- Sberbank offers Bitcoin-linked bonds, accessible to investors in Russia.

- Sberbank expands institutional crypto engagement opportunities.

- Regulatory changes enable new financial products.

Sberbank, Russia’s largest bank, launched Bitcoin-linked structured bonds on June 2, 2025, exclusively for Russian investors. Returns depend on Bitcoin’s performance against the USD and USD/RUB exchange rates.

This initiative marks a significant step in institutional crypto adoption in Russia, offering Bitcoin exposure without direct ownership.

Sberbank’s Strategic Move in Russian Crypto Markets

Sberbank has introduced a new financial product that links bond returns to Bitcoin’s performance and the USD/RUB exchange rate. This product is designed to offer qualified Russian investors exposure to cryptocurrency without requiring direct asset ownership or the use of overseas exchanges.

All transactions related to these bonds will be conducted in Russian rubles, avoiding the need for cryptocurrency wallets or foreign exchanges. This aligns purchases with Russia’s domestic legal and financial infrastructure, allowing easier access for investors.

Market responses have been notably positive, with experts highlighting the shift towards broader institutional crypto acceptance in Russia. Sberbank’s collaboration with the Bank of Russia is regarded as a strategic move in fortifying the country’s financial system.

Bitcoin’s Role in Sberbank’s Financial Innovations

Did you know? Sberbank’s move mirrors broader trends in cryptocurrency integration, paralleling Western markets where Bitcoin ETFs provide similar crypto exposure without direct ownership. This may indicate an evolving Russian financial landscape.

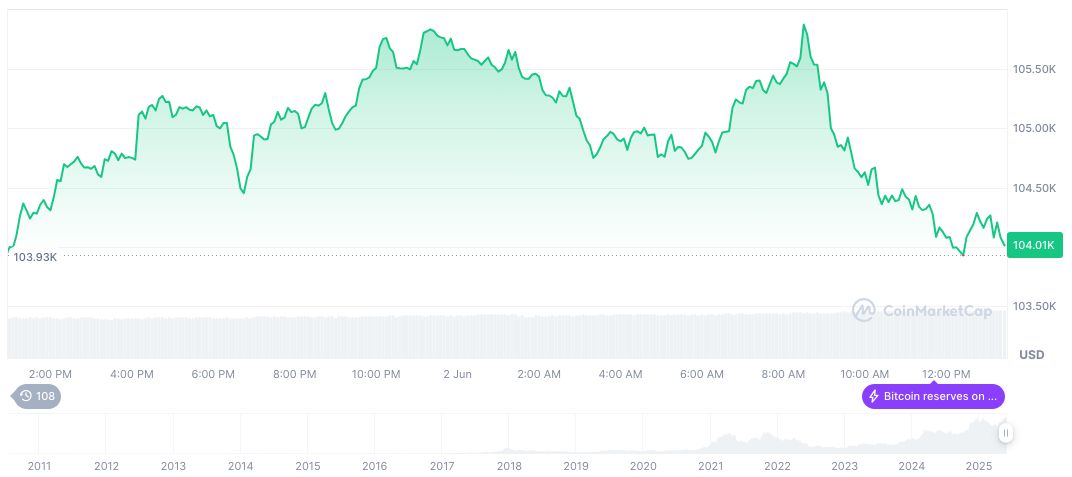

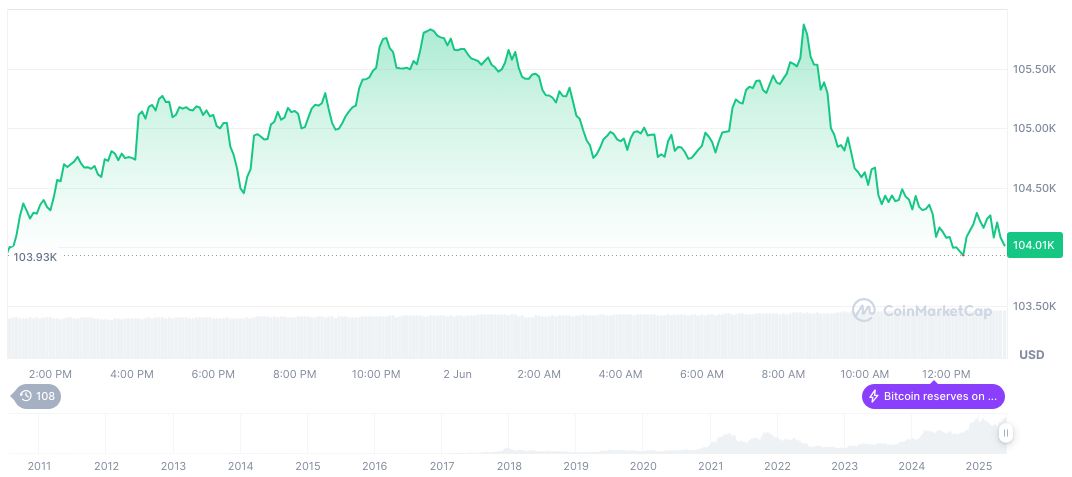

As per CoinMarketCap, Bitcoin’s current price stands at $104,248.06, with a market cap of $2.07 trillion and a dominance of 63.56%. Over the last 90 days, it recorded a 25.68% increase, reflecting significant recent volatility in the crypto market.

Coincu research suggests that Sberbank’s innovation represents an important step towards cryptocurrency integration in Russia, potentially leading to new regulatory and financial frameworks. This development could set the stage for similar products in emerging markets.

Zozulya, Director of Global Marketing, Sberbank, “Once this is allowed, there will be a ‘new world’ of instruments for investing in cryptocurrency without owning it.”

Source: https://coincu.com/341202-sberbank-bitcoin-linked-bonds-launch/