- Ethereum got a boost after SharpLink bought $463M worth of ETH

- Whale activity and a spike in new depositors seemed to back Ethereum’s price resilience

Ethereum’s price has been consolidating steadily around the $2500-range over the last month. This has been the case, despite the broader market’s mixed signals.

However, while not in bull mode just yet, ETH has been strong all along as it battles against extreme drawdowns. This consistency has triggered more interest from both retail and institutional investors.

Source: TradingView

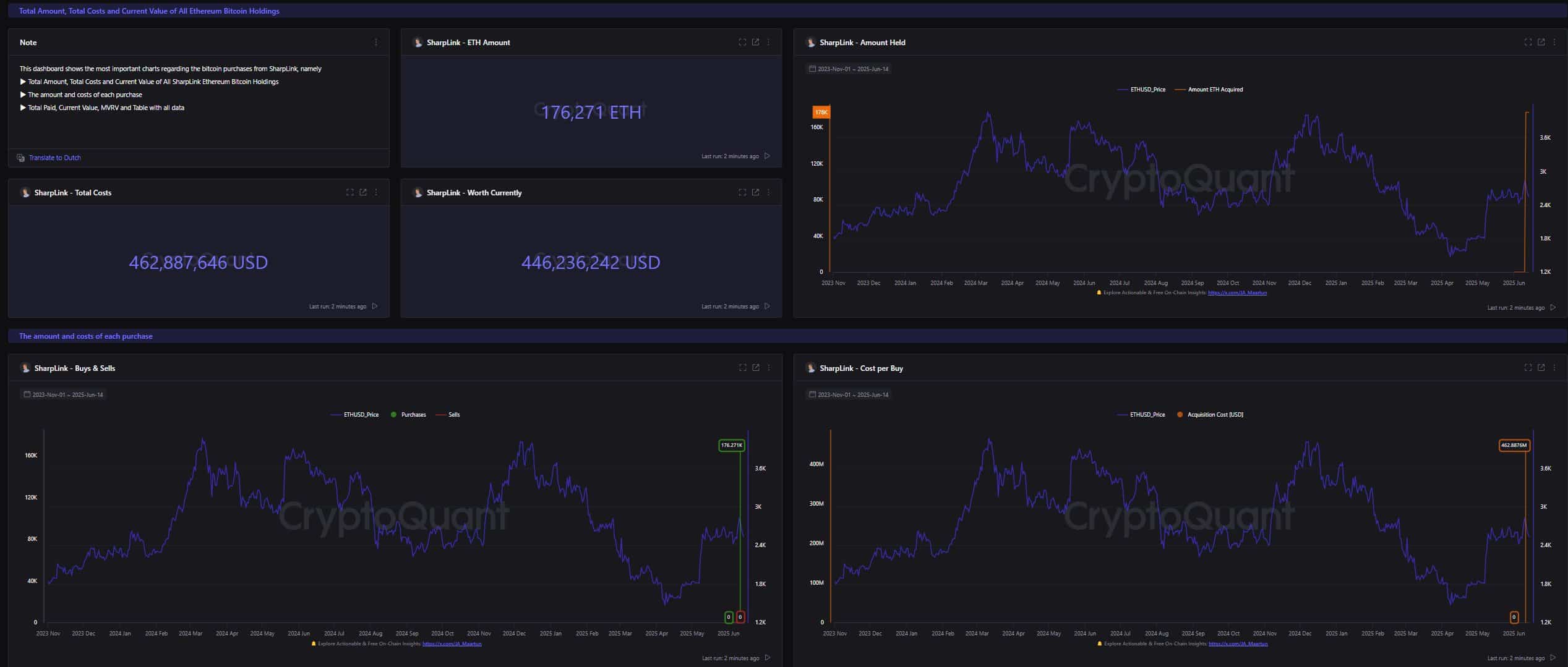

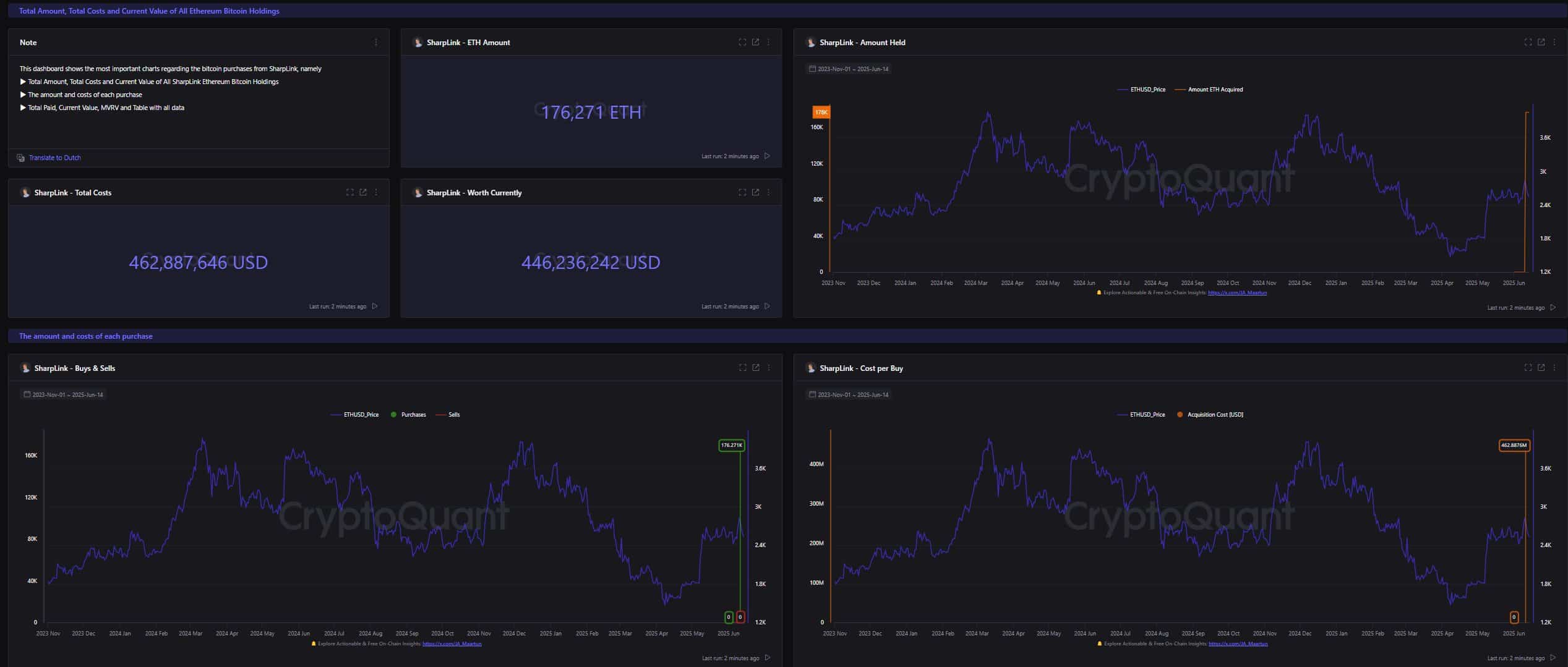

SharpLink’s massive Ethereum investment suggests strategic re-balancing

In a move as bold as MicroStrategy’s, SharpLink recently acquired 176,271 ETH – Worth about $463 million. The company is now the largest publicly traded holder of Ethereum. The move could remake how public companies see and include ETH in long-term investment positions.

SharpLink’s aggressive buy-in signals a strong confidence in future use of Ethereum in cross-border finance. Just like MicroStrategy’s bet on Bitcoin during the first institutional wave, this ETH buy-in could pave the way for others.

Source: CryptoQuant

Institutions’ favourite asset?

The timing of SharpLink’s buy aligns with a broader trend. Most traditional firms are now warming up to crypto assets. Ethereum, with its ecosystem of smart contracts, DeFi protocols, and staking opportunities, is increasingly being viewed as more than just a speculative play.

This narrative shift—from high-risk asset to long-term institutional portfolio component—is gaining ground across all the poles. As regulation becomes clearer, more firms may consider Ethereum. Not just as a hedge, but as a core asset.

Whale activity and depositor surge add fuel

On-chain data also revealed that smaller whales—entities holding between 1,000 and 10,000 ETH—have been accumulating at press time price levels. Their actions hinted at confidence in a price floor and a potential upside.

Source: CryptoQuant

In addition, the number of unique depositors interacting with Ethereum has been surging significantly too.

Such an uptick in network activity adds more fuel to the altcoin’s bullish momentum. It also reflects growing retail engagement and long-term belief in ETH’s utility.

Source: CryptoQuant

From rising institutional interests to increasing whale confidence, Ethereum’s fundamentals have been strengthening lately. In fact, SharpLink’s $463M investment could be the first of many headline moves in ETH’s next adoption cycle.

If ETH follows the trajectory Bitcoin did after MicroStrategy’s buy-ins, we may be at the beginning of a new Ethereum narrative.

Source: https://ambcrypto.com/sharplinks-463m-ethereum-bet-is-it-a-sign-of-things-to-come/