- Whale trader James Wynn shifts major funds to Bitcoin, exiting PEPE.

- BTC position totals $1.25 billion at 40x leverage.

- Market volatility rises due to Wynn’s high-profile trades.

James Wynn, a prominent whale in the crypto derivatives market, has reallocated significant capital from the PEPE meme coin to Bitcoin with a large-scale investment on May 25, 2025.

This strategic shift from PEPE to Bitcoin marks a noteworthy transition as Wynn’s $1.25 billion leveraged bet on BTC has intensified market dynamics.

Wynn Bets $1.25 Billion on Bitcoin at High Leverage

James Wynn’s movement of substantial funds signifies a pivotal shift in his trading strategy. Particularly known for large trades on decentralized platforms, Wynn’s transition from PEPE to Bitcoin highlights a potential change in market sentiment. This occurrence has precipitated discussions around his influence on the crypto sphere.

The reallocation of capital was prompted by Wynn closing PEPE positions, with over $25.19 million in gains, switching focus to Bitcoin. This sizable BTC position emphasizes the potential risks involved, given its high leverage setting. Observers have noted an immediate impact on market volatility and liquidity, as copy-traders often follow Wynn’s lead.

Key figures from the crypto community have expressed mixed reactions to Wynn’s potential market-making actions. With notable statements posted on Platform X, Wynn underscores the significance of understanding market entry and exit points. The community remains divided, some praising his strategic prowess while others voice caution over the inherent risks in copying such trades.

Bitcoin Price and Market Impact Analysis

Did you know? James Wynn’s strategic shift to Bitcoin is reminiscent of past market-moving trades where whales influenced both sentiment and asset fluctuations, often leading to larger institutional participation in Bitcoin.

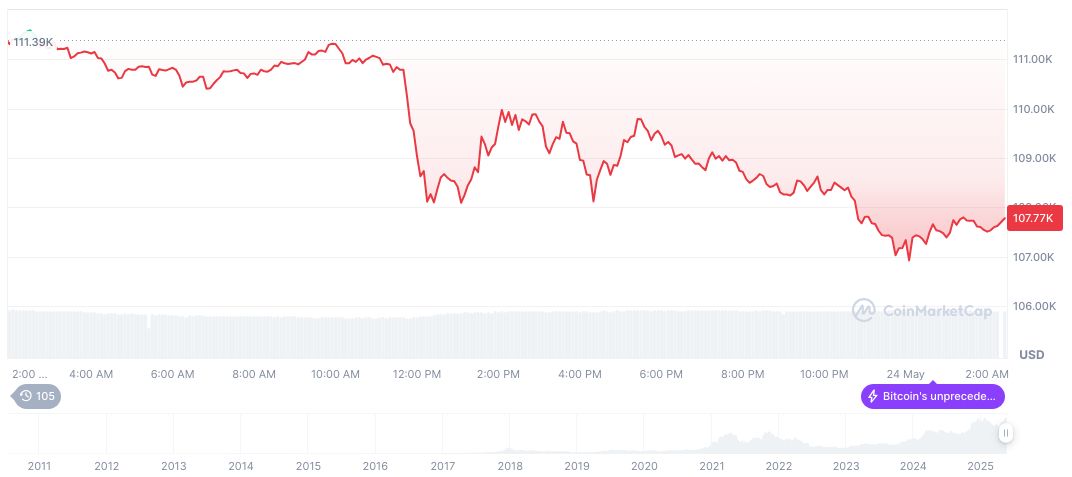

Bitcoin’s current price stands at $107,785.19, as reported by CoinMarketCap. With a market cap of $2.14 trillion, Bitcoin dominates 63.28% of the market, yet its 24-hour trading volume has decreased by 32.53%, amounting to $45.63 billion. Over the past 90 days, Bitcoin has seen a price increase of 12.37%, reflecting steady bullish momentum since mid-March.

Analysis from Coincu suggests the industry must adapt to such high-stakes trading behavior, potentially prompting enhanced regulatory scrutiny and technological advancements to prevent adverse market effects. Historical trends indicate that whale activities, akin to Wynn’s, can lead to short-term volatility followed by stabilization as market mechanisms integrate these variables.

Source: https://coincu.com/339536-james-wynn-btc-investment/