- Katherine Reilly prioritizes cryptocurrency fraud at the SEC.

- Investor losses due to crypto scams amount to $3.96 billion in 2023.

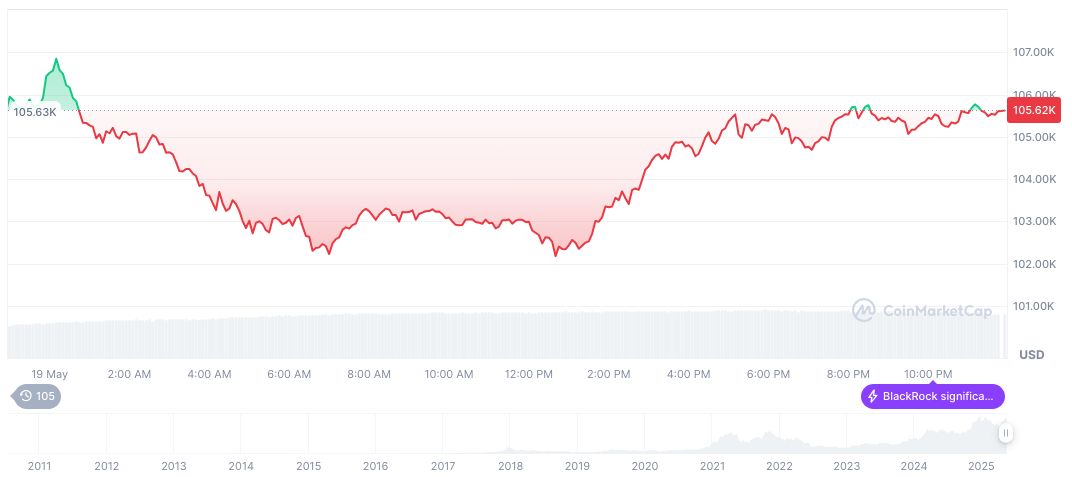

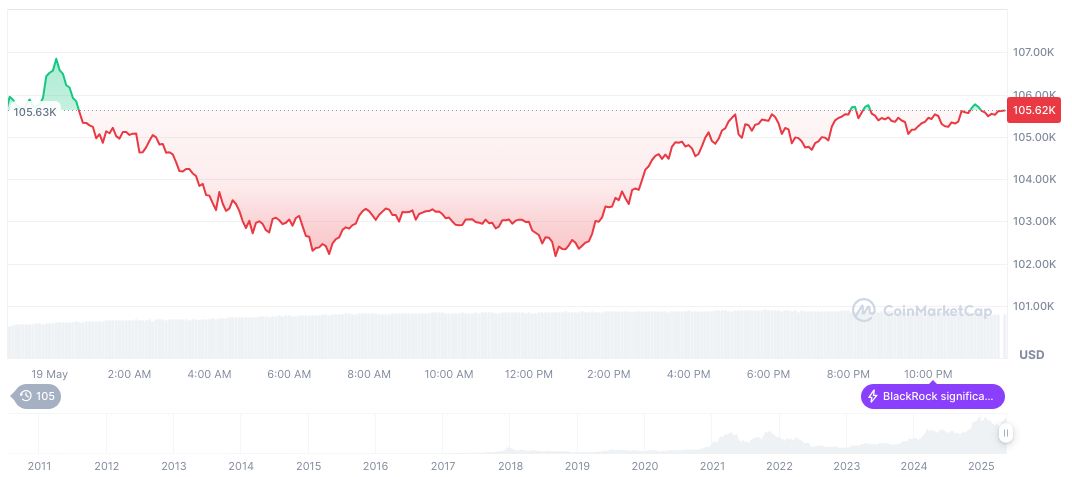

- Bitcoin’s volatility showcases the impact of cybersecurity on financial markets.

Acting Inspector General Katherine Reilly of the U.S. Securities and Exchange Commission (SEC) has prioritized cryptocurrency fraud as the main regulatory focus, as stated by CryptoSlate.

Reilly’s decision highlights significant investor losses and security concerns amid her efforts to improve internal oversight and resource allocation.

SEC Prioritizes Cryptocurrency Fraud Under New Leadership

Katherine Reilly, appointed as the SEC’s acting inspector general, identified cryptocurrency fraud as a primary oversight target. This focus comes after a reported $3.96 billion loss suffered by retail investors in 2023 due to scams. The October 2024 report indicated that 18% of all SEC complaints involved crypto fraud, reflecting growing investor concerns. Reilly’s mandate includes improving network security, addressing deficiencies noted during her tenure as deputy inspector general.

Retail investors face significant risk, and this regulatory emphasis highlights the SEC’s commitment to fraud monitoring. Despite Reilly rising to the inspector general position, policy decisions on asset classification remain secondary to operational improvements and fraud prevention.

Katherine Reilly, Acting Inspector General, U.S. Securities and Exchange Commission, emphasized her focus on “resource sufficiency and internal vulnerabilities rather than the asset class’s classification or future.”

Market reactions have illustrated the sensitivity to security breaches, as demonstrated by Bitcoin’s $1,000 price drop following the SEC’s Twitter account hack in 2024. While no major policies were announced following Reilly’s appointment, industry experts are attentive to the SEC’s actions under her leadership.

Bitcoin Volatile: $1,000 Drop from SEC Twitter Breach

Did you know? In 2024, a breach of the SEC’s Twitter account prompted a $1,000 drop in Bitcoin’s price within seconds, emphasizing how critical cybersecurity remains in financial regulatory institutions.

As of May 20, 2025, Bitcoin (BTC) shows considerable price movements. According to CoinMarketCap, BTC’s current price stands at $104,263.32, with a market cap of approximately $2.07 trillion. Notably, Bitcoin has grown by 23.6% over the past 30 days, showcasing continued market vitality despite recent adversities. The daily trading volume is down by 17.19%, indicating fluctuations in trading activity, while the circulating supply approaches its maximum limit of 21 million tokens.

Experts at Coincu highlight the dual challenges faced by the SEC, addressing both insufficient resources for fraud oversight and recruitment difficulties for technical talent. This shortage stems from regulations barring staff from holding digital assets. The agency’s approach towards better oversight could influence broader regulatory trends, impacting digital asset security standards industry-wide.

Source: https://coincu.com/338684-sec-focus-crypto-fraud-reilly/