- Nasdaq-listed small-cap firms claim plans to acquire massive crypto reserves.

- Experts cite these moves might be insider-driven “pump and dump” schemes.

- Such announcements previously caused temporary stock price spikes.

A group of Nasdaq-listed, small-cap companies announced plans to acquire significant amounts of cryptocurrencies like XRP and Solana, BlockBeats reported on June 14.

The announcements potentially point to “pump and dump” schemes, with experts expressing strong skepticism about insider motivations and lacking investor disclosures.

Small-Cap Firms Signal Large Crypto Buys, Eyed as Schemes

Several small-cap companies, with no direct ties to cryptocurrency, have revealed massive crypto purchase intentions, including Trident Digital Tech and Addentax Group Corp. Notably, both have market caps under $16 million. Critics argue these announcements may be strategic moves to temporarily boost stock values, with Matthew Sigel labeling them as possible scams.

The intended acquisitions target altcoins like XRP and Solana. However, no substantial evidence substantiates these claims. The lack of visible investor backing or capital deployment raises questions about the authenticity and feasibility of these large-scale plans. Industry reactions have been largely skeptical. VanEck’s Matthew Sigel openly criticized these announcements, suggesting they may involve manipulative behaviors to inflate stock prices. Analysts and market observers urge caution, with no formal statements from the affected cryptocurrency projects.

“A lot of this looks like insiders trying to pump and dump. If the market cap is negligible and no new investors are disclosed, I would assume this to be a scam.” — Matthew Sigel, Head of Digital Assets, VanEck

XRP Price Unaffected Despite Lack of Purchase Evidence

Did you know? In several past instances, small-cap firms’ crypto purchase announcements temporarily spiked their stock prices. Yet, these gains often reversed due to a lack of actual buying or financial backing.

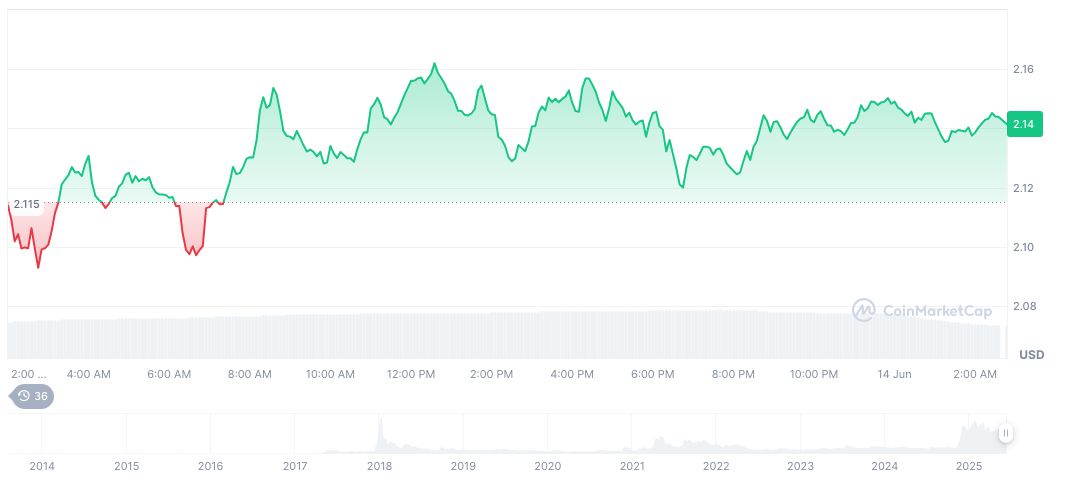

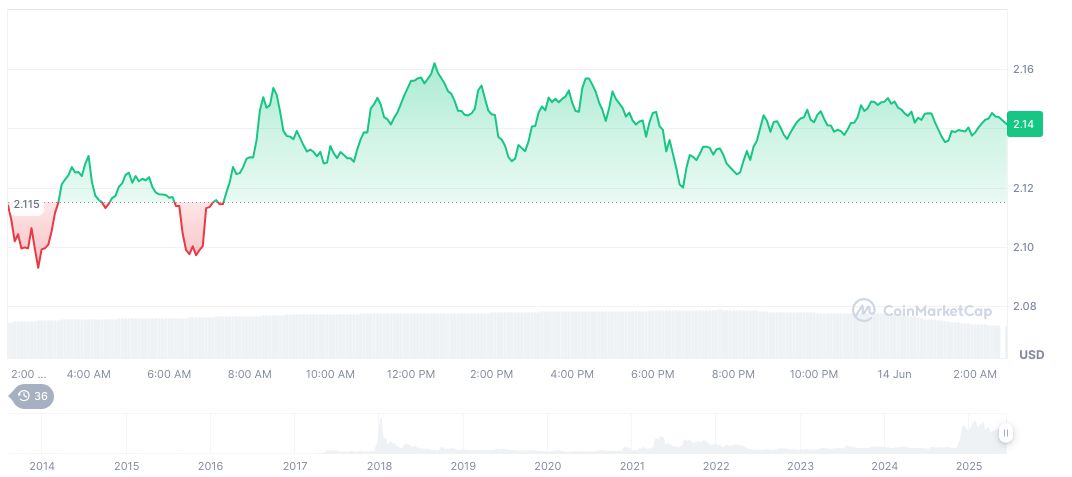

XRP currently trades at $2.14, maintaining a market dominance of 3.84%. Its market cap stands at approximately 126.11 billion according to CoinMarketCap (Last updated: June 14, 2025). Despite a 24-hour price increase of 2.33%, XRP experienced a 1.24% decline over the past week. The absence of substantial on-chain activities linked to these company announcements suggests broader market dynamics are at play.

Research from Coincu highlights the lack of firm evidence connecting the intended purchases with actual market shifts, hinting at potential regulatory scrutiny. Experts call for diligence given the absence of formal disclosures and investor updates. Warning signs remain, emphasizing the need for thorough financial evaluations and transparent market engagements. Investors are advised to follow credible market insights like those shared by Rexas Finance to stay informed.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343195-small-cap-crypto-purchase-announcement/