- Deutsche Bank considers stablecoins exploration, aiming to innovate in financial assets.

- No public statements from bank’s leadership yet.

- Potential impacts on crypto markets like Ethereum.

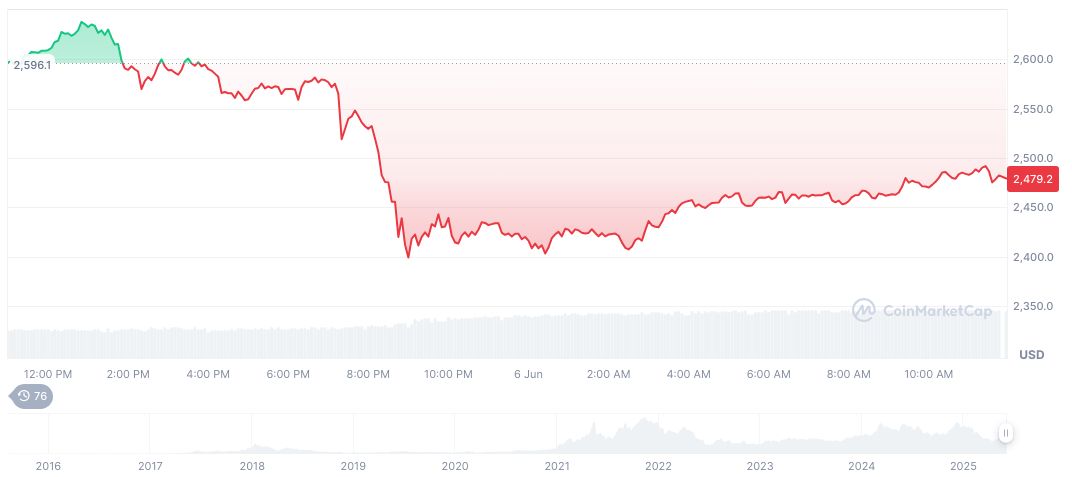

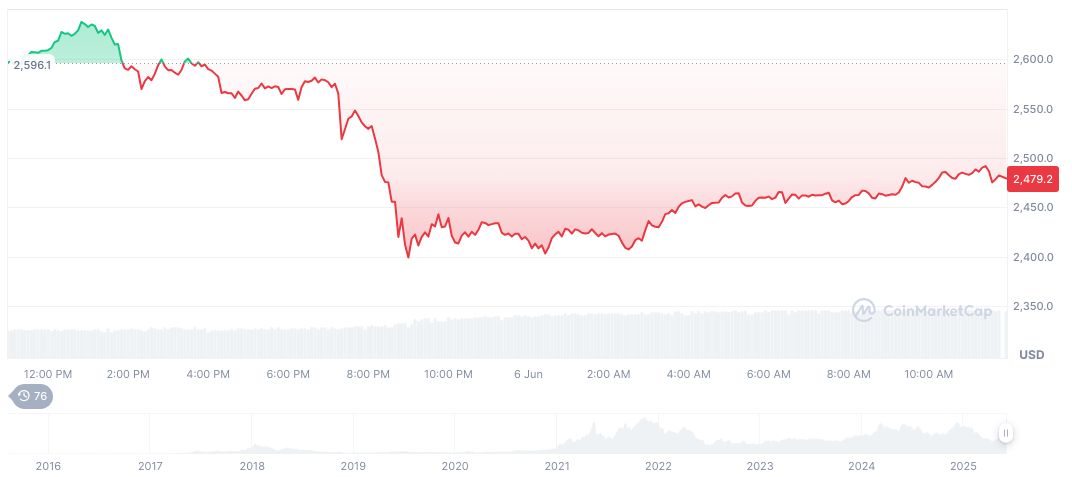

As of June 7, 2025, Ethereum (ETH) trades at $2,497.02, boasting a market cap of $301.44 billion with a 9.20% market dominance. CoinMarketCap reports a 24-hour trading volume of $16.43 billion, although this figure shows a significant 43.53% decrease. Over the past 30 days, ETH experienced a 30.50% increase, confirming substantial volatility.

The Coincu research team notes that Deutsche Bank’s potential stablecoin venture could lead to innovations in regulatory approaches and digital asset integration. Historically, similar initiatives resulted in increased market adoption within traditional finance sectors, opening opportunities for cross-industry partnerships.

Deutsche Bank’s Crypto Speculation Stances Without Confirmation

Deutsche Bank is reportedly exploring the integration of stablecoins and tokenized deposits. While rumors circulate, there are no official confirmations from the bank’s leadership or industry leaders regarding specific actions. Current reports suggest preliminary research rather than finalized plans.

Market speculation suggests this move could catalyze interest in digital currencies. However, without formal statements, the financial community remains cautious in altering investment strategies or risk assessments. Current market reactions reflect minimal volatility linked to Deutsche Bank’s rumored interest. No significant responses from high-profile figures or regulators, leaving the market primarily in a speculative stance.

“Based on the provided information, there are no direct quotes or statements from key players or leadership regarding Deutsche Bank’s exploration of stablecoins and tokenized deposits. As such, I cannot deliver quotes in the requested format since there are no verified primary source updates from executives, crypto KOLs, or regulatory bodies to cite.”

Deutsche Bank’s Potential Innovations in Blockchain Finance

Did you know? Previous institutional moves like JPMorgan’s entrance into digital assets elevated traditional banks’ roles in crypto innovation, setting a credibility precedent for entities like Deutsche Bank.

The Coincu research team notes that Deutsche Bank’s potential stablecoin venture could lead to innovations in regulatory approaches and digital asset integration.

Historically, similar initiatives resulted in increased market adoption within traditional finance sectors, opening opportunities for cross-industry partnerships.

Source: https://coincu.com/342016-deutsche-bank-stablecoins-tokenized-deposits/