- Federal Reserve Chair Powell warns of tariff impacts on inflation.

- Tariffs may pressure economic activity and inflation.

- Crypto markets often react to broader economic pressures.

Federal Reserve Chairman Jerome Powell stated that this year’s increase in tariffs could pressure economic activity and push up inflation.

This development could influence investor behavior in equity markets and cryptocurrencies amid heightened economic uncertainty.

Powell’s Tariff Warnings: Economic Growth at Risk

Federal Reserve Chair Jerome Powell raised concerns during a recent statement about the potential impacts of increased tariffs on the U.S. economy, highlighting possible pressures on economic growth and inflation.

Increased tariffs on imports could lead to higher consumer prices and reduced corporate profits, potentially slowing growth. Institutional investors might shift toward safer assets such as U.S. Treasuries, away from equities and cryptocurrencies.

Powell’s statements often influence financial markets. Historically, hawkish Fed comments have led to risk-off behavior among investors, impacting cryptocurrencies and stocks. No immediate market reactions were noted, but investor sentiment remains cautious.

Bitcoin Volatility Amid Tariff and Inflation Concerns

Did you know? Historically, tariff hikes like those of 2018-2019 led to bitcoin volatility, mirroring potential impacts from similar economic pressures today.

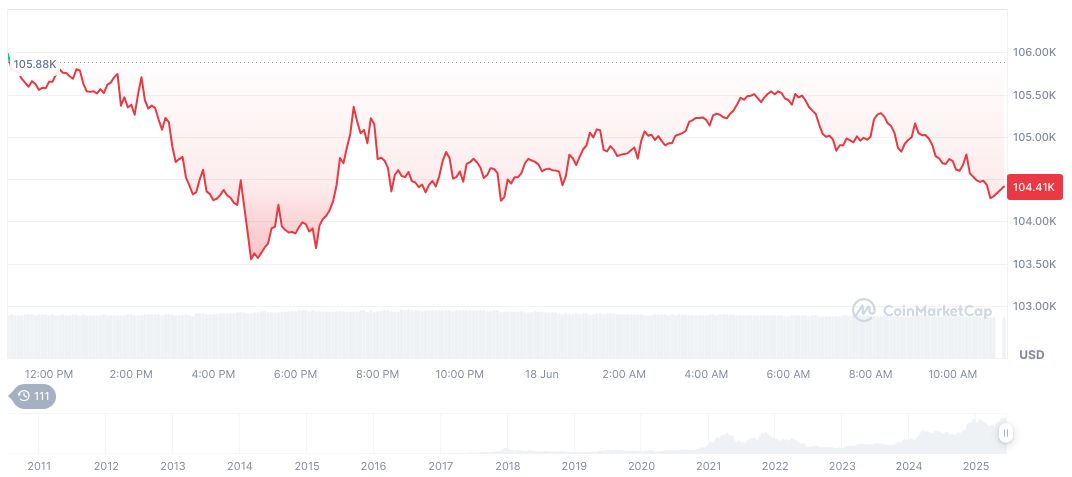

Bitcoin (BTC) is currently trading at $104,503.82 with a market cap of $2.08 trillion. Recent price movements show a 0.42% increase over 24 hours, but a 3.98% decline over the past week. As per CoinMarketCap, Bitcoin remains a dominant force, holding 64.05% market dominance.

The Coincu research team notes that potential inflationary shocks could trigger further market volatility, with cryptocurrencies reacting to macroeconomic changes. Past events suggest inflation concerns often lead to quick market corrections, with investors favoring safer assets amid uncertainty.

“Macro policy is the single most important driver for digital asset flows and risk sentiment,” stated Raoul Pal, CEO of Real Vision.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/344116-fed-chair-warns-over-tariff-impact/