- Classover Holdings entered a $500M deal to advance a SOL treasury strategy.

- Significant move in blockchain adoption for corporate reserves.

- Aligns with growing trends of public companies integrating cryptocurrency.

Classover Holdings entered a $500M deal to advance a SOL treasury strategy. Significant move in blockchain adoption for corporate reserves. Aligns with growing trends of public companies integrating cryptocurrency.

Classover Holdings, Inc. announced on June 3 that it has entered into a $500 million securities purchase agreement with Solana Growth Ventures to build a SOL-based treasury reserve. Originally reported as $5 billion, the corrected deal size reflects a focused commitment to Solana integration.

Corporate Blockchain Adoption: Classover’s Strategic Move with Solana

Classover Holdings, a NASDAQ-listed education technology firm, finalized a significant agreement with Solana Growth Ventures LLC for $500 million in senior secured convertible notes. This financial arrangement supports Classover’s strategy to acquire Solana and operate validator nodes, a move echoing the Bitcoin treasury approach by companies like MicroStrategy. Completion of initial funding, expected at $11 million, is pending customary conditions. Analyst insights from Coincu suggest this could bolster Solana’s role in corporate treasury strategies.

The announcement marked a pivotal moment, aligning with Classover’s aim to become a leader in blockchain finance strategy. The company’s operation of validator nodes on Solana contributes to network reliability and aids in generating on-chain staking rewards. This effort underscored New York-based Classover’s intentions to embrace emerging blockchain technology.

Financial markets responded with cautious optimism. The CEO highlighted, “This agreement marks a significant milestone,” illustrating institutional backing for Solana as a viable treasury asset. The move is seen as a vote of confidence amid ongoing interest in diversifying corporate reserves with cryptocurrency.

“By committing up to 80% of the net proceeds from the notes towards purchasing SOL, we are underscoring our confidence in Solana’s long-term viability as a store of value.” – Classover Holdings Executive, Classover Holdings, Inc.

Market Reactions and Expert Endorsements of Solana’s Crypto Role

Did you know? Classover’s $500 million treasury initiative mirrors trends set by firms like MicroStrategy in Bitcoin, signaling Solana’s rising stature in corporate finance.

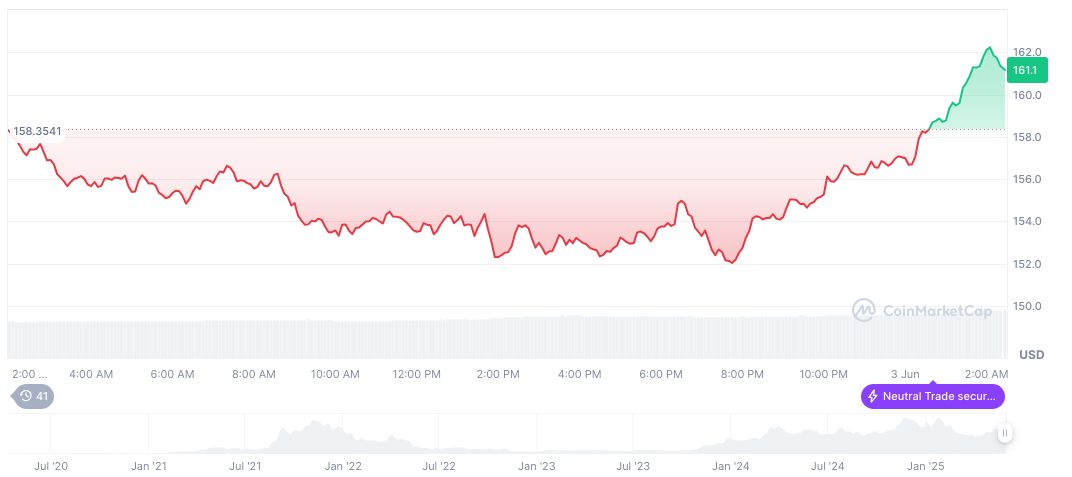

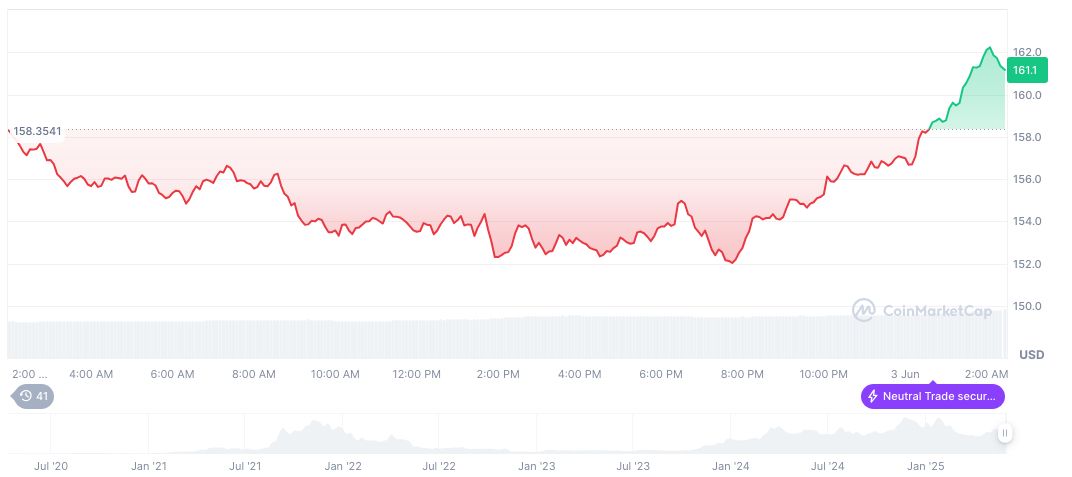

As per CoinMarketCap, Solana (SOL) currently trades at $161.30 with a market cap of $84.26 billion and a 24-hour trading volume of $3.41 billion, reflecting a 2.65% growth over the last day. Despite a 6.61% dip over the past week, SOL saw a 39.08% increase over 60 days, indicating positive long-term trends.

Coincu’s research team acknowledges the move by Classover as a progression towards diversified treasury management. The decision aligns with technological innovations and regulatory shifts, emphasizing Solana’s potential as both a financial vehicle and a strategic asset within corporate frameworks. Insights indicate Solana’s decentralization could appeal to corporations navigating an evolving crypto landscape.

Source: https://coincu.com/341285-classover-holdings-solana-deal/