- Robert Kiyosaki warns of a financial crisis linked to student loans.

- Recommends gold, silver, and Bitcoin over fiat currencies.

- Highlights unresolved problems since Nixon ended the gold standard.

Robert Kiyosaki, known for his financial insights, shared a warning on May 25, 2025, regarding a pending financial crisis tied to the $1.6 trillion U.S. student loan debt. He conveyed this to his 2.4 million followers via a post on Twitter.

Kiyosaki’s assertions attract attention due to historical references, suggesting unresolved issues from when Nixon removed the gold standard in 1971. He urges holding gold, silver, and Bitcoin as protection against potential economic imbalance. According to him, “Each crisis gets bigger because they never solve the problem… a problem which started in 1971 when Nixon took the US Dollar off the gold standard.”

Kiyosaki Identifies Student Loans as Crisis Catalyst

Robert Kiyosaki has highlighted past remedies for financial instability, such as Wall Street’s rescue of LTCM in 1998 and central banks’ bailout of Wall Street in 2008. He warns of a larger crisis linked to student loans. The anticipated crisis, according to Kiyosaki, may result from unresolved systemic issues, accentuated by Jim Rickards’ views on economic risk.

Kiyosaki’s focus on tangible assets like gold, silver, and Bitcoin suggests defensive strategies against fiat uncertainties. He advises against holding ETFs and concentrates on physical assets. Kiyosaki’s message resonates with crypto proponents, who express caution around fiat-based systems. His call to action revolves around personal financial responsibility and alternative investments.

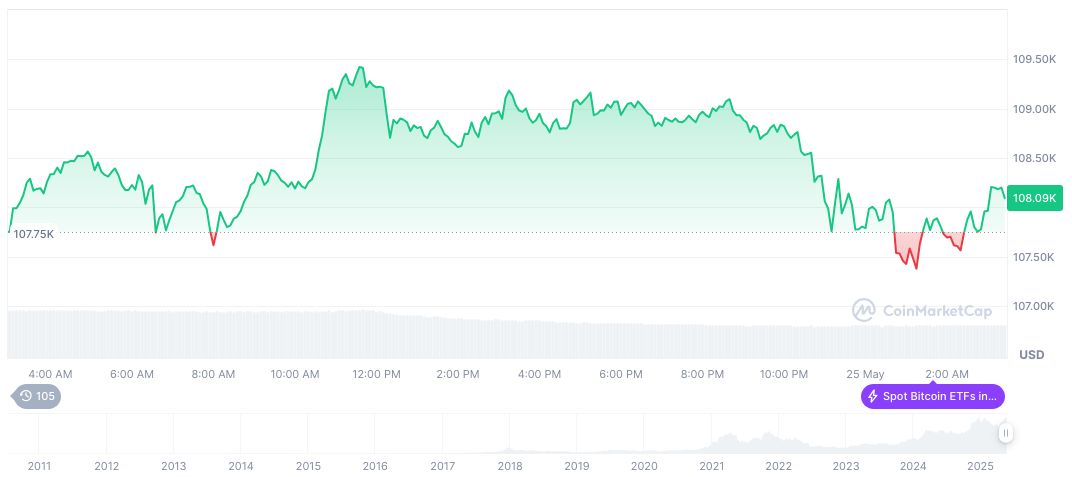

Bitcoin (BTC) is currently valued at $107,106.26, with a market cap of $2.13 trillion. Dominating 63.33% of the market, its trading volume touched $46.83 billion, showing a 27.56% decrease. Data from CoinMarketCap on May 25, 2025, shows a 3.11% price increase over the past week.

Bitcoin Rises: A Potential Haven Amid Economic Fears

Did you know? In 2008, central banks bailed out Wall Street, echoing Kiyosaki’s warning of recurrent systemic crises and bolstering his argument for asset diversification.

The Coincu research team forecasts Kiyosaki’s statements could signal a financial paradigm shift. Historical patterns and ongoing market tensions might spur increased investments in Bitcoin and precious metals. Such shifts in investment preferences could potentially reshape financial markets fundamentally.

His call to action revolves around personal financial responsibility and alternative investments.

Source: https://coincu.com/339598-kiyosaki-economic-crisis-student-debt/