- U.S. House progresses legislation impacting stablecoins and digital assets.

- Bipartisan efforts aim for August completion.

- Potential significant impacts on market regulation.

The U.S. House of Representatives is moving forward with critical cryptocurrency legislation, including the CLARITY Act and GENIUS Act, to meet a legislative deadline set for August.

This advancement signifies a pivotal moment in U.S. cryptocurrency regulation, which could reshape the market by providing clearer guidelines for digital assets.

Legislative Aims for CLARITY and GENIUS Acts

As reported by PANews, the U.S. House is advancing two major legislative initiatives, the CLARITY Act and the GENIUS Act, aiming for an August deadline. Key sponsors include Senator Tim Scott for the GENIUS Act and Chairman Glenn “GT” Thompson for the CLARITY Act. Following passage through critical committees with strong bipartisan support, these bills now move to respective floors.

Change ushered by this legislation focuses on regulating stablecoins under stringent requirements and transferring digital commodities oversight to the CFTC. Congressional efforts underscore a priority for regulatory clarity, likely influencing stakeholders like Circle and Ripple through compliance mandates.

“The passage of the GENIUS Act through the Senate marks a significant leap forward in establishing comprehensive oversight for stablecoins,” remarked Senator Tim Scott, highlighting bipartisan support for the initiative.

Responses to this legislative move are notable, with stakeholders anticipating potential impacts on market structures and asset classifications. Despite no direct quotes from major figures, the legislation’s progress appears well-received among industry proponents seeking legal clarity.

Impact on Market and Institutional Adoption

Did you know? The GENIUS Act marks the first major cryptocurrency legislation to receive U.S. Senate approval, paralleling the EU’s MiCA framework which bolstered European market confidence.

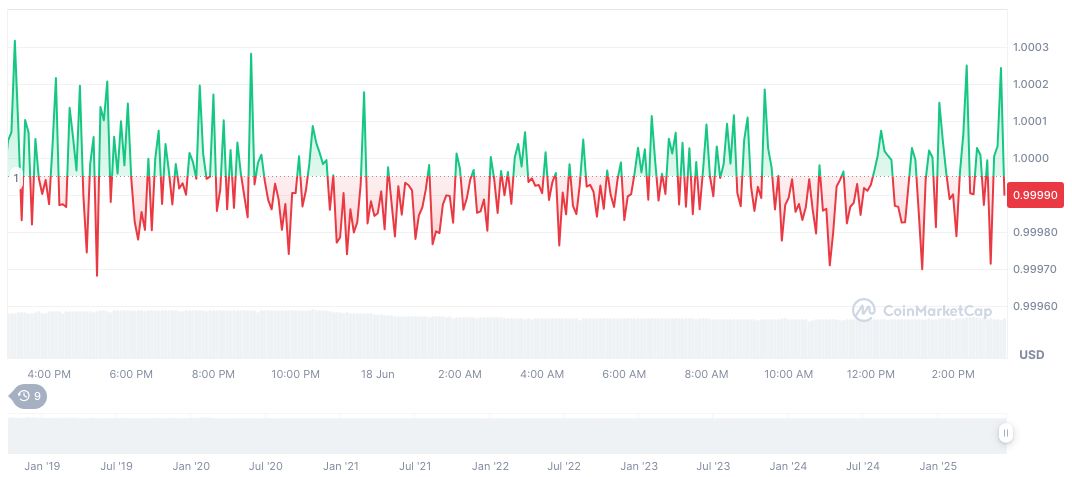

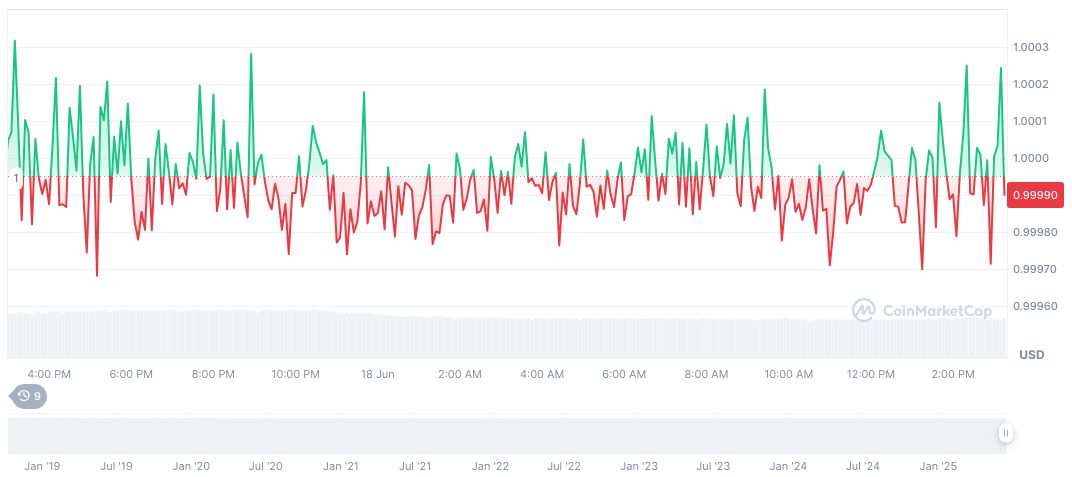

According to CoinMarketCap, USD-backed stablecoin USDC currently maintains a market cap of approximately $61.52 billion, representing 1.89% of the market with a stable 24-hour trading volume fluctuation. Price changes for the 90-day period remain minimal, underscoring consistent valuation at $1.00.

Analysis from the Coincu research team suggests these legislative advancements may accelerate institutional adoption of digital assets, boosting compliant projects and potentially leading to a reallocative shift in market dynamics towards regulatory-aligned cryptocurrencies. Access further details via the House Agriculture Committee meeting documents.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344164-house-advances-crypto-legislation-deadline/