- Dominari Holdings partners with Gryphon and Hut 8 on Bitcoin mining pivot.

- Market optimistic despite financial losses; stock surges 466% YTD.

- Eric Trump joins leadership, driving strategic direction.

Dominari Holdings (NASDAQ: DOMH) recently accelerated its transition into the cryptocurrency arena by increasing its Bitcoin holdings and unveiling significant partnerships. The New York-based firm, located in Trump Tower, achieved a notable 466% stock price increase this year despite financial losses.

The pivot to cryptocurrency is driven by Dominari’s strategic emphasis on Bitcoin mining through a joint venture with Hut 8 and a merger with Gryphon Digital Mining. The market’s enthusiastic response highlights the anticipated growth in Dominari’s crypto endeavors, elevating its stock value considerably. Eric Trump, serving as Chief Strategy Officer, is leading this transformation.

Dominari Partners with Hut 8 and Gryphon for Crypto Expansion

Dominari Holdings, headquartered in Trump Tower, initiated a transition into the crypto sector through a partnership with Bitcoin mining firm Hut 8. A joint venture, American Bitcoin, aims to enhance this pivot, merging with Gryphon Digital Mining. This collaboration strategically positions Dominari to capitalize on the growing Bitcoin mining market.

Financial implications are significant, with American Bitcoin formed to leverage over $100 million in ASIC miners and infrastructure via its cryptocurrency mission. Dominari and partners plan to control 98% of the newly formed company. They actively seek to reinforce their foothold through Bitcoin ETF shares worth $2 million, despite a net loss of $32.5 million in the first quarter.

While market reactions include a stock price surge of 466% this year, skepticism remains regarding prior IPO underperformance. Key figures involved, such as Eric and Donald Trump Jr., have each received equity prospects worth $8 million, highlighting their role in driving this strategic shift.

“Upon closing, which is expected to occur in the third quarter of this year, the company will operate under the American Bitcoin brand, led by the management and current board of directors of American Bitcoin.”

Bitcoin Market Capitalization Reaches $2.09 Trillion

Did you know? American Bitcoin’s formation echoes earlier Nasdaq-listed Bitcoin miners like Riot and Marathon, often influencing retail and institutional attraction, driving temporary spikes in the industry.

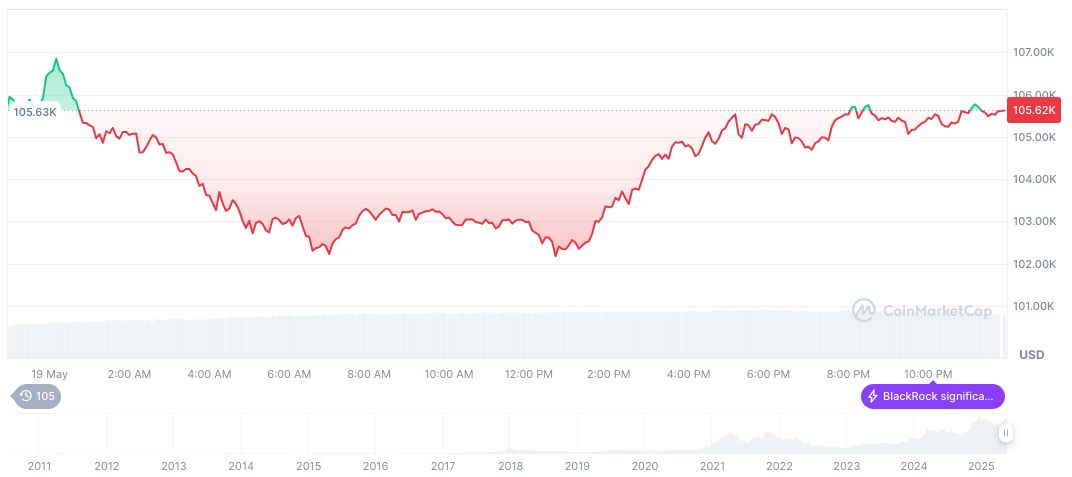

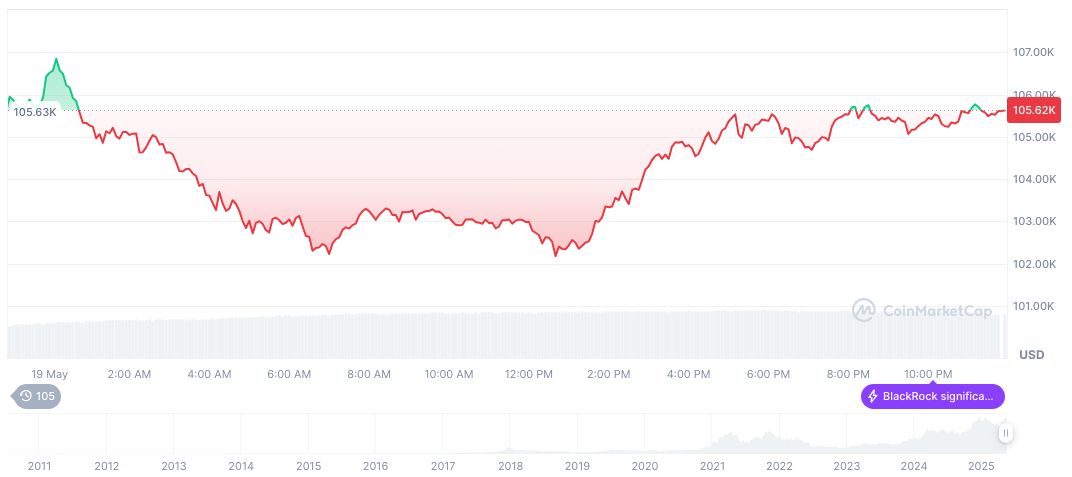

Bitcoin (BTC) currently stands at $105,181.21, with a market cap of $2.09 trillion and a 62.87% dominance. With recent positive price shifts over various time frames, its 24-hour trading volume shows a 14.19% decline. As per CoinMarketCap data, Bitcoin’s upward trajectory over 60 days reflects substantial investor interest and market movements.

The Coincu research team suggests Dominari’s cryptocurrency endeavors could lead to substantial market influence, potentially increasing volatility with Bitcoin’s price alignment. Long-term success hinges on regulatory navigation and operational effectiveness.

Source: https://coincu.com/338660-dominari-bitcoin-mining-shift/