- Meme and DeFi sectors witness significant downturn, Bonk leads decline.

- Bitcoin’s price drops 0.91%, now at $104,000.

- Unusual volatility impacts market, Nic Carter advises caution.

The crypto market has witnessed a significant pullback over the last two days, with notable declines in the Meme and DeFi sectors as of June 5, 2025.

This market downturn signals increased volatility, affecting major sectors such as Meme and DeFi, and resulting in broad-based price corrections.

Meme and DeFi Sectors Plunge Amidst Volatility

The crypto market has experienced increased volatility, with notable shifts affecting Meme and DeFi sectors. According to SoSoValue data, these sectors declined by 3.59% and 3.72% respectively in the last 24 hours. The Meme sector’s dramatic shift included a 7.42% drop in Bonk (BONK), a 9.65% decrease in dogwifhat (WIF), and a 10.62% decline in Fartcoin (FARTCOIN).

This fluctuation marks a significant change in market dynamics, potentially exacerbated by sharp price swings across major cryptocurrencies, as noted by industry analyst Nic Carter. Ethereum’s (ETH) resilience, with a minimal drop of just 0.28%, further underscores the contrasting market behavior.

Responses from the community highlight elevated risk, with experts cautioning traders to monitor on-chain metrics closely. Nic Carter, a recognized figure in the industry, tweeted about the market’s unusual volatility, suggesting careful attention to order books and possible short-term trading opportunities.

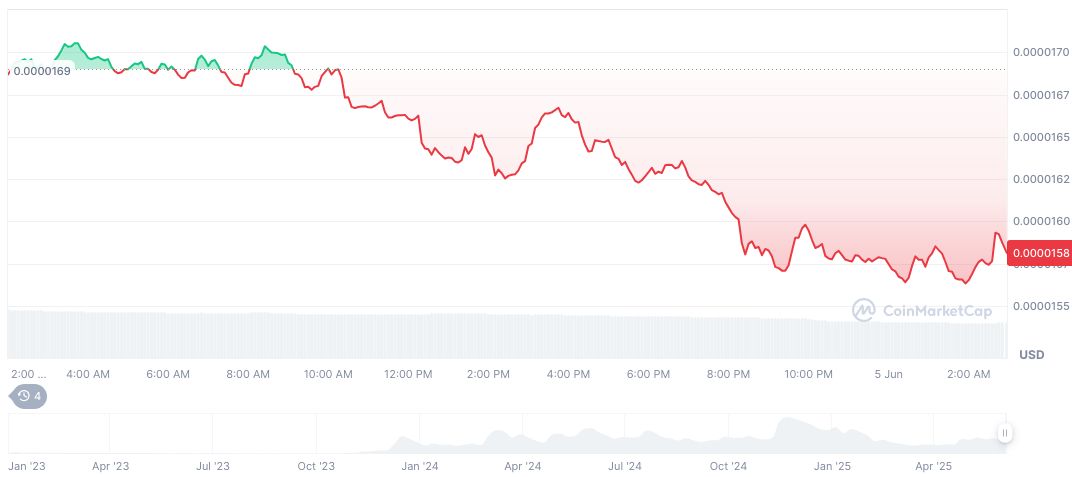

Bonk Declines Over 7% as Market Tumbles

Did you know? In past cycles, a rapid decline in meme tokens often preceded broader market corrections, where heightened volatility provided both challenges and opportunities for adaptive traders.

According to CoinMarketCap, Bonk (BONK) is currently valued at nearly zero, with a market capitalization of $1.26 billion and a diminished 24-hour trading volume of $175 million. Over the last 24 hours, Bonk’s price fell by 6.11%, yet it experienced growth of 44.82% over a 60-day period.

Coincu’s research team suggests that the current environment may lead to increased short-term trading activity as volatility introduces both risks and opportunities. Historical data exhibit that prolonged uncertainty might trigger regulatory scrutiny aimed at stabilizing such fluctuations.

Source: https://coincu.com/341656-crypto-market-decline-meme-defi-sectors/