- Hong Kong implements licensing for fiat-backed stablecoin issuers.

- Protects consumers, enhances regulatory compliance.

- Market faces tighter access and compliance needs.

Hong Kong has officially gazetted the “Stablecoin Ordinance”, establishing a licensing system for issuers of fiat-backed stablecoins. The ordinance is aimed at bolstering regulatory oversight and will come into effect by the end of 2025.

The newly enacted “Stablecoin Ordinance” requires all issuers of fiat-backed stablecoins in Hong Kong to obtain a license. Only licensed entities will be authorized to market and sell these stablecoins. This move enhances regulatory oversight and aims to protect investors through stringent compliance measures. The mandate for full 1:1 fiat reserve backing and stringent AML protocols represents a significant step toward regulating digital assets in Hong Kong. Industry response has been muted, with major stablecoin providers yet to express formal opinions. The HKMA stated:

Licensing Mandate: A New Era for Stablecoin Issuers

The newly enacted “Stablecoin Ordinance” requires all issuers of fiat-backed stablecoins in Hong Kong to obtain a license. Only licensed entities will be authorized to market and sell these stablecoins. This move enhances regulatory oversight and aims to protect investors through stringent compliance measures.

The mandate for full 1:1 fiat reserve backing and stringent AML protocols represents a significant step toward regulating digital assets in Hong Kong. Industry response has been muted, with major stablecoin providers yet to express formal opinions.

“The new licensing regime will provide better protection for the general public and investors. The HKMA will continue to engage with stakeholders as we develop the regime for stablecoin activities in Hong Kong.” – Mr. Eddie Yue, Chief Executive, Hong Kong Monetary Authority (HKMA)

Hong Kong’s Regulations Echo EU’s MiCA with Immediate Effects

Did you know? Hong Kong’s stablecoin regulations mirror similar steps in the EU’s MiCA, but impose immediate licensing from day one, setting it apart in global financial regulatory practices.

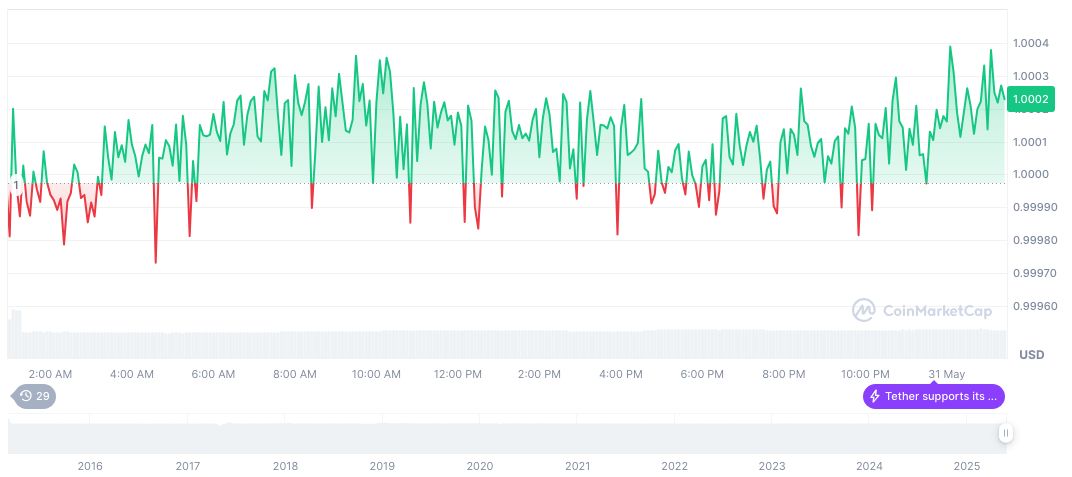

According to CoinMarketCap, Tether (USDT) maintains stable pricing at $1.00, with a market cap of $153.09 billion and 4.70% dominance. Despite a slight 0.04% price increase in the past 24 hours, trading volume saw a decline of 12.52%, standing at $87.27 billion as of May 31, 2025.

The Coincu research team notes that Hong Kong’s regulatory landscape could sharply influence crypto market dynamics, potentially leading to more transparent and secure trade environments. Regulations may drive issuers to overhaul systems to meet the strict compliance standards, impacting their operational strategies globally.

Source: https://coincu.com/340857-hong-kong-stablecoin-regulation-2/