- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Egorov highlights growing hacker threats.

- Immediate security concerns in DeFi space.

Michael Egorov, founder of Curve Finance, reported coordinated hacker attacks on DeFi platforms on June 5, 2025. These events underscore the challenges DeFi platforms face from sophisticated security threats and emphasize the need for advanced protective measures.

Coordinated attacks have hit Curve Finance, with its founder Michael Egorov revealing “hired” hackers are threatening the DeFi ecosystem. The incidents included a DNS hijacking, redirecting users to harmful sites, and highlighting vulnerabilities despite robust security protocols. Egorov explained that hackers often exploit registrar transfer issues, bypassing measures like two-factor authentication. Different hackers could coordinate efforts across platforms, compromising them at the same time for greater impact and profit. Market and community reactions have been swift, with security in the DeFi sector facing renewed scrutiny. Egorov raised awareness about the gaps in existing Internet infrastructure, calling for enhancements to tackle these challenges effectively.

Egorov Details Rise in Hack Threats to DeFi Platforms

Coordinated attacks have hit Curve Finance, with its founder Michael Egorov revealing “hired” hackers are threatening the DeFi ecosystem. The incidents included a DNS hijacking, redirecting users to harmful sites, and highlighting vulnerabilities despite robust security protocols. Egorov explained that hackers often exploit registrar transfer issues, bypassing measures like two-factor authentication. Different hackers could coordinate efforts across platforms, compromising them at the same time for greater impact and profit. Market and community reactions have been swift, with security in the DeFi sector facing renewed scrutiny. Egorov raised awareness about the gaps in existing Internet infrastructure, calling for enhancements to tackle these challenges effectively.

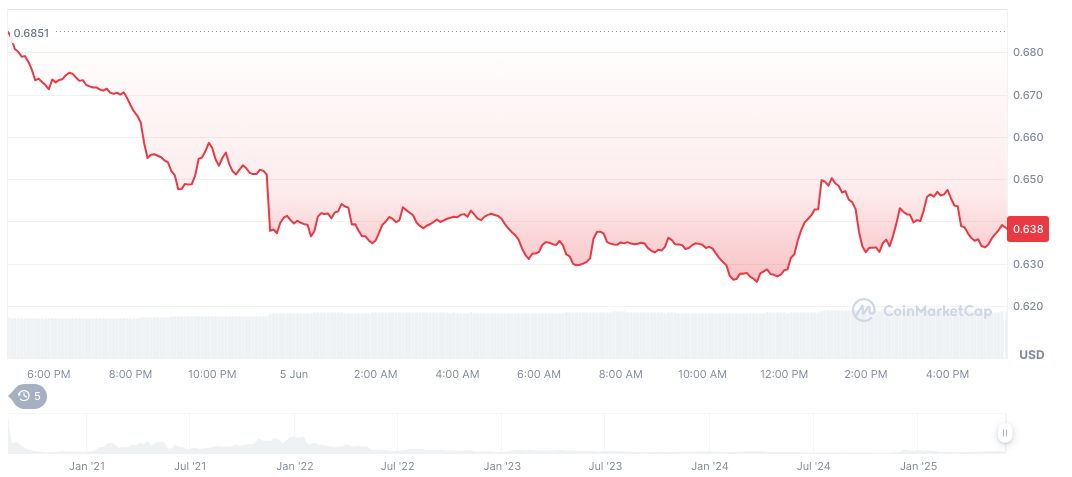

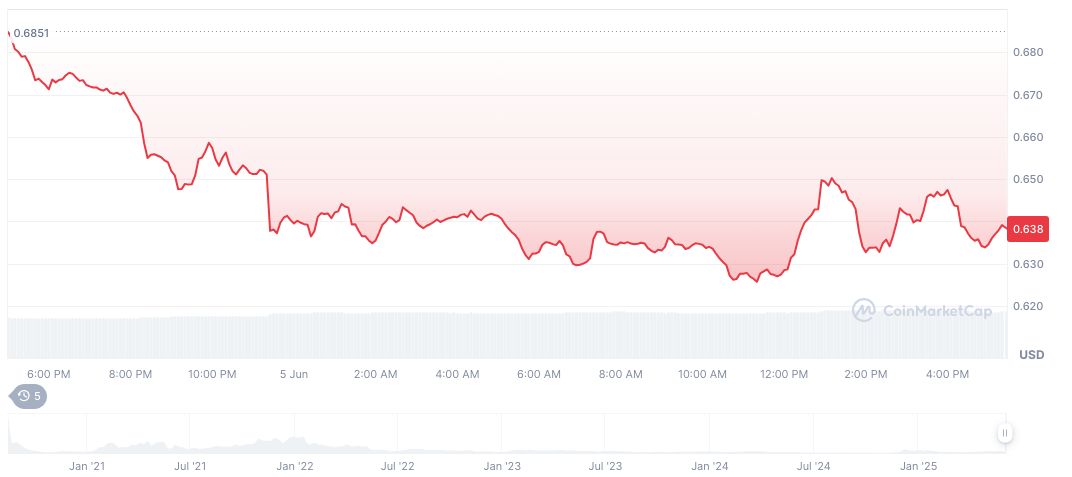

Curve DAO Token trades at $0.64, with a market cap of $861.53 million, reflecting a dominance of 0.03%. The trading volume surged to $119.85 million today, experiencing a 16.28% change. CRV’s recent price movements show a 5.88% drop in 24 hours, alongside notable gains in the past two months. Data from CoinMarketCap detailed these shifts.

DNS Hijack and Community’s Urgency for Enhanced Security

Did you know? In May, Curve Finance faced a DNS hijack. Historical incidents show frontline vulnerabilities persist for Web2-based DeFi platforms. Enhancements in internet security standards are vital.

Curve DAO Token trades at $0.64, with a market cap of $861.53 million, reflecting a dominance of 0.03%. The trading volume surged to $119.85 million today, experiencing a 16.28% change. CRV’s recent price movements show a 5.88% drop in 24 hours, alongside notable gains in the past two months. Data from CoinMarketCap detailed these shifts.

Industry experts point to a need for regulatory intervention and enhanced encryption to mitigate these threats. As the DeFi sector evolves, the focus remains on strengthening technological frameworks to bolster security standards. This commitment to innovation serves as a buffer against ongoing coordinated attacks.

Source: https://coincu.com/341812-curve-finance-hacked-egorov-response/