- OSL Group acquires 90% of Evergreen Crest for $15M in shares.

- Entry into the Indonesian crypto market.

- OSL to expand real-world assets and payment finance.

OSL Group, credited with stock code 00863, is set to acquire 90% of Evergreen Crest Holdings Ltd for $15 million. The transaction involves issuing new shares, aiming to strengthen OSL’s footprint in Indonesia’s cryptocurrency landscape.

The acquisition provides OSL with regulatory ingress into Indonesia’s emerging digital asset sector. The company plans to broaden its reach in real-world assets and payment finance, further diversifying OSL’s business model.

OSL Expands into Indonesia with $15M Acquisition

OSL Group’s acquisition involves taking a substantial stake in Evergreen Crest Holdings, facilitating swift entry into Indonesia’s crypto and futures trading markets. The move is expected to fast-track OSL’s regulatory compliance and commercial operations in the region.

The company’s access to Indonesia’s market aims to stimulate local liquidity and foster institutional engagement. Immediate market shifts remain subtle, yet the deal aligns with OSL’s strategic expansion into new business areas like real-world assets.

Patrick Pan, CEO, OSL Group, said, “With a committed vision for OSL, we’re not just charting a new path in the digital asset domain – we will be pioneering it. Our direction is crystal clear: to lead with innovation, and to scale new heights. The synergy between our revitalised team and global strategy places OSL at the vanguard of setting industry standards.”

Insight: Regulatory and Market Implications of OSL’s Strategic Move

Did you know? OSL’s usual expansions target regulated markets, reinforcing institutional engagement without major immediate price shifts. This strategy has previously seen modest impacts on asset prices, especially in intricate markets.

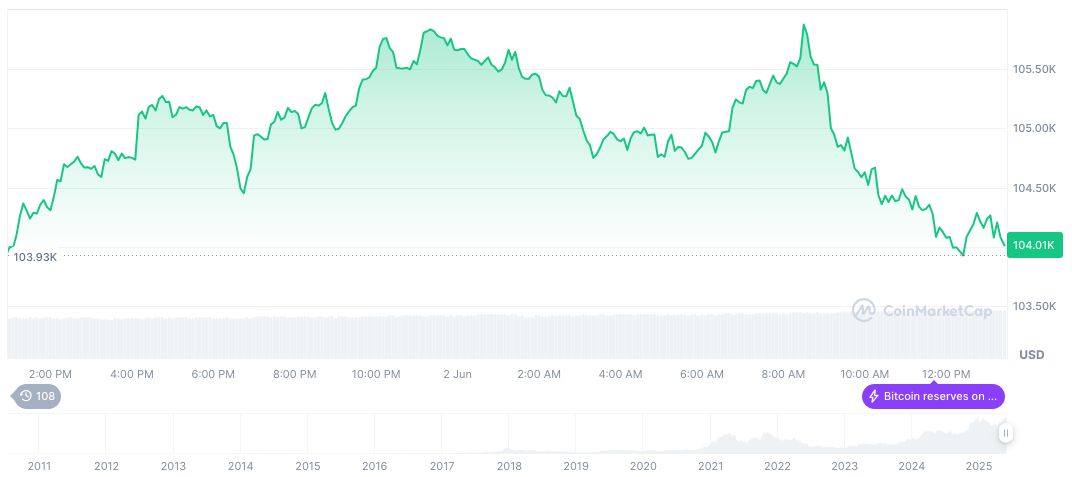

Bitcoin (BTC) prices, as per CoinMarketCap, are listed at $106,356.15 with a market cap nearing $2.11 trillion. The cryptocurrency shows fluctuations of 0.65% over 24 hours and 10.89% over a 30-day period. Market dominance stands at 63.35% as of June 3, 2025.

The Coincu research team highlights potential regulatory benefits from OSL’s acquisition, underscoring an enhanced framework for digital assets in Indonesia. Future technological synergies and financial integrations remain focal points for upcoming business development.

Source: https://coincu.com/341278-osl-group-indonesia-acquisition/