- Trump administration revokes Biden’s crypto caution in retirement plans.

- Potential litigation still affects crypto integration.

- Cryptocurrency market in 401(k)s remains below 1%.

President Donald Trump’s administration has rescinded Biden’s guidance on cryptocurrency in 401(k) plans, courtesy of the U.S. Department of Labor.

This policy reversal signifies a shift toward potentially increasing cryptocurrency investment in retirement accounts, despite ongoing concerns about fiduciary litigation risks.

Trump Administration Sways Crypto Investment Options

Under the leadership of Lori Chavez-DeRemer, the U.S. Department of Labor revoked guidance from the Biden era warning against cryptocurrency in 401(k) plans. This action aims to eliminate what the administration describes as an overreach in regulatory interference. President Trump has supported this move to broaden the types of investments available within retirement accounts.

The new guidance adopted a neutral stance on cryptocurrency, removing previous cautions without endorsing the option. However, officials note that the risk of litigation remains a concern for fiduciaries. The cryptocurrency market in the $9 trillion 401(k) sector currently accounts for less than 1% of assets, largely focusing on traditional investments.

“The Biden administration’s Department of Labor made a choice to put their thumb on the scale. We’re rolling back this overreach and making it clear that investment decisions should be made by fiduciaries, not D.C. bureaucrats.” — Lori Chavez-DeRemer, Secretary of Labor, Trump Administration

Cryptocurrency Holds Less Than 1% in 401(k) Markets

Did you know? The Trump administration’s rollback of cryptocurrency guidance follows a similar pattern with ESG regulations, hinting at broader deregulation across diverse investment choices for retirement accounts.

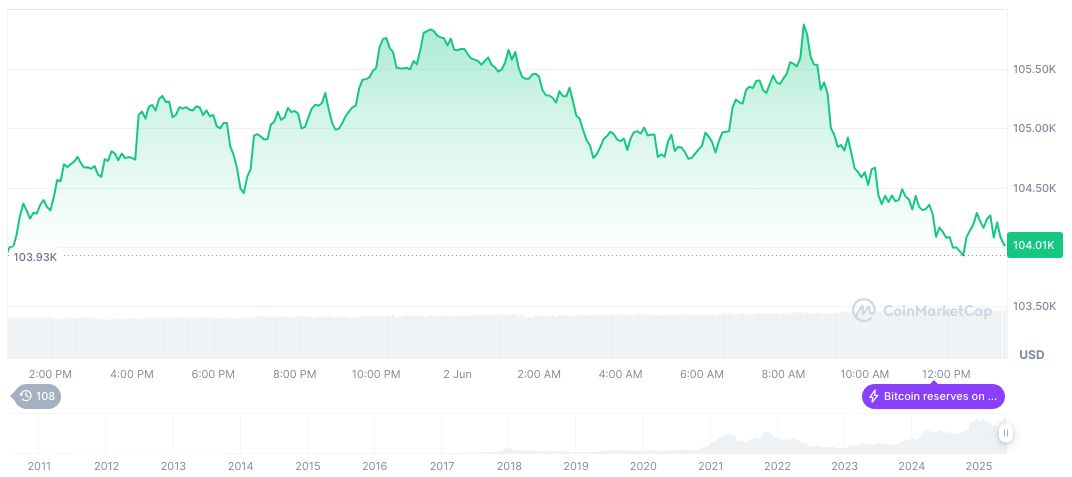

As of June 2, 2025, Bitcoin’s price stands at $104,168.99, according to CoinMarketCap, with a market dominance of 63.40%. The cryptocurrency has experienced a 1.01% decline over the last 24 hours. Total valuation reflects at 2.07 trillion, with a trading volume change of 26.80% in the last 24 hours.

Experts from Coincu emphasize that the elimination of explicit crypto warnings in retirement investments does not translate to a radical uptick in offerings. Fiduciary caution is likely to prevail due to existing regulations, influencing slow adoption despite regulatory relaxation.

Source: https://coincu.com/341219-trump-dol-crypto-retirement-guidance/