- Federal Reserve set to maintain interest rates as per CME FedWatch.

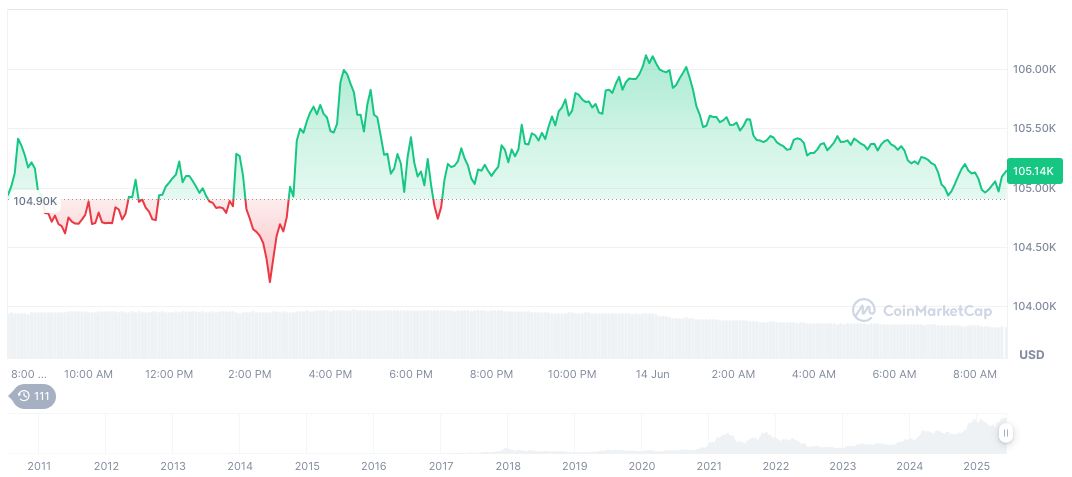

- Bitcoin prices impacted, seen at $105,015.63 with minor fluctuations.

- Crypto market shows low volatility amidst stable rate expectations.

The Federal Reserve is expected to keep interest rates steady in its upcoming June 19, 2025, FOMC meeting. Data from CME “FedWatch” shows a 99.6% probability of no rate change, with a 0.4% chance of a 25 basis point cut.

Such expectations signal a temporary hold, aligning market anticipation with stable monetary policy and limiting substantial fluctuations in the cryptocurrency realm.

Federal Reserve’s Rate Hold Influences Bitcoin’s Market Dynamics

Federal Reserve policymakers, led by Chair Jerome Powell, have shown an inclination to maintain the current interest rates, according to CME FedWatch data. The projected 99.6% probability of unchanged rates signifies broad market consensus. This situation results in limited anticipation of rate cuts for June, with crypto markets reacting accordingly.

Major cryptocurrencies have shown varied reactions, with Bitcoin recently priced at $105,015.63 amid minor downward adjustments. Nonetheless, Ethereum has seen increases in whale activity, reflecting strategic accumulation despite external influences. Volatility remains subdued with rates expected to hold steady, compelling investors to adopt a cautious approach.

“The overall cryptocurrency market has been affected, with a $150 billion drop in capitalization, highlighting the interconnectedness of these developments.” — Market Data Analyst, The Block Beats

Bitcoin Price Increases 26.63% Amid Steady Fed Rates

Did you know? In periods where the Federal Reserve’s rate hold probability exceeds 99%, crypto markets often experience reduced volatility, as seen in past years, with whales typically taking advantage of such quiet periods to amass major coins.

Bitcoin (BTC) currently holds at $105,352.20, displaying market dominance at 63.97% as per CoinMarketCap. With a capitalization nearing $2.09 trillion, recent 24-hour trading volume hit approximately $34.55 billion. Price movements over three months reveal a mixed outlook, marked by a 26.63% increase in the last 60 days, indicating investor confidence despite short-term uncertainties.

The Coincu research team foresees stable digital asset valuations linked to the Federal Reserve’s consistent monetary stance, potentially advancing institutional crypto adoption. Historical price reactions suggest possible strategic gains for well-positioned institutional and retail investors during prolonged regulatory stasis, aligning with CME expectations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343390-federal-reserve-june-2025-interest-rates/