- Eric Trump denies taking an official role at Tron Inc.

- Tron Inc. formed through a $210 million reverse merger.

- TRX token surged 5% after merger announcement.

Eric Trump, the second son of former President Donald Trump, has denied taking an official position with Tron Inc., despite reports from sources like the Financial Times. The statement comes amidst a $210 million reverse merger between TRON and SRM Entertainment.

Eric Trump’s public denial highlights the importance of verifying leadership changes, which can significantly affect financial markets. Following the merger announcement, TRX experienced a 5% increase in market price, reflecting investor confidence.

TRON’s Strategic Merger Boosts Market Confidence

Tron Inc. was formed through a reverse merger involving TRON and SRM Entertainment, creating a new entity with significant assets. Eric Trump denied involvement, while maintaining his appreciation for Justin Sun, TRON’s founder. TRX surged 5% post-announcement, indicating investor confidence in TRON’s strategy.

Financial implications are notable, as TRX now holds a more prominent position in public markets. The $210 million deal is structured in a corporate treasury style, including a $100 million equity investment into SRM. This could influence digital asset management strategies.

“Stablecoins and blockchain are revolutionizing global payments, enabling faster, cheaper, and more transparent transactions. With over 310 million international user accounts and average daily transactions YTD exceeding $20 billion, TRON strives to be the protocol of choice for onchain settlement serving the mass populations worldwide.” — Justin Sun

TRON’s Progress Aligns with Industry Trends

Did you know? When companies, like MicroStrategy, adopt a digital asset treasury model, their target tokens often get a bullish push akin to TRON’s current market sentiment.

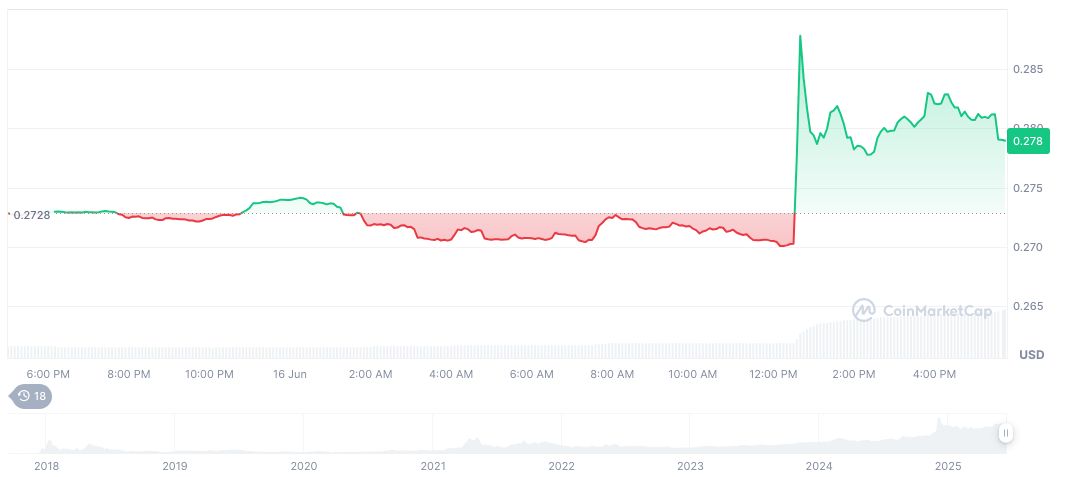

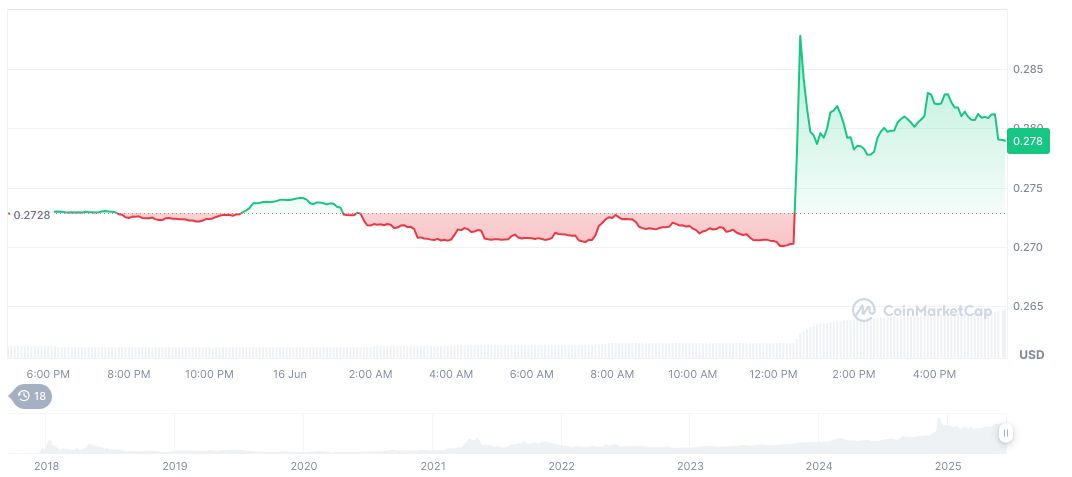

TRON (TRX) has shown recent growth trends. Trading at $0.28 with a market cap exceeding $26.47 billion, it maintains a market dominance of 0.78%, according to CoinMarketCap. The token’s 24-hour trading volume reached $1.26 billion, marking a 292.07% increase. TRX’s 90-day price surged by 24.03%, suggesting robust momentum.

Coincu analysts predict the merger could enhance TRON’s treasury-management approach, paralleling successful corporate models like MicroStrategy. Such alliances, though potentially bringing regulatory scrutiny, may also increase TRON’s appeal to public market investors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343641-eric-trump-tron-inc-denial/