- Federal Reserve rate cuts anticipated in fall 2025

- US GDP shows marginal contraction improvement

- Bitcoin stability amidst economic changes

Paul Stanley of Granite Bay Wealth Management predicts that the Federal Reserve may introduce rate cuts in fall 2025, following the US first-quarter GDP’s marginal contraction improvement as of May 29, according to BlockBeats News.

The potential rate adjustment by the Federal Reserve, anticipated by analysts, reflects reaction to updated GDP data and suggests evolving economic strategies, aligning with market trends.

Fed Rate Cuts Speculated on Revised 0.2% GDP Contraction

Paul Stanley, a renowned analyst from Granite Bay, predicts a shift in Federal Reserve policies. The outlook is informed by revised first-quarter GDP data indicating a 0.2% contraction, improving from previously reported figures. Market expectations and CME data align with his predictions.

Potential rate cuts in 2025 are anticipated to stabilize economic conditions, resonating with broader market sentiment. According to CME data, market prices align with anticipated rate adjustments, indicating collective expectations.

Economic experts and market observers express tentative support for Stanley’s predictions. Industry sentiments reflect cautious optimism, with discussions highlighting the potential impact on financial markets and future economic strategies. Observations underscore the influence of revised GDP data on policymaking decisions.

He graduated from Bentley College with a Bachelor’s in Economics and Finance. – Paul Stanley (Granite Bay Wealth Management)

Bitcoin Holds Despite GDP Revamp; Experts Weigh in on Implications

Did you know? The revision of GDP data aligns with historical instances where economic policy adjustments followed similar patterns. Past GDP revisions influenced rate decisions, reinforcing the data’s importance in forecasting Federal Reserve actions.

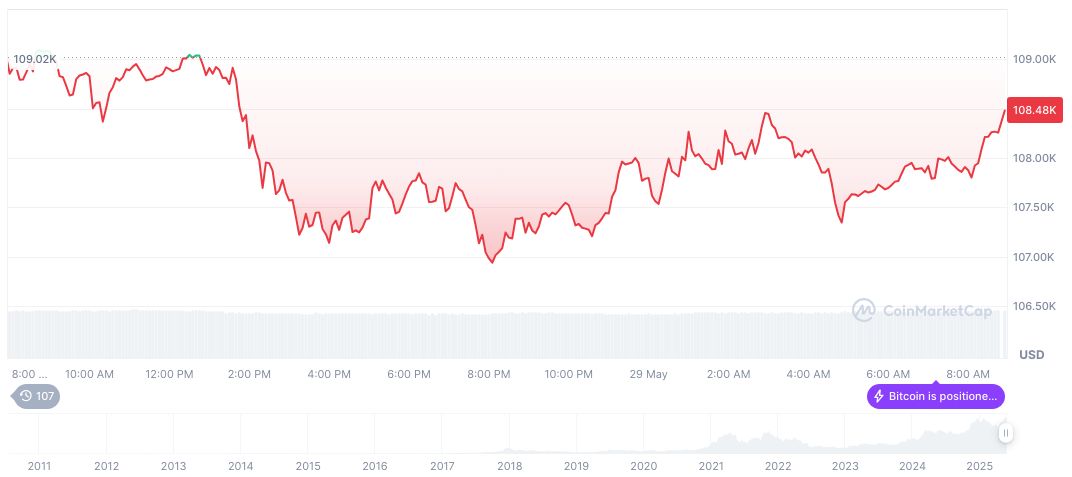

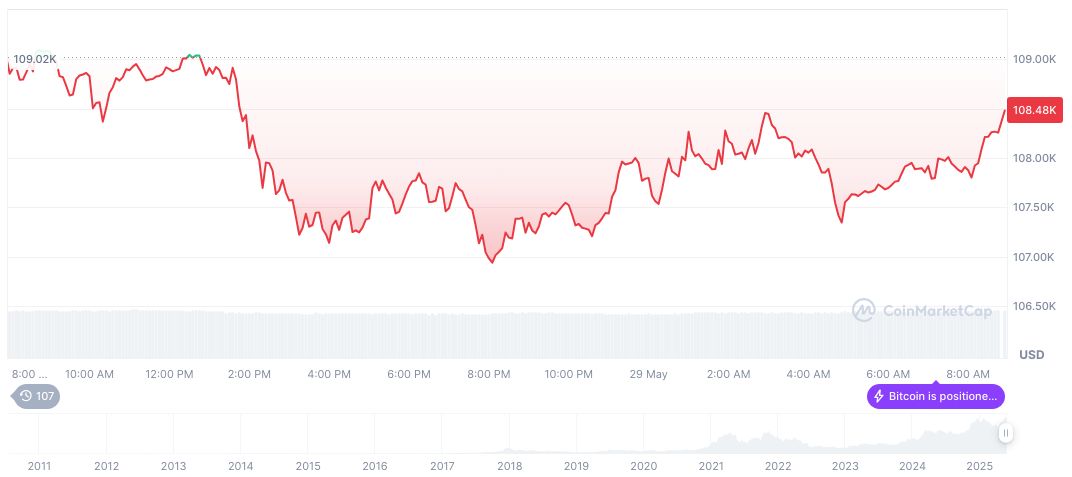

Bitcoin (BTC) shows a market cap of formatNumber(2151045330467.60, 2) and a price of $108,247.45. Its market dominance stands at 62.75%, with a 24-hour trading volume reported at formatNumber(52330884976.79, 2). Data from CoinMarketCap show a 0.43% drop over the last 24 hours. Other notable movements include decreases of 2.76% over seven days, while longer-term data indicate a price rise by 33.82% over 90 days.

Coincu research analyzes Federal Reserve’s potential rate cuts, indicating significant financial implications. Historical trends suggest monetary easing could bolster investment confidence and foster broader economic recovery. Coincu stresses the importance of aligning regulatory steps with technological advancements to optimize market outcomes.

Source: https://coincu.com/340494-federal-reserve-rate-cut-speculation-2/