- Changpeng Zhao comments on Bitcoin reserving risks and management strategies.

- Risk isn’t binary; it is a continuous spectrum.

- Balancing risk and return is essential for companies.

Binance’s founder, Changpeng Zhao, asserted on social media that while companies building Bitcoin reserves undertake risks, these can be managed effectively. Risk is not binary but a spectrum, he said in the statement.

Zhao’s remarks highlight the integral role of risk management when investing in digital assets, portraying a nuanced understanding of the delicate balance between risk and return in cryptocurrency holdings.

Zhao’s View on Risk: Balance Over Binary Choices

Zhao, an influential figure in the cryptocurrency industry, provided insights on the nuances of risk management relating to Bitcoin reserves. He emphasized the notion that avoiding risks entirely poses its own risks, suggesting a balanced approach for optimal outcomes.

These insights evoke discussions about the responsibilities of companies navigating Bitcoin investments. According to the Chainalysis Team, “The share of all attributed crypto transaction volume associated with illicit activity fell to 0.14% from 0.61% in 2023.” The discourse around measured discretion as a strategy to mitigate potential losses while maximizing returns has garnered attention.

The community’s response ranges from supportive to cautious. Some emphasize the importance of such balanced strategies, while others express concerns regarding inherent volatility. Zhao’s statement gains traction as analysts further dissect its implications for the cryptocurrency market.

Bitcoin’s Market Position and the Impact of Strategic Reserves

Did you know? Zhao’s perspective on Bitcoin reserves resembles past strategies during the 2017 crypto boom, reflecting evolving risk management techniques.

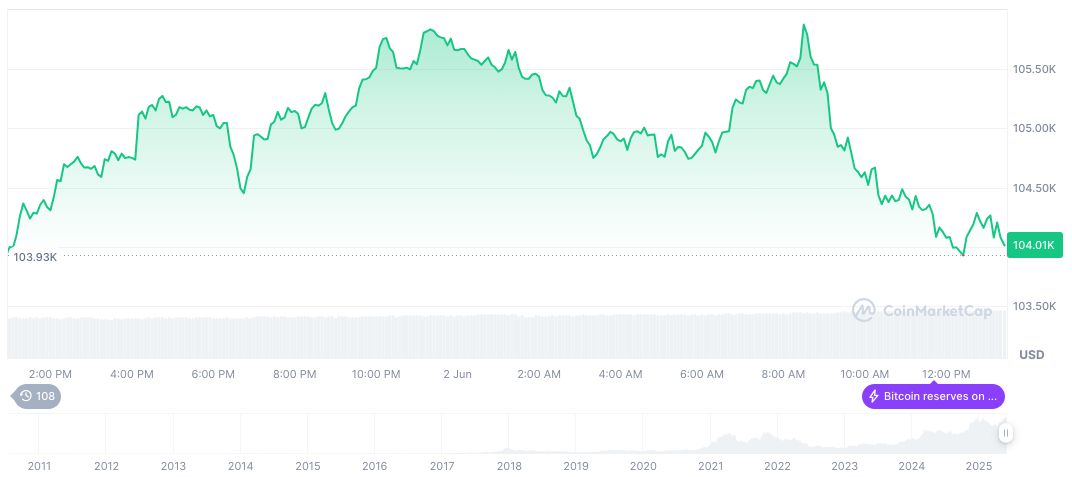

According to CoinMarketCap, Bitcoin currently trades at $105,321.80 with a market cap at $2.09 trillion, holding 63.11% dominance. Despite a 4.04% drop over the past week, Bitcoin’s price climbed by 26.73% over the last 60 days, showcasing a mixed performance.

The Coincu research team finds that companies adopting Zhao’s approach may influence both financial outcomes and market strategies, particularly in handling emerging regulatory challenges. Historic volatility makes robust risk assessments vital, as firms seek balanced entry points amidst potential technological shifts. Learn more about similar approaches in Web3 Services at OKX.

Source: https://coincu.com/341375-binance-cz-bitcoin-risk/