- Major tech firms like Apple and Google are considering stablecoin integration.

- The U.S. Senate is reviewing the GENIUS Act for stablecoin regulation.

- Stablecoin adoption could set a global precedent for financial innovation.

Major tech firms, including Apple, Google, Meta, and others, are reportedly in discussions about integrating stablecoins into their payment systems.

These initiatives aim to reduce transaction costs and enhance global payment efficiency. In alignment with these developments, the U.S. Senate is considering the GENIUS Act to regulate stablecoin transactions, potentially serving as a global precedent.

Tech Giants and Legislative Moves Influence Stablecoin Adoption

The tech industry’s move into stablecoin integration comes amid growing venture capital funding within the sector. As such, major financial entities, including Stripe’s recent acquisition of the startup Bridge, highlight the robust interest. Legislating stablecoin use in the U.S. could serve as a global model. Conversely, Uber CEO Dara Khosrowshahi publicly acknowledged the company’s research into stablecoin usage for money transfers, reflecting internal exploration of potential benefits.

“Stablecoin will be one of the strongest places that I would invest long term… It has set a great innovation frontier for the rest of the world, and I believe that all the other countries, especially Asian countries, Singapore, and Hong Kong, will quickly follow.” – Alice Li, Head of US, Foresight Ventures

“Stablecoin will be one of the strongest places that I would invest long term… It has set a great innovation frontier for the rest of the world, and I believe that all the other countries, especially Asian countries, Singapore, and Hong Kong, will quickly follow.” – Alice Li, Head of US, Foresight Ventures

Stablecoins’ Global Impact: Hong Kong and Tether Insights

Did you know? Hong Kong’s recent stablecoin bill, aligned with U.S. standards, marks a move toward global rule harmonization, showcasing Asia’s rapid follow-up on U.S. advancements.

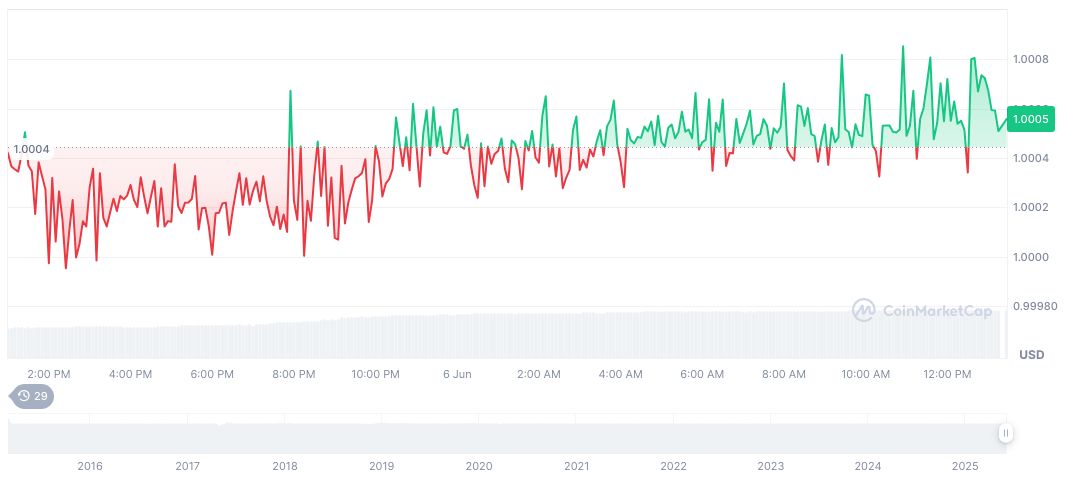

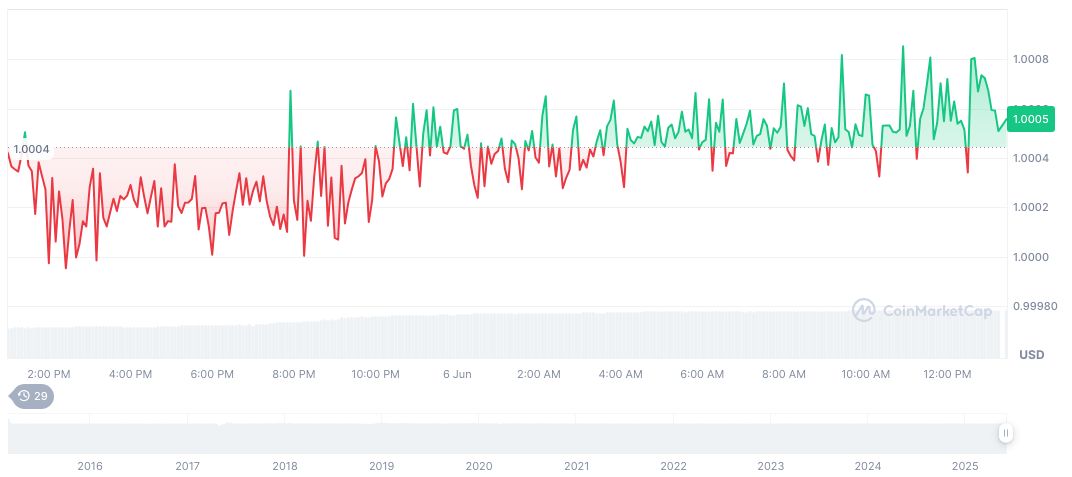

Tether USDt (USDT), with its market cap of $154.21 billion, remains a dominant stablecoin with current trading prices at $1.00 and trading volume at $100.46 billion. The past 90 days saw a minimal price change of 0.08%, displaying remarkable stability in volatile markets, data from CoinMarketCap shows.

Insights from the Coincu research team indicate that stablecoin legislation like the GENIUS Act could significantly affect financial and technological landscapes, promising innovations in transactional processes. With global interest, expected outcomes entail broader adoption across industries, potentially setting the stage for widespread institutional embrace.

Source: https://coincu.com/341893-tech-giants-stablecoins-integration/