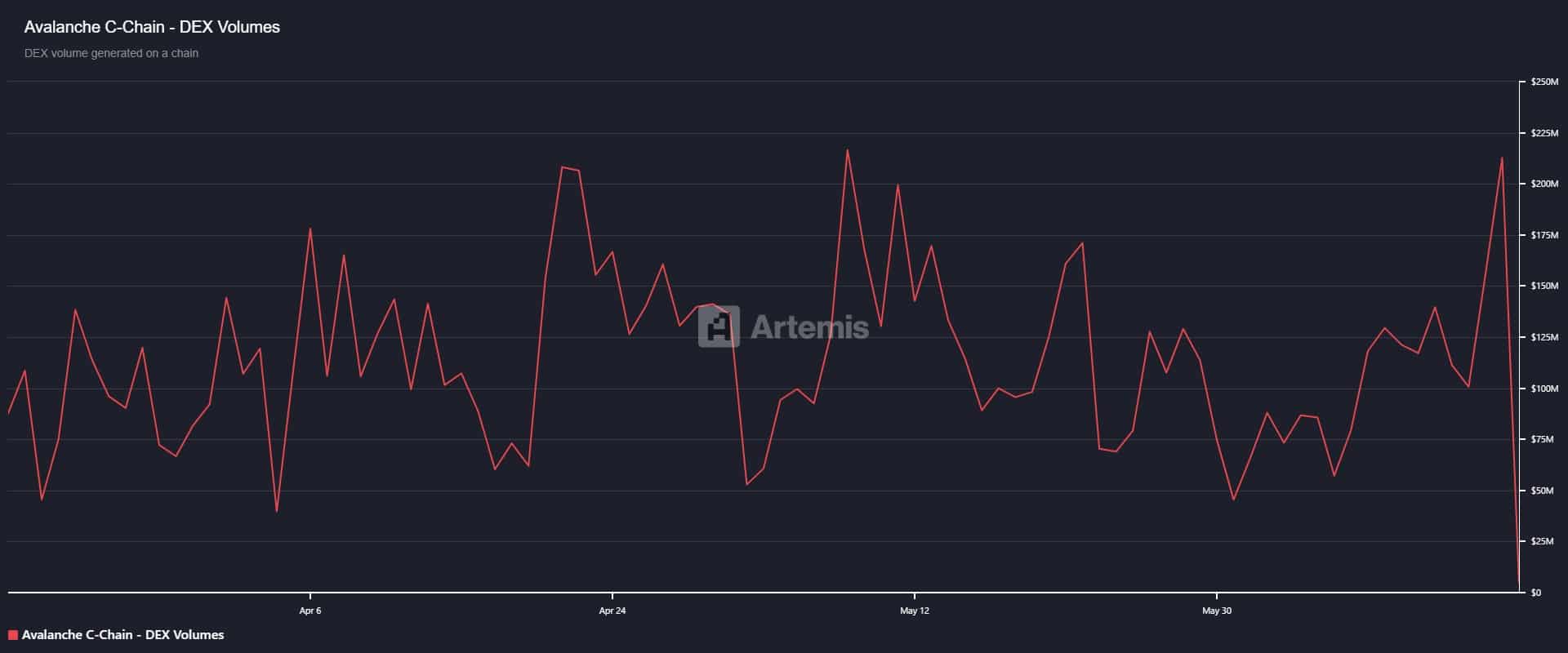

While activity spiked on-chain, DeFi-related metrics told a different story.

There’s been a notable decline in Decentralized Exchange (DEX) trading volume for the asset over the past 24 hours. As of press time, volume dropped to around $5 million—its lowest point in the past three months.

This drop suggests that on-chain traders are not utilizing AVAX as actively as before, which may partly explain its recent price decline.

Source: Artemis

Additionally, Stablecoin Supply on the Avalanche chain has fallen sharply, hitting its lowest level during this period.

The current figure of $1.1 billion indicates reduced demand for stablecoins on the chain, further contributing to AVAX’s price weakness.

The continued drop in DEX trading and Stablecoin Supply has negatively impacted the asset’s growth.

Source: https://ambcrypto.com/avalanche-sees-6-5-mln-eth-flow-in-24-hours-yet-its-defi-volume-crashed-why/