- Arca sold its Circle shares due to IPO allocation dispute.

- Focus shifts to alternative stablecoins like USDT.

- Criticism for lack of allocation to crypto-native firms.

Arca’s Chief Investment Officer, Jeff Dorman, declared the sale of Circle (CRCL) holdings on June 7, in response to their minimal IPO participation.

The dispute underscores a broader tension between crypto firms and traditional finance, with Arca moving towards other stablecoins.

Arca Sells Circle Shares Over $9.865M IPO Discrepancy

Arca, under the guidance of Jeff Dorman, decided to exit its Circle positions, publicly stating that Circle’s IPO allocation favored traditional finance institutions over crypto-native firms. Dorman emphasized that Circle only awarded Arca a $135 Thousand allocation, despite their $10 Million subscription request.

Arca’s decision to end its association with Circle marks a shift towards USDT as an alternative stablecoin. This move results from dissatisfaction with Circle’s prioritization of traditional finance partners, which Arca believes overlooked early support from crypto-native entities.

The crypto investment community observed Arca’s action, with Dorman critiquing Circle’s IPO share distribution strategy, expressing disappointment in Circle’s preference for traditional finance over digital asset investors. No official responses from other industry leaders have been reported.

“You decide to give fat allocations to TradFi mutual funds and hedge funds who likely didn’t even read your prospectus, have no wallets, and will never use your product.” – Jeff Dorman, CIO, Arca

Market Implications of Arca’s Circle Exit

Did you know? This situation echoes past crypto IPO allocation disputes, like the Coinbase IPO, where established financial entities were favored over crypto-focused investors.

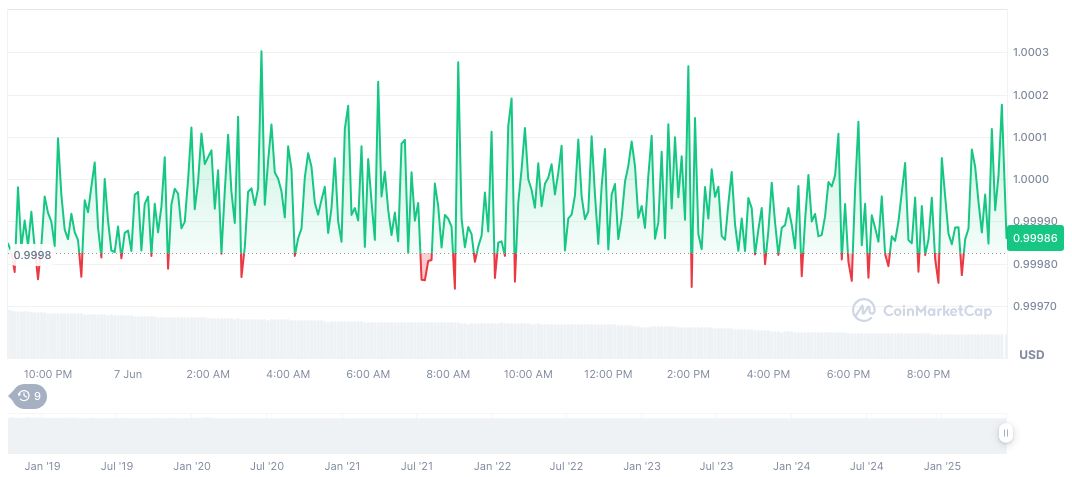

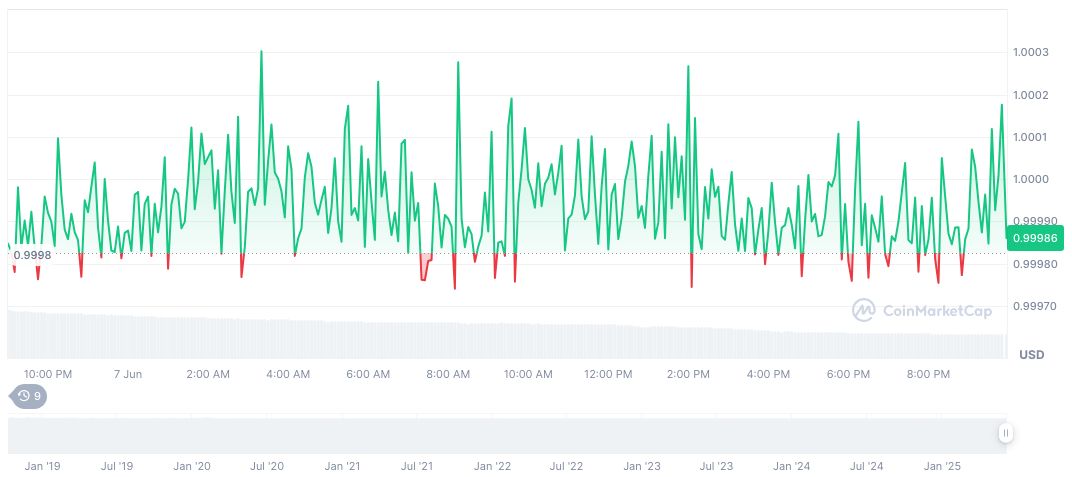

USD Coin (USDC) maintains a stable price of $1.00, with a $61.08 Billion market cap. CoinMarketCap reports a 1.97% price drop over 24 hours, with trading volume decreasing by 45.98%. The circulating supply stands at over 61.09 Billion as of June 7, 2025.

Coincu’s research indicates the strategic move by Arca could signal a decreasing trust in Circle’s commitment to crypto-native partnerships. Such repositioning may trigger broader shifts in stablecoin preferences among other crypto-focused investment firms, potentially disrupting existing market dominance.

Source: https://coincu.com/342125-arca-divests-circle-shares/