- Polymarket recession odds fall to 26%, with trading volume over $6.6 million.

- Market volatility signals possible interest in stablecoins and ETH.

- No major crypto figure comments on prediction contract as of June 9.

U.S. recession odds on Polymarket have decreased to 26% from a peak of 66% on March 2, with over $6.6 million traded by June 9. This decline signals significant shifts in market speculation.

Polymarket, a decentralized prediction market, is seeing changes in the probability of a U.S. recession by 2025. As trading volume exceeds $6.6 million, this pause in rising odds draws attention from market observers.

Polymarket Recession Odds and Trading Volume Surge

Polymarket participants have shown interest in predicting a potential U.S. recession by 2025. The market, once reaching a 66% chance earlier in March, has seen odds decrease dramatically to 26%. This shift reflects changing trader sentiments and macroeconomic evaluations. Sharp declines in prediction odds have occurred despite ongoing global market fluctuations.

The dramatic decrease in odds, accompanied by hefty trading volumes, has prompted discussions around platform usability and the validity of market data. Nevertheless, core digital assets like ETH and USDC remain stable but could experience ripple effects due to increased speculation. Major institutions including Goldman Sachs and JPMorgan have raised their recession probabilities, although no direct comments have emerged from Polymarket executives. Digital forums remain active as community members debate prediction market reliability. The financial community continues to assess the potential impact on investment strategies.

We now see a 45% chance of recession, while JPMorgan recently hiked its recession probability to 60%.’ – Goldman Sachs, Investment Bank

Recession Predictions and Regulatory Implications

Did you know? In March 2025, odds of a U.S. recession on Polymarket soared to 66% following economic policy shifts, echoing past volatility during political events.

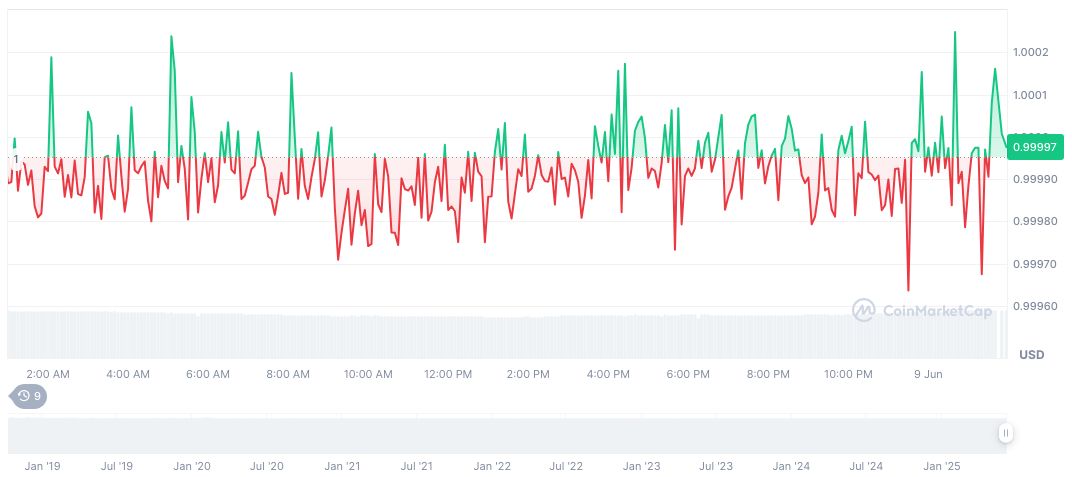

USDC, utilized in Polymarket for settlements, maintains a steady price at $1.00 as per CoinMarketCap. Its market cap sits at $61.06 billion, supporting its 1.85% market dominance. Recent slight fluctuations in trading volume reflect broader stablecoin dynamics amid shifting market expectations.

Coincu research suggests that prediction markets could face enhanced scrutiny due to these odds swings, possibly leading to increased regulatory oversight. Investors may employ historical pricing analysis to navigate potential outcomes as policy changes impact economic markers.

The financial community continues to assess the potential impact on investment strategies.

Source: https://coincu.com/342301-polymarket-recession-2025-odds/