- Ant International adopts HSBC’s tokenized deposit service in Hong Kong.

- Boosts 24-hour payments and efficiency via blockchain.

- Pioneers Hong Kong’s blockchain-finance integration.

Ant International has become the first corporate customer to utilize HSBC’s tokenized deposit service in Hong Kong, marking a pivotal step on May 24, 2023, towards integrating blockchain with traditional finance.

This initiative facilitates real-time, 24/7 fund transfers in HKD and USD. It enhances cross-border financial efficiency, demonstrating a major shift in Hong Kong’s approach to digital finance.

Ant International’s Pioneering Blockchain Move with HSBC

Ant International’s adoption of HSBC’s tokenized deposit service represents an important integration of blockchain technology with traditional finance. This service, now live in Hong Kong, enables real-time, 24-hour payments in both HKD and USD between corporate accounts through tokenized deposits. Prior to its official launch, a successful pilot had been conducted on Ant International’s Whale platform. Improving cross-border fund management efficiency highlights blockchain’s utility in financial operations.

The launch of HSBC’s service signals enhancements in digital payment infrastructure, allowing round-the-clock operations and addressing limitations in traditional banking hours. HSBC’s initiative is a first for Hong Kong, leveraging blockchain’s capabilities to spearhead advancements within the region’s financial structures. Key systems regarding treasury management and liquidity are set to benefit as corporate clients experience greater operational efficiencies.

“The service addresses key limitations in traditional banking hours and settlement times.” – HSBC, Representative, HSBC Hong Kong.

Both corporate and government sectors have responded positively, evidencing confidence in blockchain-tech integration. Notably, industry observers have pointed out the significance of traditional banks like HSBC leading blockchain-based financial services. Despite the absence of direct statements from prominent executives, the development has seen active support, indicating wider acceptance and trust in tech-driven financial innovation.

Global Trends and Insights on Tokenized Services

Did you know? Hong Kong’s adoption of tokenized deposit services aligns with global trends where traditional banks are increasingly exploring blockchain to improve financial efficiency.

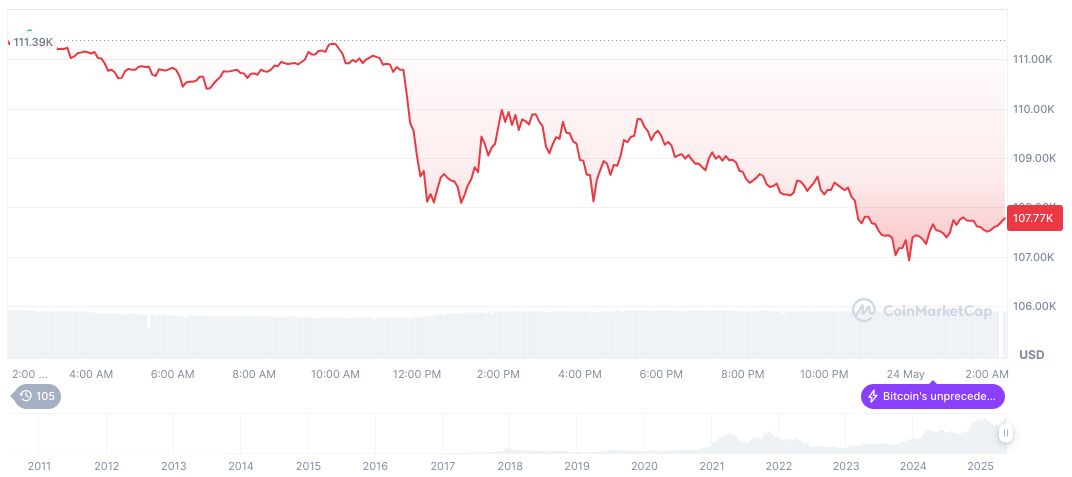

Bitcoin (BTC) is trading at $108,272.43 with a market cap of $2.15 trillion, as per CoinMarketCap. It maintains a market dominance of 63.09% and has seen a 24-hour trading volume of $66.19 billion, marking a 5.99% shift. BTC prices have decreased by 2.29% over the past 24 hours but marked a 4.55% increase over the last week.

Coincu’s research team observes that the deployment of tokenized financial services in Hong Kong could set regulatory precedents and stimulate technological innovation within financial markets. Drawing from historical blockchain trends, similar implementations may boost blockchain adoption globally, reinforcing the merge of digital and traditional finance systems.

Source: https://coincu.com/339401-ant-international-hsbc-blockchain/