- OpenFX completes $23 million funding to enhance its trading network.

- The initiative aims to rival SWIFT with efficient transactions.

- OpenFX plans currency expansion, impacting global trading.

OpenFX announced the completion of a $23 million funding round led by Accel, aiming to expand its stablecoin-based cross-border trading network. The initiative seeks to modernize and replace traditional transfer systems like SWIFT.

The $23 million funding is crucial for OpenFX’s plan to expand its support from seven to ten currencies by this summer, enhancing its global reach in the cross-border transaction market.

OpenFX Raises $23 Million to Challenge SWIFT

OpenFX’s latest funding round, conducted while the company emerged from an 18-month stealth period, has positioned it for significant growth. Founded by Prabhakar Reddy, OpenFX supports a network based on stablecoins, including the US dollar, euro, and Mexican peso, with plans to add currencies from Southeast Asia. OpenFX’s mission is to foster an open, cost-effective, and immediate digital trading environment, potentially altering global currency markets significantly.

Raising $23 million, led by Accel, positions OpenFX to challenge existing frameworks by introducing efficient alternatives to traditional systems like SWIFT. The market is expected to witness enhanced speed and reduced transfer costs, crucially impacting the landscape of international transactions as these developments unfold.

Notable statements emphasize innovation in cross-border payments. Prabhakar Reddy remarked, “At OpenFX, we’re on a mission to make money move as freely as data,” highlighting ambitions for network transparency and broad accessibility. Industry reactions suggest cautious optimism about new efficiencies and the potential reshaping of transaction dynamics.

Stablecoin Adoption and Market Insights

Did you know? Efforts to replace SWIFT through blockchain-based solutions have been ongoing, with RippleNet being a notable precursor. These initiatives often boost stablecoin adoption, enhancing on-chain asset flows, particularly in major cryptocurrencies.

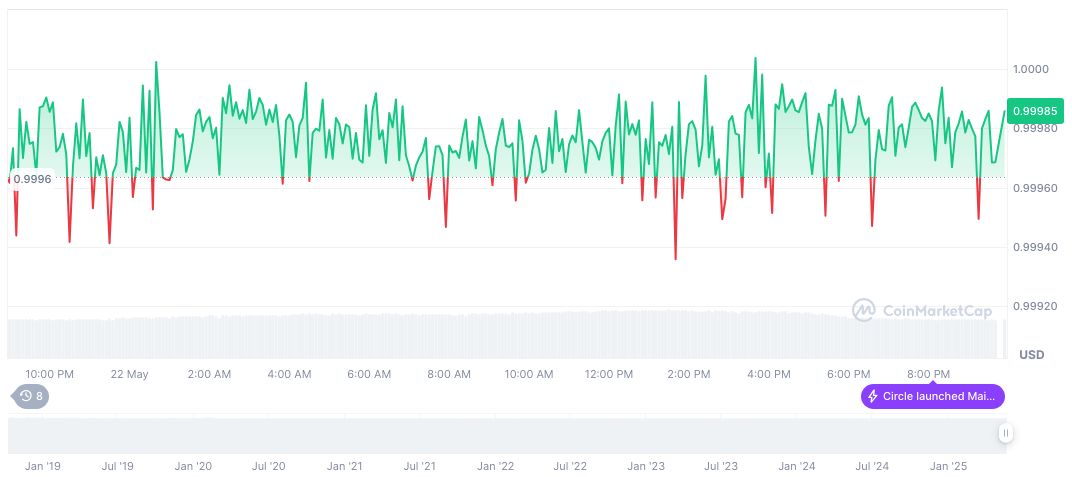

Data from CoinMarketCap indicates that USDC, a prevalent stablecoin, maintains its $1.00 peg despite minor fluctuations. Its market cap is at $61.32 billion with 24-hour trading volumes reaching $15.73 billion. Over the past 90 days, the stablecoin has seen a slight decline of 2.41%.

The Coincu research team foresees significant impacts on the financial landscape, with potentially reduced dependency on traditional wire transfer systems. As OpenFX’s stablecoin model gains traction, expect institutions to reconsider existing frameworks for international transactions, potentially adjusting regulatory approaches to accommodate emerging digital solutions.

Source: https://coincu.com/339187-openfx-23m-funding-stablecoin/