- JPMorgan’s decision opens Bitcoin purchases while excluding custody options.

- CEO Dimon shifts stance, allowing digital asset exposure.

- Lack of custody aligns with risk mitigation strategy.

JPMorgan Chase, led by CEO Jamie Dimon, announced on May 20, 2025, that it will facilitate Bitcoin purchases for its clients but will not offer storage or custody services.

The move signifies increasing acceptance of Bitcoin in mainstream finance as institutions adjust risk strategies while responding to client demands.

JPMorgan Steps into Bitcoin Market without Custody Services

JPMorgan Chase, led by CEO Jamie Dimon, will now allow clients to purchase Bitcoin through its platform, marking a significant shift in the bank’s approach to cryptocurrency. Dimon, a historically vocal critic of Bitcoin, has gradually adjusted his stance as digital asset adoption grows within institutional finance. “We’ve seen significant demand from our clients to offer access to Bitcoin, while maintaining our own risk controls,” Dimon remarked in the announcement. Clients can gain exposure to Bitcoin but must manage custody themselves, reflecting JPMorgan’s strategy to limit its risk exposure.

As institutions like JPMorgan begin facilitating cryptocurrency transactions, the immediate implication is a notable increase in Bitcoin accessibility for investors. This decision, however, underscores their continued cautious approach by excluding custody services, keeping the bank’s assets separate from potential cryptocurrency market volatility.

The financial community has reacted to this development with mixed views. While some see it as a positive endorsement of Bitcoin’s legitimacy, others note the continued absence of custody services as a sign of persistent skepticism. Government and regulatory bodies have not publicly commented, reflecting their typically cautious postures on institutional digital asset integration.

Bitcoin’s Market Reaction and Institutional Strategy Shifts

Did you know? JPMorgan allowing Bitcoin purchases reflects a significant change since Dimon labeled Bitcoin a “fraud” in 2017, demonstrating the currency’s growing acceptance.

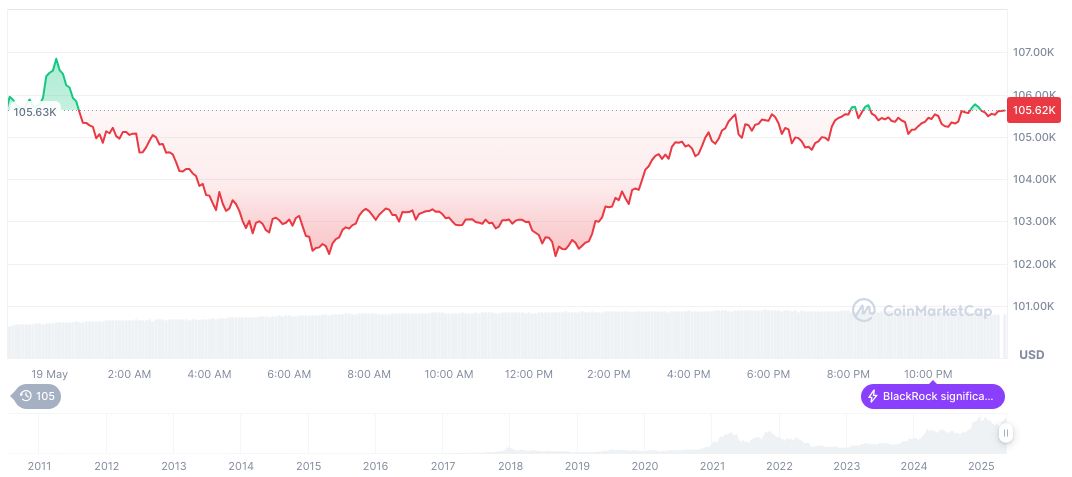

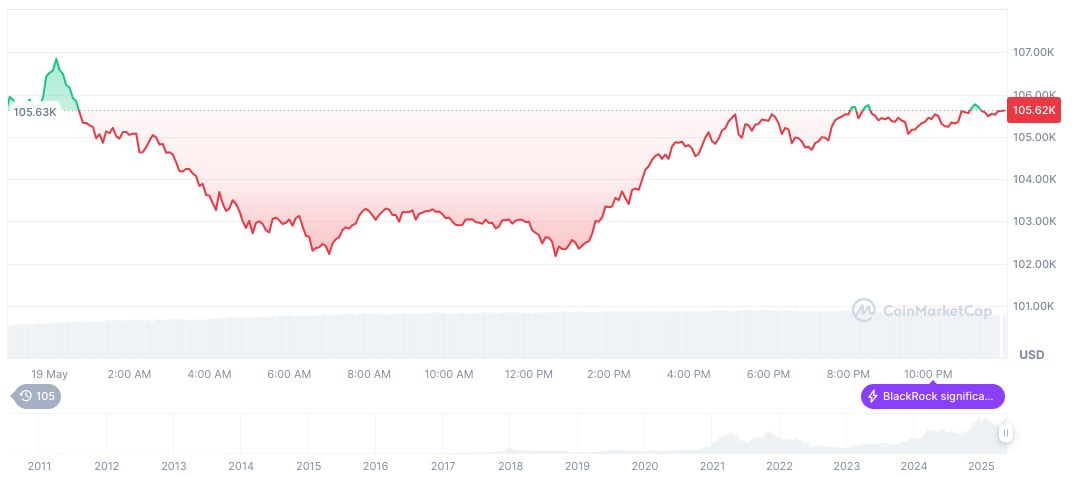

As of May 20, 2025, Bitcoin (BTC) trades at $105,978.46, experiencing a 2.97% rise over 24 hours, as reported by CoinMarketCap. With a market cap of $2.10 trillion, Bitcoin holds a market dominance of 62.82%. Over 90 days, its price has increased by 11.12%, supported by heightened institutional interest.

Coincu’s research team suggests that while JPMorgan’s cautious approach to limiting direct Bitcoin custody may reflect broader industry trends, it also highlights evolving regulatory landscapes. Enhanced financial infrastructure and products could emerge, but regulatory and compliance dilemmas remain significant barriers to full custodial services.

Source: https://coincu.com/338621-jpmorgan-bitcoin-buying-no-custody/