- Binance will change leverage, margin levels in June 2025.

- Traders need to adjust strategies promptly.

- Impacts LRCUSDT and PHBUSDT contracts significantly.

Binance will adjust leverage and margin levels for perpetual contracts LRCUSDT and PHBUSDT on June 6, 2025, at 06:30 (UTC). The changes will affect existing contract positions.

These adjustments are part of Binance’s routine updates to enhance market stability and improve risk management for traders.

Binance Modifies Contract Leverage Ahead of June 2025

On June 6, 2025, Binance plans to update the leverage and margin specifications for LRCUSDT and PHBUSDT. This action forms part of the exchange’s regular oversight to maintain its platform’s stability and risk controls.

These changes are set to affect multiple aspects of trading strategies used by Binance’s clientele. Users are encouraged to review and adjust their positions accordingly to accommodate new trading conditions.

“This adjustment is part of Binance’s periodic review and update of contract specifications to maintain market stability and risk management.” — Changpeng Zhao, CEO, Binance

Market Dynamics Shaped by Binance’s New Margin Rules

Did you know? In past Binance updates, similar adjustments have had notable impacts on market dynamics as traders recalibrate strategies. This reflects the platform’s ongoing commitment to regulatory adherence and risk control.

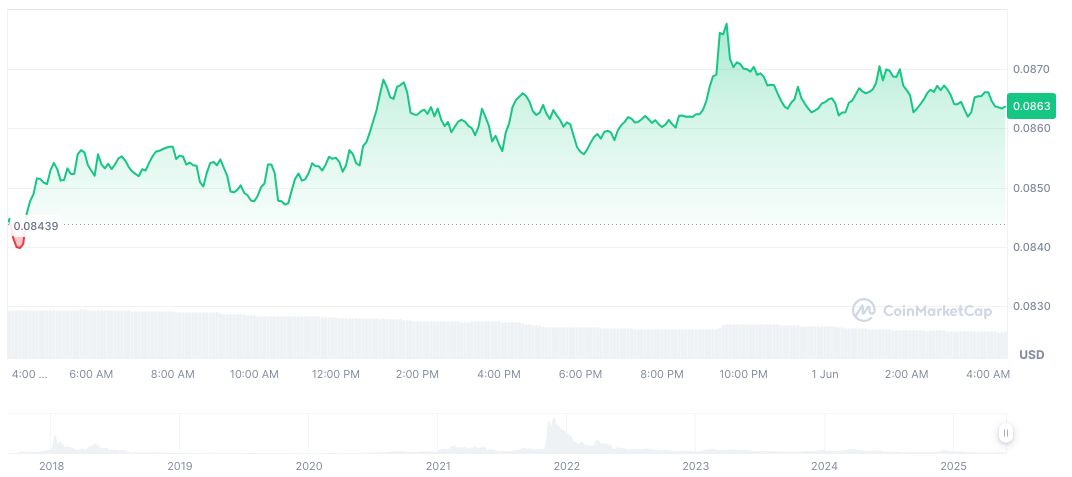

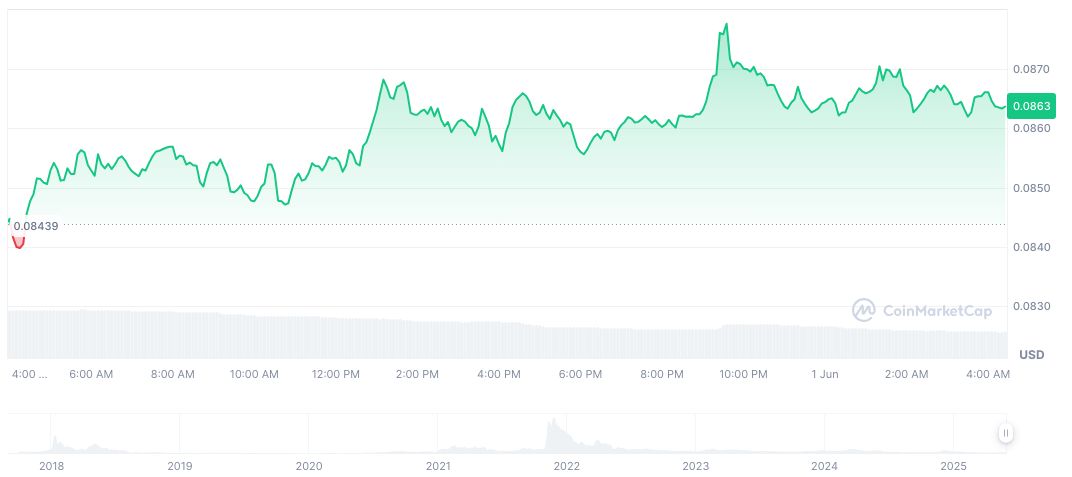

As of June 2, 2025, Loopring’s market data indicates a price of $0.09 with a market cap of $117,189,876. Recent trends show price decreases over various time frames, attributed to market adjustments. Data is sourced from CoinMarketCap.

The CoinCu research team suggests these adjustments potentially anticipate shifts in trading volumes across affected contracts. Historical trends reveal that such adjustments precede liquidity fluctuations, necessitating agile responses from active traders.

Source: https://coincu.com/341097-binance-leverage-margin-adjustment-2025/