- The SEC seeks public comments on WisdomTree’s Bitcoin ETF rule modifications.

- Input on whether to permit in-kind ETF share creation.

- Potential implications for Bitcoin market structure and liquidity.

The U.S. Securities and Exchange Commission announced on June 3, 2025, that it is seeking public comments regarding a rule change for the WisdomTree Bitcoin Fund on the Cboe BZX Exchange. This inquiry could reshape the ETF landscape, potentially affecting market dynamics. The SEC encourages public input, leaving a window of 21 days for responses from stakeholders.

The SEC has opened the floor for public input on whether to amend rules surrounding in-kind creation and redemption for the WisdomTree Bitcoin Fund. The fund, a spot Bitcoin ETF, faces scrutiny under existing ETF structures due to potential market manipulation and custody concerns. This move follows previous delays regarding similar rules for BlackRock and VanEck funds. The feedback period, lasting 21 days, seeks stakeholder opinions.

Changes from this inquiry

could see a smoother ETF flow by reducing costs and sell pressure in the Bitcoin market. Institutional participants can circumvent cash settlements with this rule change, affecting ETF share trading patterns. Currently, spot Bitcoin is directly held by the ETF, impacting the BTC market structure.

Public responses are pivotal, as they may influence regulatory stances. While some observers argue it could legitimize digital assets, the SEC maintains neutrality.

“Institution of proceedings is appropriate at this time in view of the legal and policy issues raised by the proposed rule change. Institution of proceedings does not indicate that the Commission has reached any conclusions with respect to any of the issues involved. Rather, the Commission seeks and encourages interested persons to provide comments on the proposed rule change.” — U.S. Securities and Exchange Commission (SEC)

Benefits of In-Kind Creation for Crypto ETFs

Did you know? In-kind creation and redemption can lower costs and increase efficiency for crypto ETFs, echoing similar benefits seen in traditional markets when adopted.[2]

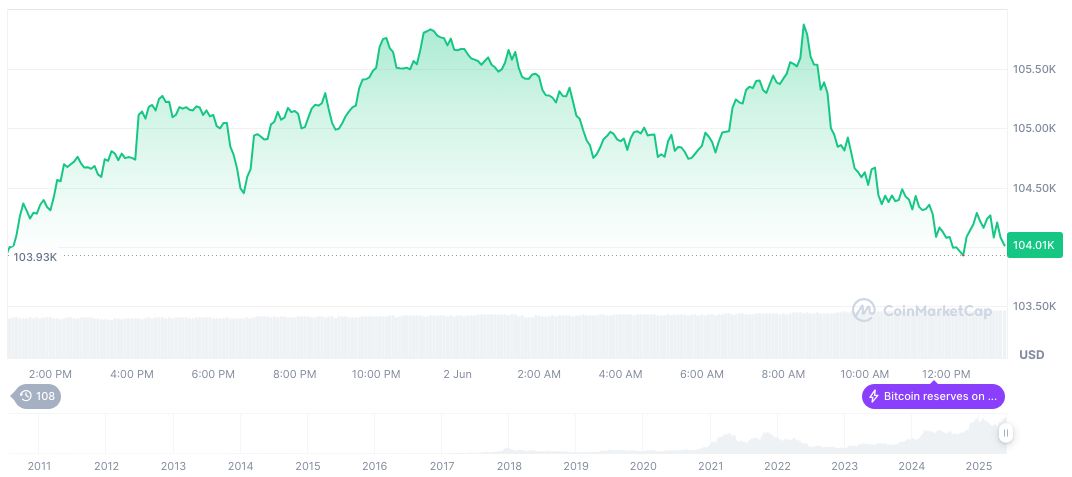

Bitcoin (BTC), currently valued at $106,333.87 with a market cap of $2.11 trillion, maintains a robust dominance of 63.14%, as reported by CoinMarketCap. Over the past 24 hours, BTC experienced a price increase of 0.83%, alongside a trading volume of $47.66 billion, showing a 33.85% surge.

Coincu research underscores how adopting in-kind creations could enhance institutional engagement, possibly improving liquidity and reducing disruption in BTC markets. This ETF format, aligning with historical trends, suggests a potential for broader asset adoption in the crypto ETF segment.

Source: https://coincu.com/341281-sec-seeks-comments-wisdomtree-bitcoin-etf/