- Coordinated swaps and dumps by KOGE and ZKJ resulted in a flash crash.

- Millions of dollars exchanged through strategic liquidity exit moves.

- Absence of official statements leaves industry speculating on market stability.

On June 15, two major crypto wallets orchestrated strategic swaps involving KOGE and ZKJ tokens. Addresses 0x1A2…27599 and 0x078…8bdE7 executed large-scale transactions, substantially impacting market liquidity.

These coordinated actions underscore significant market manipulation risks, as seen in previous events like the Binance Alpha airdrop. The impact resulted in a rapid liquidity exit, affecting ZKJ and KOGE’s pricing.

Strategic Swaps Shake Market Liquidity

On June 15, addresses 0x1A2…27599 and 0x078…8bdE7 conducted major swaps between KOGE and ZKJ, totaling $6.056 million. Strategically, the swaps involved 82,284 KOGE, immediately followed by their swift exit. This tactic diminished liquidity, causing rapid price drops.

Market liquidity plunged, resulting in sharp price declines for both tokens. This strategy closely resembled previous wash trading activities seen during the Binance Alpha airdrop, reinforcing ongoing DeFi market risks. Flash crashes posed potential contagious effects on related markets.

As of now, there are no official statements or public tweets from top industry figures addressing the incident.

Historical Context, Price Data, and Expert Insights

Did you know? Earlier KOGE-ZKJ swaps during the Binance Alpha airdrop event utilized similar low-slippage strategies, paving the way for strategic liquidity farming actions seen on June 15.

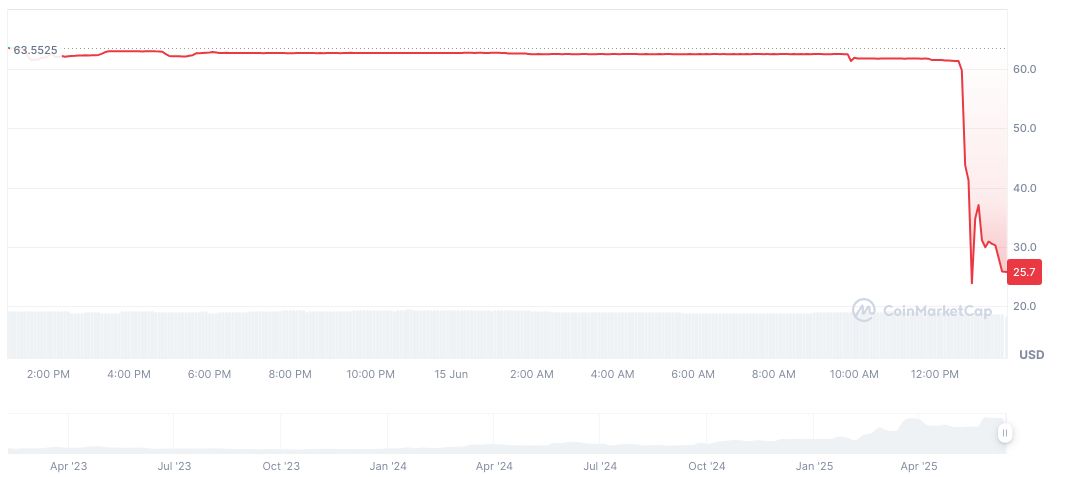

KOGE, trading at $26.33, saw its price plummet 58.03% in 24 hours amid notable market movements. Market capitalization stands at $89,215,069, reflecting drastic valuation drops as highlighted by CoinMarketCap.

Based on CoinCu analysis, such strategic swaps present potential regulatory scrutiny, emphasizing risks associated with concentrated liquidity exits. Historical events like this underscore the potential for rapid market shifts within DeFi ecosystems, necessitating vigilance in crypto regulation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343477-koges-zkjs-liquidity-flash-crash/