Key Points:

- SEC stops DeFi Corp’s $1B Solana raise over missing internal control financial report.

- DeFi Corp secured $24M PIPE investment to grow its Solana treasury despite SEC filing setback.

- Company now holds over 609,000 Solana tokens after leadership shift led by ex-Kraken executives.

DeFi Development Corp has withdrawn its S-3 registration filing with the US SEC after the agency said the company was not eligible to file the form. The Nasdaq-listed firm disclosed on Wednesday that it had failed to include a management report on internal control over financial reporting, a requirement for Form S-3 eligibility.

Consequently, the SEC rejected the filing. DeFi Development Corp stated that it withdrew the registration statement in line with the public interest and investor protection rules. The company had originally filed the statement on April 25 to raise up to $1 billion, with a portion of the funds planned for Solana token acquisitions.

Solana Acquisition Strategy Continues

Despite the filing setback, the company has not abandoned its plans to increase Solana holdings. In its statement, DeFi Development Corp said it intends to submit a resale registration statement in the future. The funds raised would be used for general corporate purposes, including more Solana purchases.

In a May update, the company announced that it had adopted Solana liquid staking and transferred some holdings to dfdvSOL, a liquid staking token. The firm warned that changes in Solana’s market price could affect the final value if the tokens are converted into cash.

In addition to its earlier filing efforts, the firm announced a $24 million private investment in public equity (PIPE) on May 1. As reported by CoinCu, the company said this capital would be used to strengthen its Solana holdings. The PIPE funding reflects ongoing interest in Solana as part of the firm’s updated strategy.

Shift Toward Crypto-Focused Operations

DeFi Development Corp, formerly known as Janover, was once a real estate financing business. It operated a platform that connected lenders and commercial property buyers. The company has since shifted focus and now positions itself as a Solana Treasury Company.

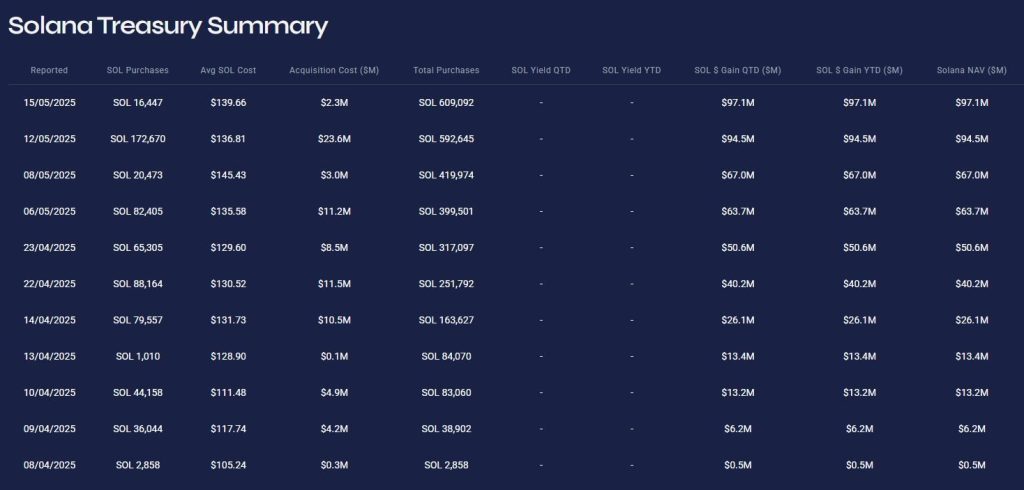

The firm began accumulating Solana in early April, starting with a purchase of 2,858 SOL. By May 15, it had completed 11 separate Solana purchases. The most recent buy added 16,447 SOL at an average price of $139.66. In total, DeFi Development Corp now holds 609,190 Solana, valued at over $97 million at current prices.

New Leadership and Strategic Direction

The company’s direction changed following a leadership transition. A group of former Kraken exchange executives acquired over 728,000 shares of DeFi Development Corp on April 7. Joseph Onorati, former chief strategy officer at Kraken, has since taken over as chairman and CEO.

DeFi Development Corp’s move into crypto reflects a wider trend. Many companies have added digital assets to their balance sheets. According to Bitbo, corporate Bitcoin holdings now exceed 3 million BTC, valued at over $342 billion.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Source: https://coincu.com/342844-sec-blocks-defi-corps-1b-solana-buying-spree/