- CoinShares has filed for a Solana spot ETF, joining a competitive market.

- The ETF includes institutional-grade custodian services from Coinbase Custody and BitGo Trust.

- Market sentiment is positive, supported by Solana’s network growth and strong Total Value Locked (TVL).

CoinShares has filed a Form S-1 with the US Securities and Exchange Commission for a Solana (SOL) spot ETF, joining other major firms in this competitive bid. The filing, highlighted by Bloomberg analyst Eric Balchunas, showcases intense institutional interest.

The Solana ETF aims to provide investors with direct price exposure to Solana, including staking rewards. This move might enhance SOL’s attractiveness as a crypto investment. The ETF lists Coinbase Custody and BitGo Trust as custodians, indicating robust institutional-grade solutions.

Industry Insights

Industry analysts estimate a 70-90% chance of approval due to growing regulatory openness. While official developer reactions on GitHub are absent, Solana’s increased Total Value Locked (TVL) and growing DeFi presence signal market optimism.

CoinShares has just become the eighth firm to file for a spot Solana ETF, further intensifying the race. Tons of engagement with the SEC, issuers are quickly updating/redrafting S-1s. Momentum is notably higher compared to pre-ETH ETF days. — Eric Balchunas, ETF Analyst, Bloomberg

CoinShares has just become the eighth firm to file for a spot Solana ETF, further intensifying the race. Tons of engagement with the SEC, issuers are quickly updating/redrafting S-1s. Momentum is notably higher compared to pre-ETH ETF days. — Eric Balchunas, ETF Analyst, Bloomberg

Market Sentiment Positive Amid Strong Solana Fundamentals

Did you know? The Solana blockchain has been gaining traction due to its high throughput and low transaction costs, making it an attractive option for decentralized applications.

CoinShares recently submitted the S-1 document for a Solana (SOL) spot ETF to the US Securities and Exchange Commission. According to Bloomberg ETF analyst Eric Balchunas, CoinShares is now the eighth institution competing for such a product. This filing is significant as it underscores the growing interest from high-profile firms like Fidelity and Grayscale in offering Solana-based investment solutions.

This collective push for a Solana ETF reflects heightened institutional enthusiasm. It suggests an expected regulatory openness regarding digital assets compared to previous Bitcoin and Ethereum ETF proceedings. The use of Coinbase Custody and BitGo Trust for asset security further strengthens the prospectus, appealing to investors seeking reliable crypto exposure.

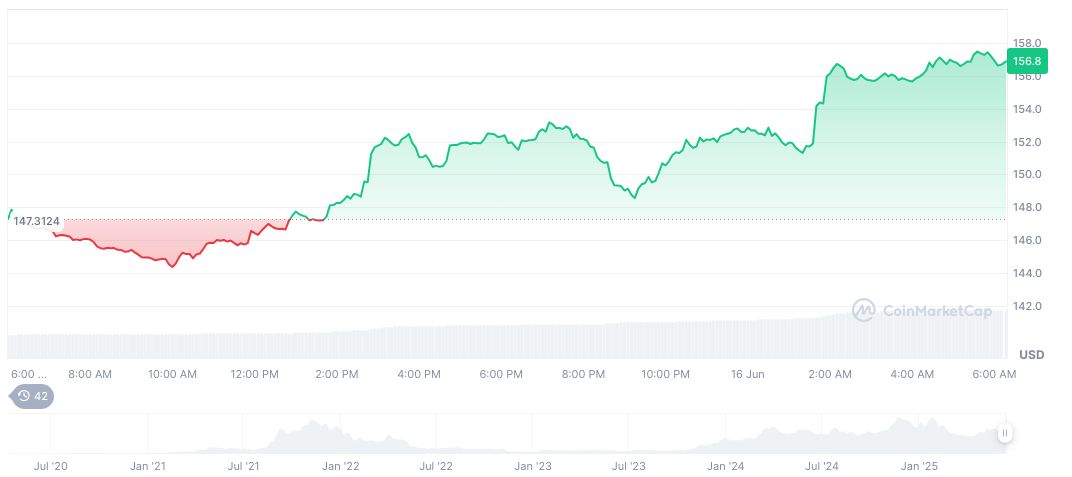

Market reactions have been notably positive. The growth in Solana’s network activity, including a substantial Total Value Locked (TVL) of 8.7 billion, underscores positive sentiment. Representatives, however, remain measured in their public communications, focusing on the ETF structure and potential financial inflows rather than speculative statements.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343650-coinshares-solana-spot-etf/