- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Fed prioritizes price stability amid inflation concerns.

- Crypto markets show mixed responses to policy signals.

Loretta J. Mester of the Cleveland Fed highlighted inflation moderation, but emphasized levels remain above the 2% target. Market response unveils vigilance as crypto assets eye macroeconomic cues closely.

Loretta J. Mester’s recent commentary noted inflation moderated but flagged vigilance over instability. The Cleveland Fed’s focus on price stability underscores challenges despite cautious policy measures. The Federal Reserve signals continuous caution, with rates maintained at 4.25%-4.5%, aligning with a commitment to a 2% inflation target. Market reactions have been relatively muted, with base rates steady, preventing abrupt shifts in investment behavior. Jerome Powell also emphasized vigilance against inflation volatility, stating, “Higher real rates may also reflect the possibility that inflation could be more volatile going forward than in the inter-crisis period of the last quarter-century.”

Fed Policy: Vigilance Amidst Inflation Challenges

Loretta J. Mester’s recent commentary noted inflation moderated but flagged vigilance over instability. The Cleveland Fed’s focus on price stability underscores challenges despite cautious policy measures. The Federal Reserve signals continuous caution, with rates maintained at 4.25%-4.5%, aligning with a commitment to a 2% inflation target. Market reactions have been relatively muted, with base rates steady, preventing abrupt shifts in investment behavior. Jerome Powell also emphasized vigilance against inflation volatility, stating, “Higher real rates may also reflect the possibility that inflation could be more volatile going forward than in the inter-crisis period of the last quarter-century.”

Experts suggest macro-stability signals could mediate crypto volatility, with policy continuity likely supporting institutional confidence in crypto asset valuation. Historical trends affirm crypto market responsiveness to economic policy shifts, anticipating prolonged vigilance in high-risk asset segments.

Did you know? Markets typically view hawkish Fed signals as a cue for reduced risk in assets like Bitcoin, often amplifying volatility.

Bitcoin Dynamics and Market Sentiment Shift

Did you know? Markets typically view hawkish Fed signals as a cue for reduced risk in assets like Bitcoin, often amplifying volatility.

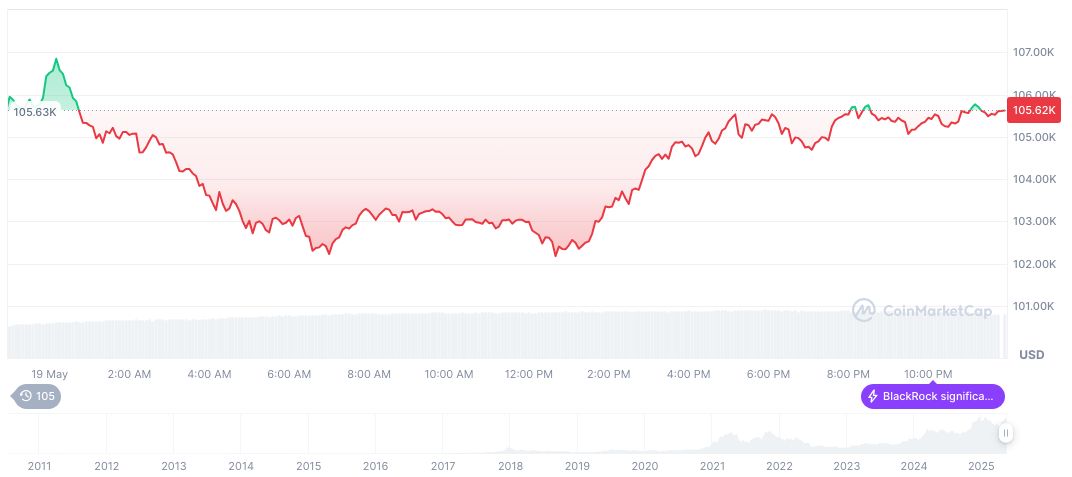

Bitcoin maintains a trading price of $106,039.60, according to CoinMarketCap. Market cap approaches $2.11 trillion, holding dominance at 63.14%. Trading volume noted a decline, dropping 22.99% within 24 hours. Bitcoin’s price experienced a 0.8% increase over 24 hours with a significant rise of 25.5% over 30 days, reflecting macroeconomic sentiment.

Experts suggest macro-stability signals could mediate crypto volatility, with policy continuity likely supporting institutional confidence in crypto asset valuation. Historical trends affirm crypto market responsiveness to economic policy shifts, anticipating prolonged vigilance in high-risk asset segments.

Source: https://coincu.com/338734-feds-mester-inflation-stability-focus/